The Central Board of Indirect Taxes and Custom(CBIC) has notified that GSTR-9 and GSTR-9C Filing requirement Waived for Taxpayers with 2 crore and 5 crore Turnover.

Reetu | Jul 4, 2023 |

GSTR-9 and GSTR-9C Filing requirement Waived for Taxpayers with 2 crore and 5 crore Turnover

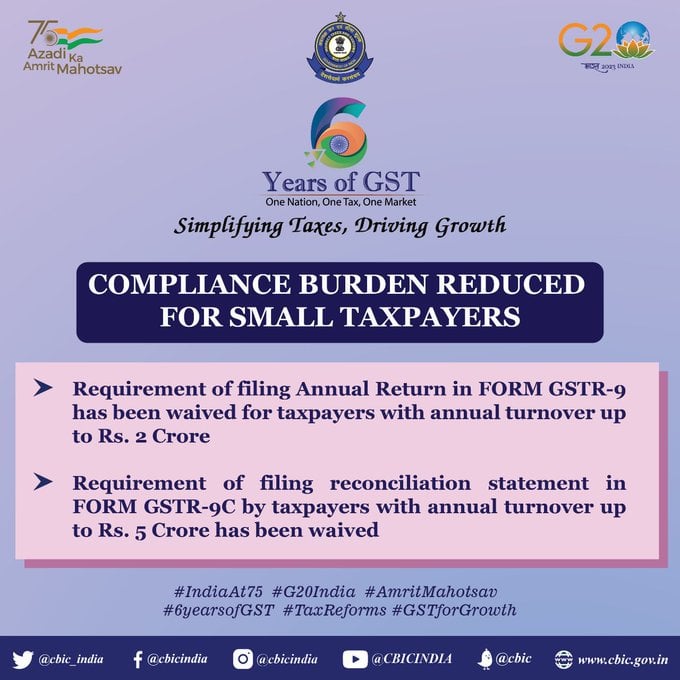

The Central Board of Indirect Taxes and Custom(CBIC) has notified that GSTR-9 and GSTR-9C Filing requirement Waived for Taxpayers with 2 crore and 5 crore Turnover.

For Reducing Compliance burden of Small Taxpayers, CBIC take this step and made this waving-off of Filing requirement decision to contribute more in ease of doing business initiative.

Via his twitter handle, CBIC announced this. The tweet is goes like, “6YearsOfGST Reducing compliance burden of Small Taxpayers. 1. Requirement of filing Annual Return in FORM GSTR-9 has been waived for taxpayers with annual turnover up to Rs.2 Crore. 2. Requirement of filing reconciliation statement in FORM GSTR-9C by taxpayers with annual turnover up to Rs.5 Crore has been waived ”

Form GSTR-9 is used to file GST annual returns for normal taxpayers, SEZ units, and SEZ developers.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"