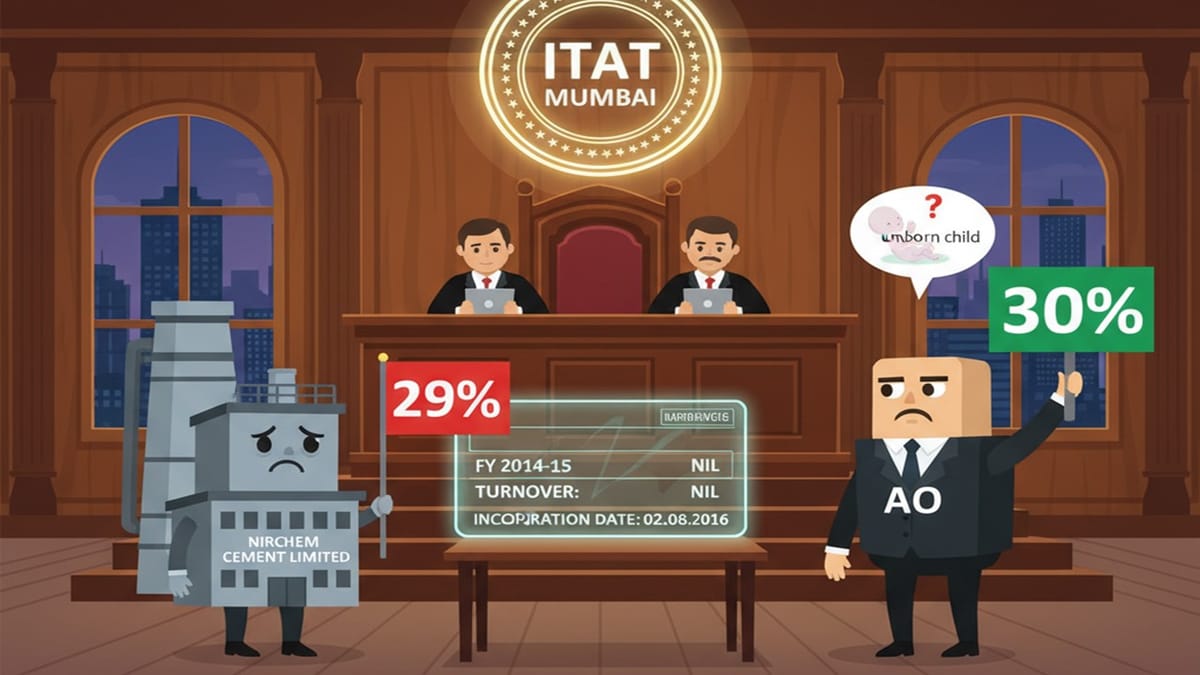

ITAT Mumbai ruled that a company incorporated in FY 2015-16 cannot claim the 29% concessional tax rate meant for companies existing in FY 2014-15, and upheld the 30% tax rate applied by the AO.

Saloni Kumari | Nov 10, 2025 |

ITAT Upholds 30% Tax Rate for Newly Incorporated Company Not Eligible for 29% Concession

The company was newly formed in the financial year 2015-16, so it could not claim the 29% tax rate linked to the financial year 2014-15 turnover. ITAT confirmed the 30% rate was correct and endorsed the decision made by the assessing officer (AO).

The present appeal has been filed by a company named Nirchem Cement Limited (Appellant) against the Assisstent Commissioner of Income Tax, Circle – 2(3)(1) (Respondent), in the Income Tax Appellate Tribunal (ITAT) “B” Bench, Mumbai, before Shri Vikram Singh Yadav (Accountant Member) and Shri Sandeep Singh Karhail (Judicial Member). The case is related to the assessment year 2017-18.

The assessee filed its income tax return (ITR) for the assessment year 2017-18, declaring a total income of Rs. 9.5 crore and paying tax at 29%, as per the Finance Act, 2017. The filed return was statutorily accepted under Section 143(3) with the same tax rate (29%). Later on, the assessing officer (AO) issued a rectification notice under Section 154, saying the correct rate should be 30%, not 29% and chose the return for scrutiny. The AO finally passed an order dated 22.03.2024, increasing the tax rate to 30% and recomputing the interest under Sections 234B and 234C.

Assessee dissatisfied with the action of the assessing officer (AO), then filed an appeal before the CIT(A), challenging the order passed under section 154 of the Act, claiming the correct tax rate is 29%, not 30%.

The assessee said that according to the Finance Act, 2017, domestic companies with a turnover below Rs. 5 crore in the financial year 2014-15 are taxed at 29%. Since the company was incorporated only in 2016, its turnover for the financial year 2014-15 was Nil, so it should get the 29% rate benefit.

However, the CIT(A) rejected the claims of the assessee and said that the 29% rate applies only to companies existing in the financial year 2014-15 with turnover up to Rs. 5 crore. The assessee did not exist then, so the lower tax rate cannot apply.

The tribunal agreed with the ruling of CIT(A) that the company came into existence only on August 02, 2016, so it was not in existence in the financial year 2014-15. Hence, it is not eligible for the 29% tax rate meant for companies in existence in that FY. The 30% rate applies to all other companies, including new ones like the assessee. The AO’s correction under Section 154 was valid because this was an obvious mistake.

The Tribunal compared it to “expecting an unborn child to have income”; since the company did not exist in FY 2014-15, it couldn’t have turnover for that year.

In the final decision, the ITAT held that the AO was right in correcting the mistake and applying the 30% tax rate. Hence, the appeal filed by Nirchem Cement Limited has been dismissed.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"