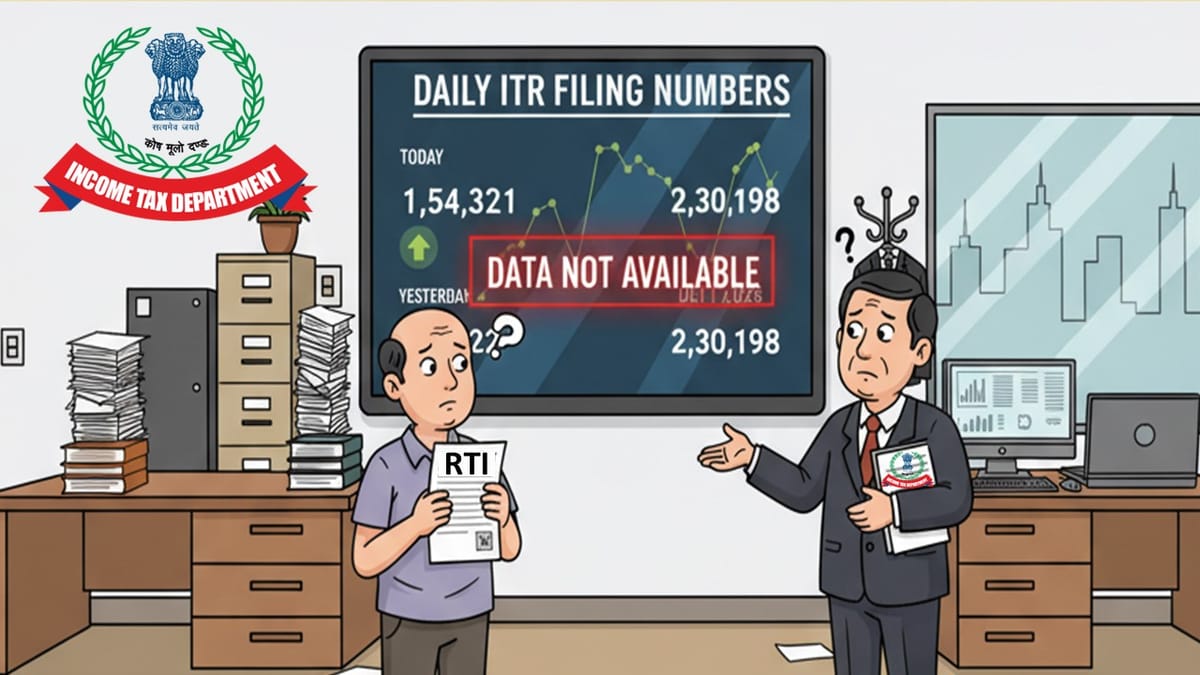

When RTI was filed by Pallav Parashar, asking the ITR Filing data for September 1 to September 15, 2025, the CPC, Bengaluru, said that the data was unavailable.

Nidhi | Sep 27, 2025 |

Income Tax Dept Shows Daily ITR Filing Numbers, But Says ‘Data Not Available’ in RTI

The recent incident has raised the question of the transparency maintained by the Income Tax Department. A user, Pallav Parashar, on Platform X, shared how he filed a Right to Information (RTI) request but was answered with “data not available“.

The income tax department displays the daily number of Income Tax Returns (ITRs) filed, but when the RTI was filed by Pallav Parashar, asking the same data for September 1 to September 15, 2025, the central processing centre (CPC), Bengaluru, said that the data was unavailable.

The user wrote that the data is only for publicity, and when it comes to accountability, the data disappears.

The response from the CPC claimed that the authority under the RTI Act does not create information, interpret information, solve problems raised by applicants, or file replies to hypothetical questions. They said that the RTI can only be filed for the information that already exists with the public authority.

The CPC also referred to a Delhi High Court ruling in the case Supreme Court of India Vs Commoodore Lokesh Batra and Ors., which held that the public authority is not obligated to create or collect information sought by an applicant which is not available with it.

ANOTHER SHOCKER BY @IncomeTaxIndia : @IncomeTaxIndia flashes daily ITR filing numbers on its website, but under RTI it says, “data not available.”

When it’s for publicity, data exists.

When it’s for accountability, it vanishes!This isn’t transparency…it’s a cover-up. pic.twitter.com/oAebQMheWl

— Pallav Parashar (@FCAPallav) September 25, 2025

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"