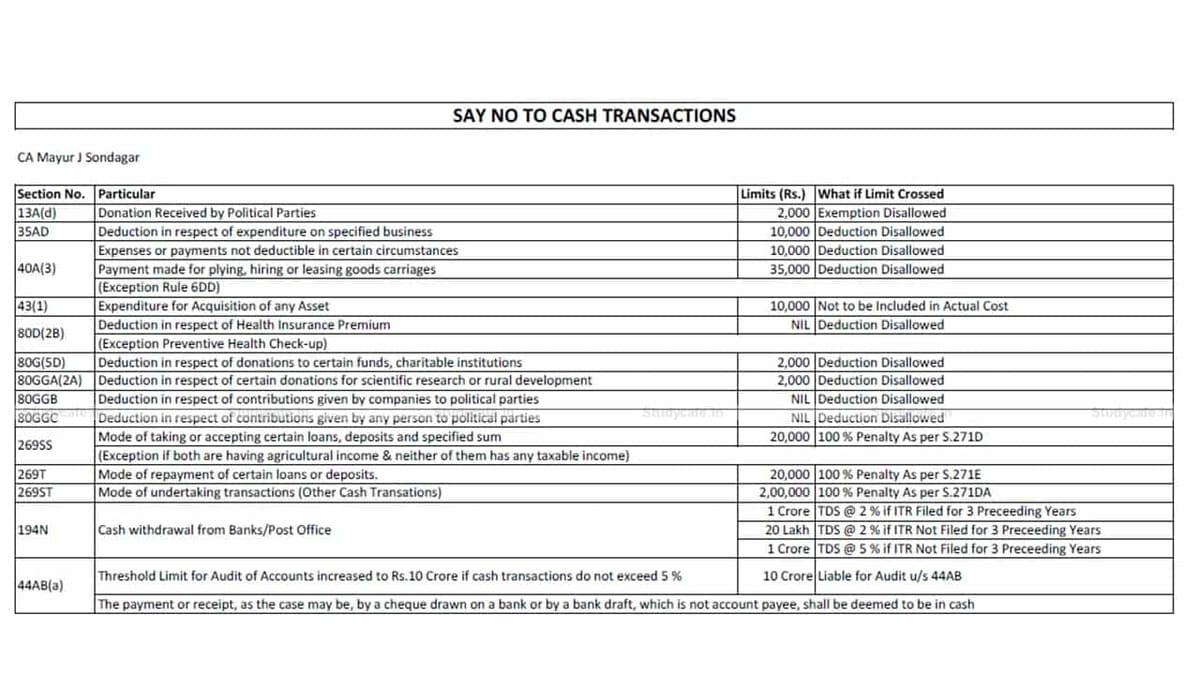

CHART SUMMARY OF LIMIT OF AMOUNT OF CASH TRANSACTION UNDER INCOME TAX

CA Mayur J Sondagar | Jul 16, 2021 |

CHART SUMMARY OF LIMIT OF AMOUNT OF CASH TRANSACTION UNDER INCOME TAX

| Section No. | Particular | Limits (Rs.) | What if Limit Crossed |

| 13A(d) | Donation Received by Political Parties | 2,000 | Exemption Disallowed |

| 35AD | Deduction in respect of expenditure on specified business | 10,000 | Deduction Disallowed |

| 40A(3) | Expenses or payments not deductible in certain circumstances | 10,000 | Deduction Disallowed |

| Payment made for plying, hiring or leasing goods carriages | 35,000 | Deduction Disallowed | |

| (Exception Rule 6DD) | |||

| 43(1) | Expenditure for Acquisition of any Asset | 10,000 | Not to be Included in Actual Cost |

| 80D(2B) | Deduction in respect of Health Insurance Premium | NIL | Deduction Disallowed |

| (Exception Preventive Health Check-up) | |||

| 80G(5D) | Deduction in respect of donations to certain funds, charitable institutions | 2,000 | Deduction Disallowed |

| 80GGA(2A) | Deduction in respect of certain donations for scientific research or rural development | 2,000 | Deduction Disallowed |

| 80GGB | Deduction in respect of contributions given by companies to political parties | NIL | Deduction Disallowed |

| 80GGC | Deduction in respect of contributions given by any person to political parties | NIL | Deduction Disallowed |

| 269SS | Mode of taking or accepting certain loans, deposits and specified sum | 20,000 | 100 % Penalty As per S.271D |

| (Exception if both are having agricultural income & neither of them has any taxable income) | |||

| 269T | Mode of repayment of certain loans or deposits. | 20,000 | 100 % Penalty As per S.271E |

| 269ST | Mode of undertaking transactions (Other Cash Transations) | 2,00,000 | 100 % Penalty As per S.271DA |

| 194N | Cash withdrawal from Banks/Post Office | 1 Crore | TDS @ 2 % if ITR Filed for 3 Preceeding Years |

| 20 Lakh | TDS @ 2 % if ITR Not Filed for 3 Preceeding Years | ||

| 1 Crore | TDS @ 5 % if ITR Not Filed for 3 Preceeding Years | ||

| 44AB(a) | Threshold Limit for Audit of Accounts increased to Rs.10 Crore if cash transactions do not exceed 5 % | 10 Crore | Liable for Audit u/s 44AB |

| The payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be in cash | |||

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"