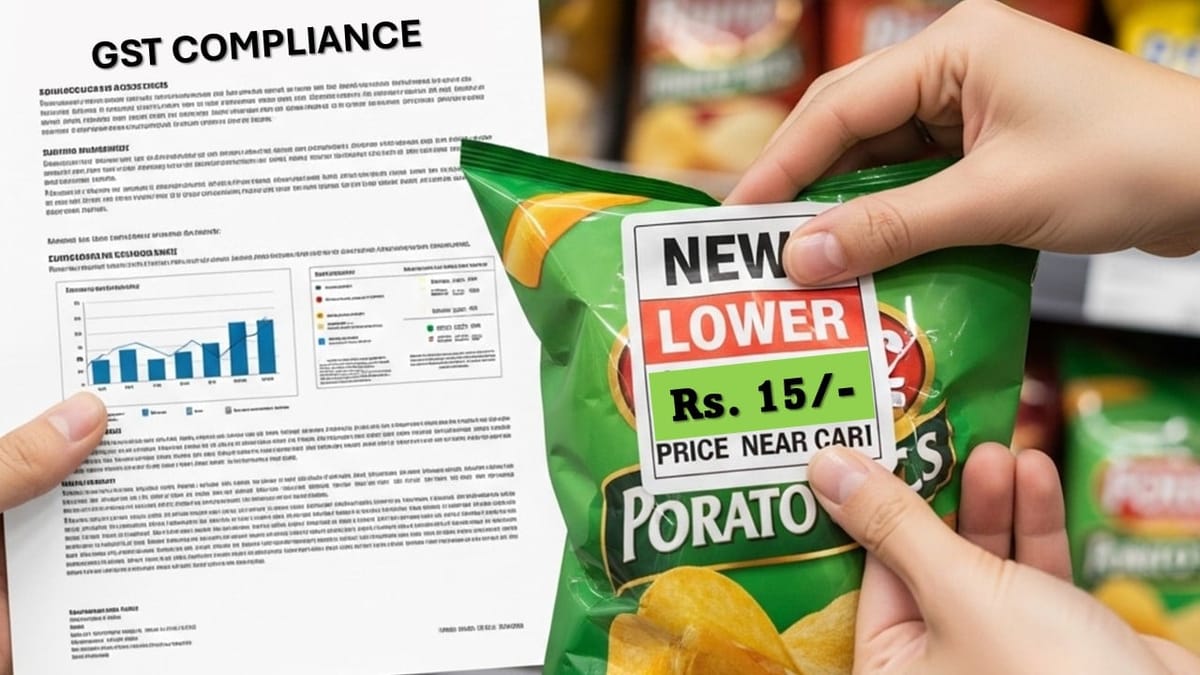

The Government eases compliance for prepackaged goods after GST revision, allowing voluntary price updates on existing stock and simplified dealer communication.

Vanshika verma | Sep 19, 2025 |

No More Newspaper Ads! Govt. Simplifies Legal Metrology Compliance Post GST Revision

The Central Govt. has received representation from industry & trade associations regarding the requirement for simplifying the procedure for legal compliance by manufacturers and importers of prepackaged commodities in the wake of GST revision.

After reviewing the concerns of the industry and in supersession of the earlier advisory dated September 9, 2025, the Central Government has taken a decision to permit manufacturers, packers, importers, or their representatives, who so desire, to voluntarily affix an additional revised price sticker on unsold packages manufactured before September 22 , 2025 and currently in their possession, provided that the original price declaration on the package remains permitted.

Government emphasised that the existing Rules do not mandate the affixing of revised price stickers by manufacturers, packers, importers, or their representatives on unsold packages manufactured before September 22, 2025 and lying with them.

Excluding this, by virtue of powers vested under Rule 33 of the Legal Metrology (Packaged Commodities) Rules, 2011, the Central Government, has decided to abandon the requirement in Rule 18(3) to issue advertisements about revised amounts/prices in two newspapers by manufacturers and importers.

As a result, the manufacturers, packers and importers are now required to send only circulars to wholesale dealers and retailers, etc., about revised prices with a copy thereof endorsed to the Director, Legal Metrology of the Central Government and Controller, Legal Metrology of All States/UTs and to ensure price compliance at the retailer level.

Manufacturers, packers and importers will take instant measures to sensitise dealers/retailers/consumers about the revision in the GST rate via all possible channels of communication, including electronic, print and social media.

The Government has clarified that any packaging material or wrapper remaining unutilised with a manufacturer, packer, or importer prior to the revision of GST may continue to be used for packing goods until March 31, 2026, or until the existing stock of packaging material or wrappers is fully exhausted, whichever occurs earlier. However, Govt. also mandated that the retail sale price (MRP) must be corrected to reflect the implementation of GST. Such corrections may be carried out by stamping, affixing stickers, or through online printing, as applicable, at any suitable place on the package.

It is informed that the declaration of the revised unit sale price on unsold pre-packaged commodities or on unused packaging material/wrappers bearing a pre-printed MRP is not mandatory. However, manufacturers, packers, importers, or their representatives may, if they so desire, voluntarily declare the revised unit sale price.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"