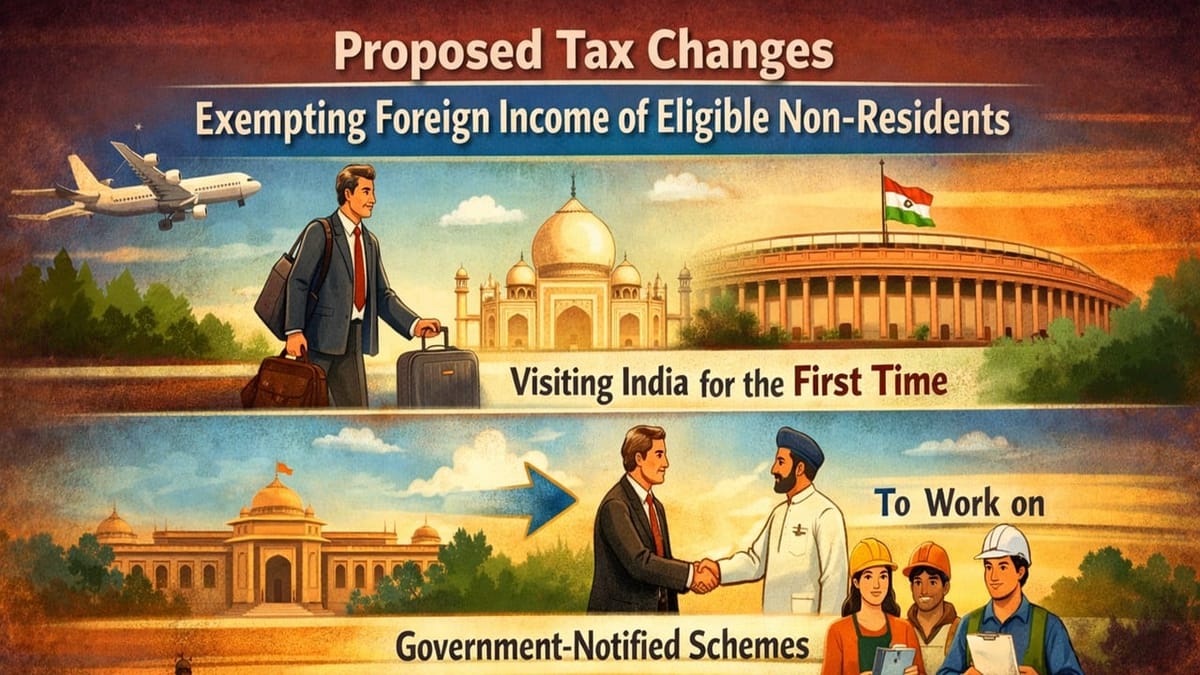

Proposed tax changes will exempt the foreign income of eligible non-residents visiting India for the first time to work on government-notified schemes from April 2026.

Saloni Kumari | Feb 3, 2026 |

Big Relief for NRIs: Foreign Income to Remain Tax-Free When Working on Govt Schemes from 2026

The new income tax rules 2025 currently grant tax exemptions to certain income earned by non-residents of India, foreign companies, and similar persons when they are involved in specific government-notified schemes. Such exemptions are given under Section 11, read with Schedule IV of the Income Tax Act, which specifies the types of income that are not added to their total taxable income in India.

The government of India has proposed a key change to these non-residents who visit India to render certain services in connection with any notified scheme of the Central Government, to provide greater tax clarity and confidence for NRIs.

Under the proposal, the government is planning to amend the said schedule to give exemption to an individual who has been a non-resident of India for a period of five consecutive tax years immediately before the tax year during which he/she visits India for the first time for rendering services under the notified scheme, provided all prescribed conditions are met. If such an individual visits India for the first time to render services connected with a notified government scheme, their income earned outside India will not be taxed in India.

This change is scheduled to take effect from April 01, 2026, and will apply to the tax year 2026-27 and subsequent tax years. The key aim of this action is to encourage skilled non-residents to participate in government-notified schemes without worrying about taxation on their foreign income.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"