Reetu | Mar 3, 2023 |

RBI Revises Bank Audit Fee: Know the changed Fees

The Reserve Bank of India(RBI) has revised the Bank/ Branch Audit Fee Structure. By revising the fee structure, it has increased the fees for Bank Branch Audit by 10%.

It has been decided to revise the instructions on remuneration payable to the SCAs and SBAs of NBs effective from the FY 2022-23, in terms of the provisions of Section 10 (2) of the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970/1980.

The revised instructions are given below:

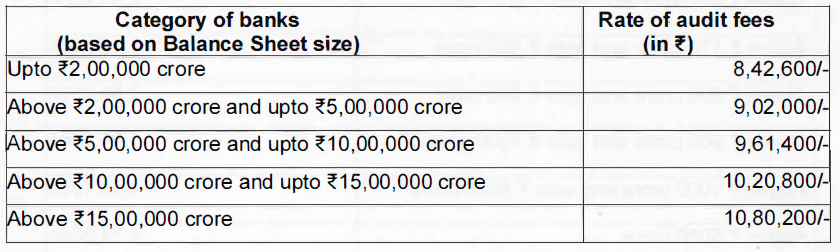

The fees admissible to the SCAs for Audit of the Head/Central Office as an accounting unit shall be as under:

Note: The total remuneration, as per above mentioned schedule, shall be divided equally among all the SCAs of the bank concerned. As hitherto, no separate fee will be payable to the SCAs in respect of audit of Regional, Zonal or Divisional Offices or other Controlling Offices by whatever name they are called. In case the bank intends to appoint a separate auditor for the above offices, fee paid for such auditor should be based on the quantum of advances.

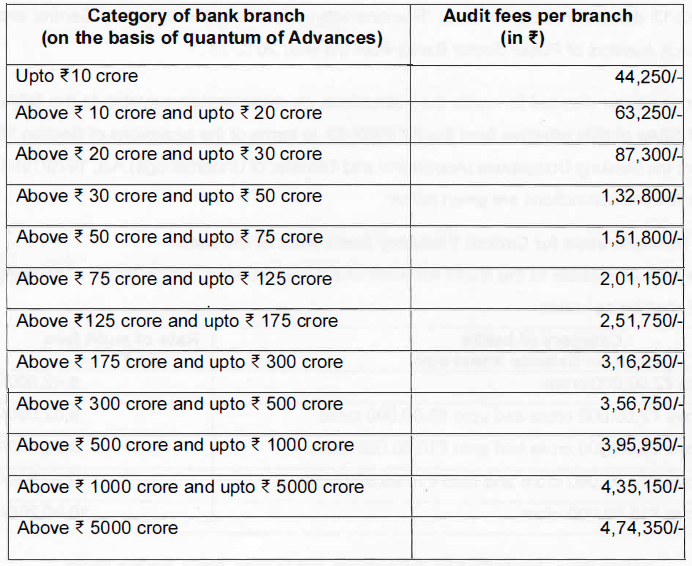

(i) The fees admissible to the SBAs shall be as under:

(ii) The main operating office of the bank (irrespective of the fact whether it is attached to Head/ Central Office of the bank or functions as a separate unit), Centralised Processing Units (CPUs)/ Loan Processing Units (LPUs)/and other centralised hubs, by whatever nomenclature called, which are taken up for the purpose of statutory branch audit during a particular year, will be treated as any other branch. Accordingly, the fees admissible for the audit work thereof will be on the basis of the above-mentioned schedule.

(iii) For branches operating as NPA recovery branches, or branches where there is no advances portfolio, such as service branches, specialised branches, etc., the banks, with the approval of their Board/Audit Committee of the Board (ACB), shall propose the audit fees (arrived on the basis of volume of business of the branch, existing fee, etc.) and seek approval of RBI on a case-to-case basis.

(i) The bank concerned shall, with the approval of their Board/ACB, decide fees for all other items of work [such as additional certifications required by Securities and Exchange Board of India (SEBI), preparation of Long Form Audit Report (LFAR), scrutiny and incorporation of returns of branches, auditing of consolidated financial statements, quarterly/half-yearly limited review, other additional certifications/reporting required by RBI, etc.] carried out by their Statutory Auditors (SCAs and SBAs).

(ii) For reimbursement of the lodging & boarding charges, traveling charges, halting allowance and daily conveyance payable to the Statutory Auditors, the banks are given the discretion to decide the same in a cost-effective manner, in mutual consent with the auditors.

(iii) In case of any dispute between the Statutory Auditors and the bank regarding settlement of their bills, the MD & CEO of the concerned bank shall be the final authority to decide the claims.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"