The department has urged the taxpayers not to click on suspicious links.

Nidhi | Jul 19, 2025 |

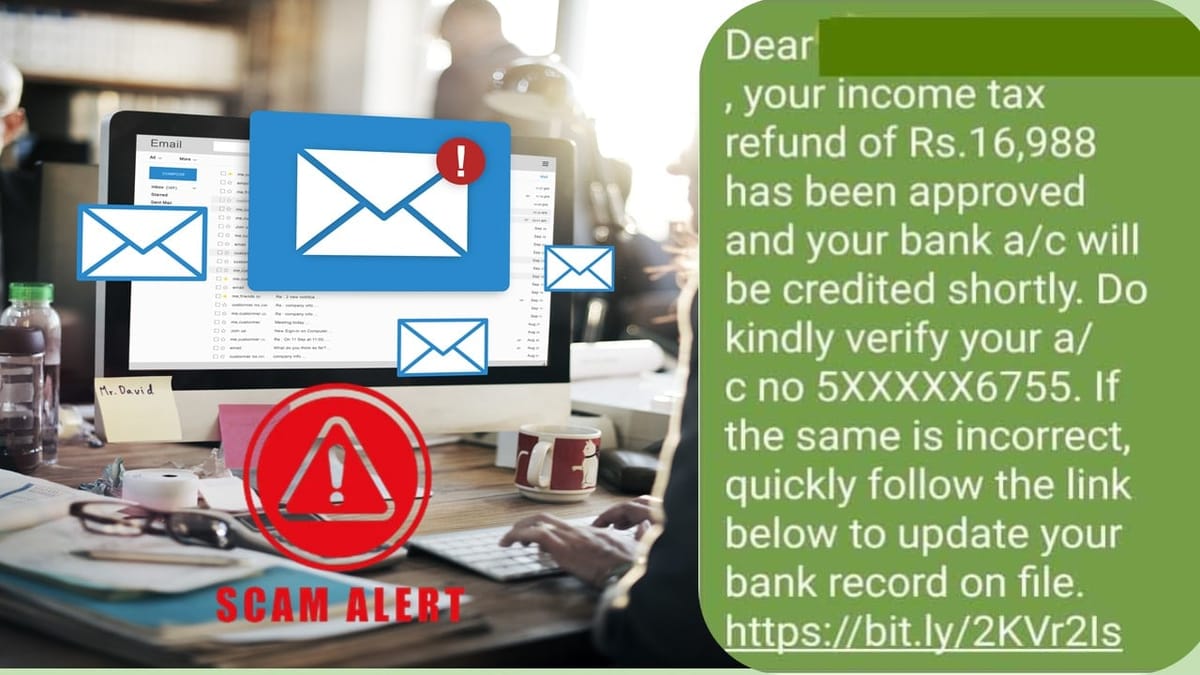

Income Tax Department Cautions Taxpayers Against Fake Refund Emails

The Income Tax Department has warned taxpayers to be careful with the fake emails regarding tax refunds. The department has urged the taxpayers not to click on suspicious links. The department never asks the taxpayers to share bank details or any other personal information through email. There are many fake websites that seem like the original website of the Income Tax Department. Additionally, many emails regarding the refund ask for immediate manual verification from the recipients. These are phishing scams aimed at deceiving the recipients.

Taxpayers are advised to always verify their refund status on the official website at incometax.gov.in.

If you get an email or see a website that looks like it is from the Income Tax Department but seems suspicious, follow these steps:

Has Official Domain: The official website for the Income Tax Department is www.incometax.gov.in. The income tax department’s email comes from the addresses, which end with: @incometax.gov.in, @tdscpc.gov.in, and @gov.in.

Does Not Ask to Share Personal Information: The income tax department never asks for personal data such as your PAN, Aadhaar, bank details, OTPs, or Credit/Debit card numbers via email, SMS, or phone calls.

Has DIN: The official communication issued by the income tax department has a unique Document Identification Number (DIN). You can check the authenticity of the DIN on the e-filing portal of the Income Tax Department.

Does Not Ask to Make Payment Through Unauthorised Channels: The income tax department never asks for payments through gift cards, UPI or a personal account. They only accept payments through authorised banking channels and official websites.

Website Has Secured Connection: Check if the website has a secure connection. To check this, look for https://” at the beginning of the website URL and a padlock symbol.

Unofficial Domain: The fraudsters use unofficial domains that look like the official one. For example, the fake domains can look like:

Threatening Messages: The fake emails have threatening language, such as Your Refund Will be Cancelled, “Click Here to Claim Refund”.

Lots of Spelling Error: the fake emails or websites have spelling mistakes in their sentences.

Different URLs: Displayed URL does not match the website URL when u click on it.

Emails that ask to transfer money to personal accounts

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"