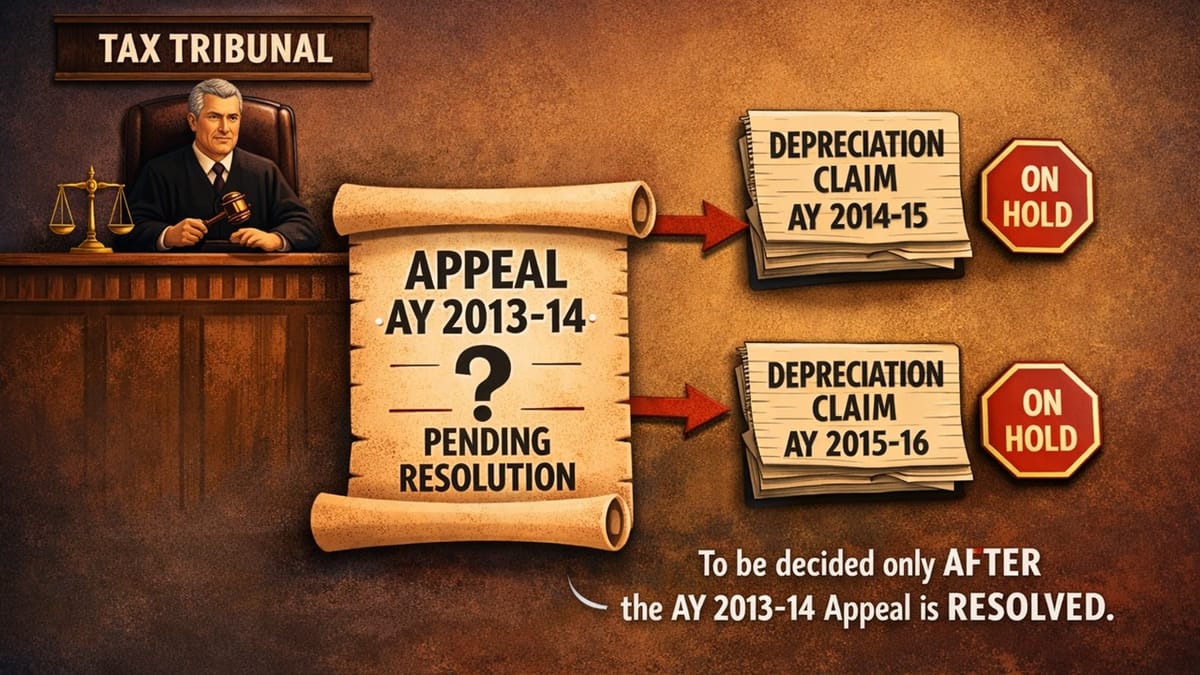

ITAT held that depreciation claims for AY 2014-15 and 2015-16 are consequential and must be decided only after the pending AY 2013-14 appeal is resolved.

Saloni Kumari | Dec 25, 2025 |

Depreciation Claims for Later Years Cannot Be Decided Without Resolving Earlier Years: Rules ITAT

The company’s claim for depreciation in 2014-15 and 2015-16 is linked to the unresolved 2013-14 case. The tribunal remanded the cases to the lower authority to be decided after the 2013-14 appeal is settled.

Tata Hitachi Construction Machinery Company Private Limited has filed the two appeals in the ITAT Bangalore, challenging the appellate orders dated January 13, 2020, and January 20, 2020.

Both the appeals were filed on a common issue: that CIT(A) confirmed the depreciation disallowance worth about Rs. 17.27 crore and Rs. 12.95 crore on “Brand and Technology” assets for the assessment years 2014-15 and 2015-16, respectively.

Previously in AY 2013-14, two companies named M/s Serviplem Technology and M/s. Comoplesa Lebrero were acquired by the assessee, and depreciation was claimed on the brand and technology value of Rs. 77.82 crore. However, the Tax Officer (AO) and the Transfer Pricing Officer (TPO) held the actual cost as NIL and hence disallowed depreciation worth Rs. 9.72 crore for AY 2013-14. The appeal of the assessee for that AY has been left pending since 2017.

On this issue, the assessee company argued that the aforediscussed depreciation pertains to the Assessment Years 2014-15 and 2015-16 and depends on the outcome of the pending appeal for AY 2013-14. Therefore, the tax department cannot decide on depreciation belonging to later years until the AY 2013-14 issue is resolved.

When the tribunal analysed the arguments of both sides, it noted that the assessee’s appeal, belonging to the AY 2013-14, has been kept pending for more than 8 years. The disallowance in 2014-15 and 2015-16 is “consequential” on the outcome of AY 2013-14. Hence, the lower authorities, i.e., CIT(A), should have either combined the appeals or waited for the 2013-14 decision before deciding the later years.

In the final decision, the tribunal restored both the appeals belonging to the AY2014-15 and 2015-16 and sent the case back to the CIT(A) with directions to decide them after the AY 2013-14 appeal is fully decided. The tribunal did not give any ruling on whether depreciation should actually be allowed or not. Overall, the appeals have been allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"