The GST proceedings under Section 74 must be based on clear evidence of fraud and cannot be initiated merely on suspicion, ruled the High Court.

Saloni Kumari | Jan 12, 2026 |

GST Returns and E-Way Bills Are Enough to Prove Movement of Goods, Toll Receipts NOT Mandatory: Allahabad HC

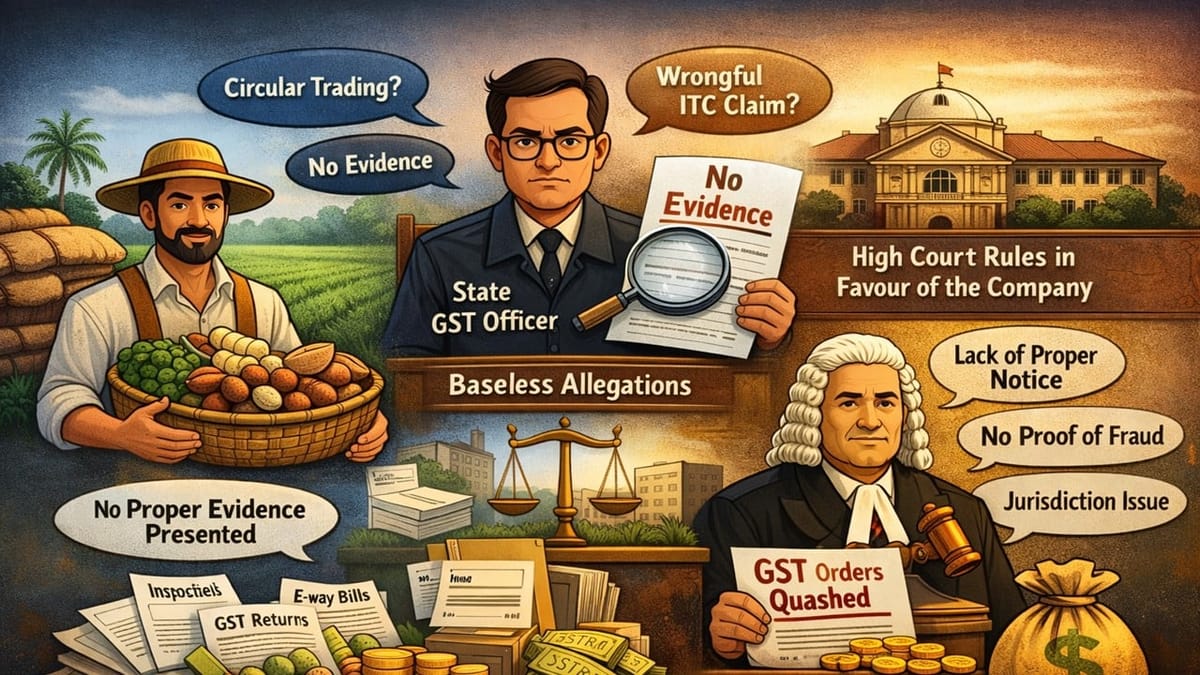

The Allahabad High Court has set aside GST orders passed against a company engaged in the business of agricultural goods and areca nuts. The Court ruled that the tax department acted without a proper legal basis while accusing the company of circular trading and wrongful claim of input tax credit.

The case has been filed by a company named Raghuvansh Agro Farms Limited in the Allahabad High Court, challenging two GST orders dated January 10, 2025, and May 31, 2023, passed by the GST authorities or lower authorities.

The dispute arose when a GST survey was conducted in 2019; thereafter, the State GST authorities started proceedings under Section 74 of the GST Act. Wherein, the GST department alleged the company availed Input Tax Credit (ITC) without actual movement of any goods. In conclusion to these allegations, tax, interest, and penalty were imposed on the company, which were later upheld in appeal.

As per the department the petitioner has failed to bring on record the toll plaza receipts, which could not justify the actual physical movement of the goods. He further submits that the petitioner in certain cases has failed to bring on record cogent material for proving actual physical movement of the goods, therefore, the impugned orders are justified.

When the Allahabad High Court analysed the case, it observed that proceedings were initiated against the petitioner company under Section 74 of the SGST Act, and to initiate proceedings under the said section, the authorities should have proper evidence proving the fraud. The court said the said section proceedings are duty-bound to show the reason for fraud, willful misstatement, or suppression of fact for the availment of input tax credit wrongly or excessive claim of input tax credit (ITC). Meaning, the authority should issue a show-cause notice explaining the reason why a particular action is being taken against the petitioner. Like in the present case, the petitioner had wrongly availed or utilised input tax credit due to some fraud or willful misstatement or suppression of fact.

But, the authorities in the current case neither issued the show cause notice nor did the final order record any such finding. The Court said that in the absence of these essential ingredients, the entire proceedings were without jurisdiction. The court further noted that all the purchases made by the petitioner were supported by proper evidence, like tax invoices, e-way bills, and transport documents. Payments were made through banking channels, and the transactions were properly reflected in GST returns such as GSTR-1, GSTR-2A, and GSTR-3B. However, the department did not analyse these documents and relied only on the suspicion raised during the survey.

Additionally, the court noted that the case of the company was under Central GST jurisdiction, and the State GST authorities failed to show any valid notification or legal basis for initiating proceedings against it. The court further noted that the proceedings against one of the petitioner company’s suppliers had already been dismissed in the past by the Central GST authorities. It held that once the supplier was cleared, no adverse inference could be drawn against the petitioner on that basis.

In conclusion to the aforesaid findings, the High Court held all the arguments served by the GST department as invalid. The High Court quashed the GST orders passed by the authorities and allowed the writ petition. The court directed that any amount deposited by the company be refunded within one month.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"