CIT(E) directed to freshly examine charitable objects and activities under amended Section 12AB framework

Meetu Kumari | Nov 19, 2025 |

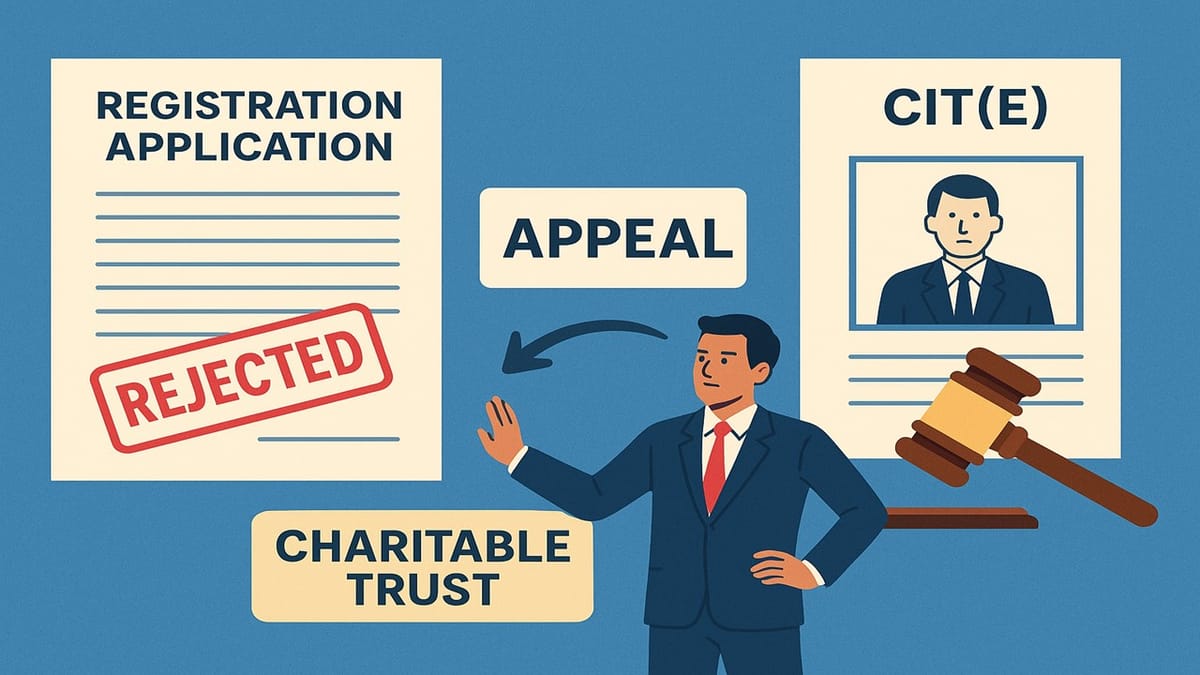

ITAT Remands 12AB Registration Rejection; Holds Section 13(1)(b) Cannot Be Invoked at Registration Stage

The assessee is a public charitable trust established for welfare activities connected with the Dashashrimali Kanthibandh (Vaishnav) Vanik Gnati community. It originally received provisional registration under Section 12AB(1)(ac)(vi) for AYs 2022-23 to 2024-25. In March 2023, it applied in Form 10AB for conversion to regular registration under Section 12AB(1)(ac)(iii).

After issuing notices and examining replies, the CIT(E) rejected the application holding that the trust’s objects catered to a specific community and were hit by Section 13(1)(b). The trust later filed a fresh application on 30.06.2024, citing CBDT Circular 07/2024, but this was also rejected on 06.12.2024 as non-maintainable. The assessee appealed both orders and sought condonation of the delay.

Issue Raised: Whether the CIT(E) was justified in rejecting the assessee’s 12AB registration by invoking Section 13(1)(b) and concluding that the trust benefits a particular community without evaluating its actual charitable activities or applying the amended Section 12AB(4) framework.

Tribunal Held: The ITAT held that the CIT(E) erred by relying solely on object clauses referencing the community name, without examining the genuineness of activities, application of funds, or overall charitable purpose. The Tribunal reiterated that Section 13(1)(b) cannot be invoked at the stage of granting registration; it becomes relevant only during assessment when exemption under Sections 11-12 is examined.

The Tribunal clarified that even under the amended Section 12AB regime, the correct approach is to grant registration where the trust’s activities are genuine and charitable and thereafter monitor compliance through the “specified violation” mechanism under Section 12AB(4). The ITAT set aside the order and remanded the matter for fresh consideration. The second appeal, arising from the rejection of the later application, was deemed ineffective because the core controversy had already been remanded. The CIT(E) must re-examine the case independently and cannot reject registration solely because membership is restricted to a particular community.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"