Reetu | Jul 16, 2024 |

Good News: Due Date Extended due to Portal Glitches

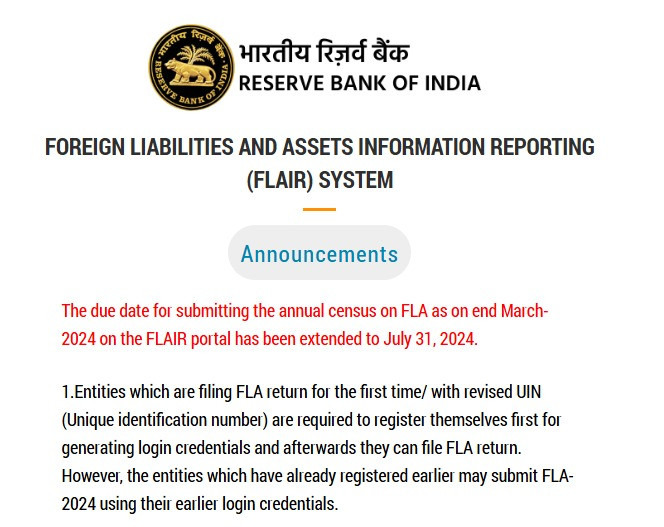

The Reserve Bank of India (RBI) has extended the Due date for submitting Foreign Liabilities and Assets (FLA) Return for the year ended 31st March 2024 till 31.07.2024.

The annual return on Foreign Liabilities and Assets (FLA) is required to be submitted by companies, Limited Liability Partnership (LLP), etc. which have received FDI (foreign direct investment) and/or made FDI abroad (i.e. overseas investment) in the previous year(s) including the current year i.e., who holds foreign assets or/and liabilities in their balance sheets;

Originally the date for filing the FLA Annual Return for Financial year (FY) 2023-24 was 15th July 2024.

RBI in an Announcement Stated, “The due date for submitting the annual census on FLA as of the end of March 2024 on the FLAIR portal has been extended to July 31, 2024.“

CS Anupriya Saxena wrote “Message received from FLA Team.. #FLAIR #FLARETURN Is another extension on its way?”

CA Gaurav Pingle wrote on his twitter handle “The due date for filing FLA return with RBI has been extended upto July 31, 2024. If the FLA portal had been working good, this extension wasn’t required. Atleast RBI considered practical issues & technical aspects & has granted extension. MCAV3 doesn’t consider this at all..”

31st July is an important date for compliance as now three important due dates are falling on this day. Due Date to file the Income Tax Return (ITR), FLA, and TDS Return for Quarter 1 of FY 2024-25 are all on 31st.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"