The Chief Commissioner of Income Tax, Allahabad, has recently released a notification inviting applications for the posts of Consultants in the fields of (i) Income Tax (Judicial) and (ii) PR Works/Protocol

Ravi Kumar | Apr 15, 2023 |

Income Tax Department Recruitment 2023: Check Posts, Qualification and How to Apply

Income Tax Department Recruitment 2023: The Chief Commissioner of Income Tax, Allahabad, has recently released a notification inviting applications for the posts of Consultants in the fields of (i) Income Tax (Judicial) and (ii) PR Works/Protocol. As per Income Tax Department Recruitment 2023 official notification, the eligibility criteria for the two positions vary slightly but both require applicants to be retired officers from the Central Government with at least three years of experience in the relevant field. In addition to this, applicants should possess a Bachelor’s degree from a recognized university, and experience in Income Tax-related work is preferable. As per the Income Tax Department Recruitment 2023 official notification, the age limit for both positions is 65 years. The consolidated remuneration for both positions is Rs.30,000/-.

Interested applicants should submit the filled application form (Appendix) along with self-attested supporting documents for educational qualifications and experience to the Chief Commissioner of Income Tax, Allahabad. The terms of reference as mentioned in Annexure-I for Consultant for (Judicial) and Annexure-II for Consultant for (PR Works/Protocol) should be accepted by the applicants before submitting the application. As per Income Tax Department Recruitment 2023 official notification, the last date for submission of the application is 24.04.2023 (05:00 P.M.).

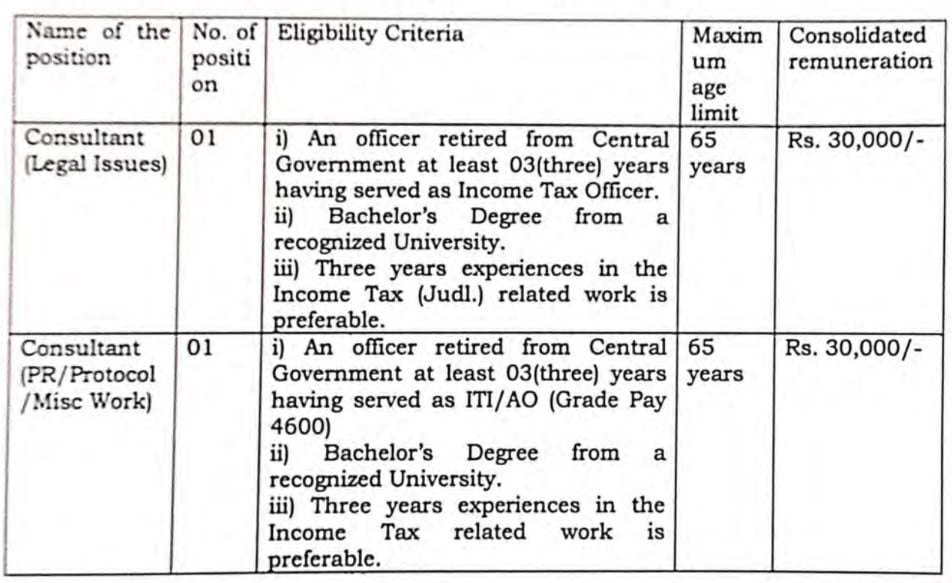

As per Income Tax Department Recruitment 2023 official notification, the post name and number of vacancies are given below:

As per Income Tax Department Recruitment 2023 official notification, the age limit for both positions is 65 years.

As per Income Tax Department Recruitment 2023 official notification, the eligibility criteria for each post are as follows:

Consultant for (Judicial)

i) The candidate must be an officer retired from the Central Government with at least 03 (three) years of experience as an Income Tax Officer.

ii) The candidate must have a Bachelor’s Degree from a recognized university.

iii) It is preferable that the candidate has three years of experience in Income Tax (Judicial) related work.

iv) The maximum age limit for the candidate is 65 years.

Consultant for (PR Works/Protocol)

i) The candidate must be an officer retired from the Central Government with at least 03 (three) years of experience as an ITI/AO (Grade Pay 4600).

ii) The candidate must have a Bachelor’s Degree from a recognized university.

iii) It is preferable that the candidate has three years of experience in Income Tax related work.

iv) The maximum age limit for the candidate is 65 years.

As per Income Tax Department Recruitment 2023 official notification, the consolidated remuneration for both positions is Rs.30,000/-.

As per Income Tax Department Recruitment 2023 official notification, to apply for the post of Consultant for Judicial or Consultant for PR Works/Protocol, interested candidates must download and fill out the application form (Appendix) with accurate details. They must also attach self-attested copies of their educational qualification and experience certificates along with the acceptance of the Terms of Reference as mentioned in Annexure-I for Consultant for (Judicial) and Annexure-II for Consultant for (PR Works/Protocol).

The completed application form along with the supporting documents should be sent by post to the Chief Commissioner of Income Tax, Aaykar Bhawan, 38, M.G. Marg, Civil Lines, Allahabad-211001 before the deadline. The last date for submission of the application is 24.04.2023 (05:00 P.M.). Candidates must ensure that their application form and supporting documents are received by the concerned authority before the deadline. Any incomplete or late applications are likely to be rejected, so applicants must ensure that all the necessary documents are enclosed with the application form and that they are sent in advance of the deadline.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"