With ITR season on it's peak, Taxpayers have been making complaints and queries regarding issues with the e-filing portal.

CA Pratibha Goyal | Jul 2, 2024 |

With Less than 1 month left for ITR Filing: Tax Professionals battle Income Tax Portal Glitches

The due date for filing an Income Tax Return (ITR) for the Assessment Year 2024-25 (AY 2024-25) is 31st July 2024. This due date applies to Taxpayers not having applicability of an Audit under any act or Transfer Pricing Audit under the Income Tax Act.

As per the Income Tax Data, 14267827 Income Tax Returns have been filed on 30th June 2024. With ITR season at its peak, Taxpayers have been making complaints and queries regarding issues with the e-filing portal, including slow processing times, technical glitches, and delays in refunds. Problems like TDS mismatch, difficulty in filing revised returns, and issues with accessing the 26AS page have been reported by the users of the Income Tax Portal. Also, users feel that the Income Tax return filing process has become more complex and we need a more simplified process and efficient resolution of issues.

A lot of users have written to Income Tax India on Twitter. Some of these have been shared below.

CA Sudhir Halakhandi of Ajmer-Beawar writes “ITR site is working very slow, even after filing of ITR the downloading of receipt is taking too much time. It is wasting the precious time of professionals. Please look into the matter & do the needful.”

CA Mayur J Sondagar has asked if the View Form 26AS option was working in IT Portal?

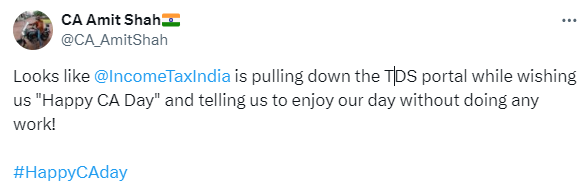

Even the TDS Portal was facing Glitches. CA Amit Shah wrote “Looks like @IncomeTaxIndia is pulling down the TDS portal while wishing us “Happy CA Day” and telling us to enjoy our day without doing any work!”

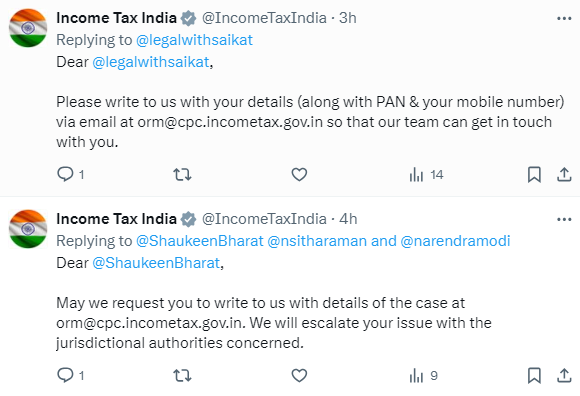

The Income Tax department has been actively addressing user complaints and queries regarding issues with the e-filing portal. Some screenshots of responses are given for reference.

Share your Income Tax glitches related to ITR on [email protected] for fast resolution.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"