The Minister of State, Shri Rameshwar Teli in the Ministry of Petroleum And Natural Gas in a written reply to a question raised in Lok Sabha Stated, "Matter of inclusion of Petrol/Diesel under GST regime deferred by GST Council."

Reetu | Mar 21, 2023 |

Matter of inclusion of Petrol/Diesel under GST regime deferred by GST Council

The Minister of State, Shri Rameshwar Teli in the Ministry of Petroleum And Natural Gas in a written reply to a question raised in Lok Sabha Stated, “Matter of inclusion of Petrol/Diesel under GST regime deferred by GST Council.”

Prices of petrol and diesel in the country have been market-determined with effect from 26.06.2010 and 19.10.2014 respectively. Since then, the Public Sector Oil Marketing Companies (OMCs) take appropriate decision on pricing of petrol and diesel. Effective 16 June, 2017, daily pricing of petrol and diesel has been implemented in the entire country.

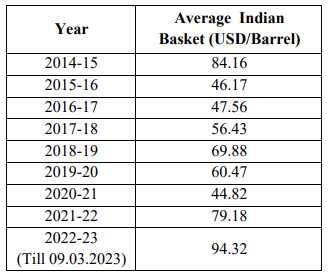

The yearly average international prices of Indian basket of Crude oil since 2014-15 are given below:

The crude oil price in USD/Barrel terms does not reflect the depreciation of INR/USD exchange rate.

The details of contribution to Central Exchequer from excise duty on petroleum products since 2014 are given below:

The above is based on data provided to Petroleum Planning and Analysis Cell (PPAC) by 15 major oil & gas companies.

The GST Council in its 45th meeting held on 17th September, 2021 had considered the inclusion of Petrol/Diesel and other petroleum products under the GST regime but the matter was deferred by the Council till larger deliberations on account of its heavy repercussions on the exchequer. The issue has not been taken up by the Council as an agenda item for any further deliberation subsequent to the said meeting.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"