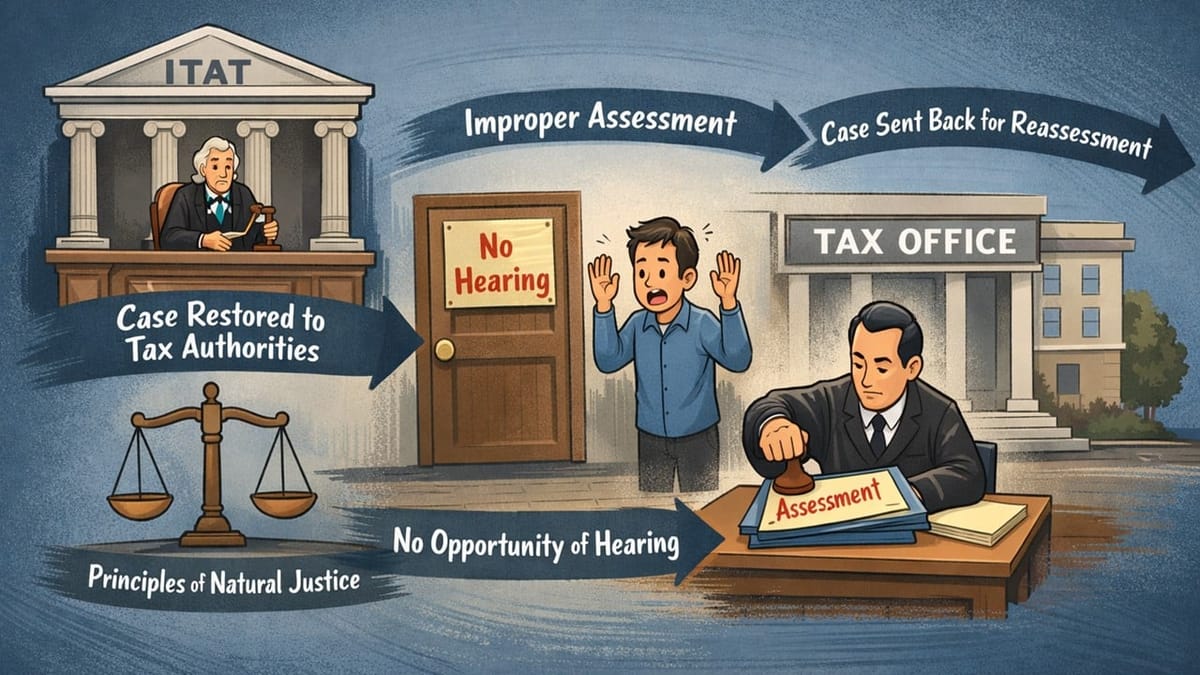

The ITAT restored the case to the tax authorities after finding that the assessment was completed without granting a proper opportunity for hearing.

Saloni Kumari | Feb 19, 2026 |

ITAT Remands Matter to AO Citing Violation Of Natural Justice

The Income Tax Appellate Tribunal (ITAT), Bangalore Bench, has restored the case for the company for the Assessment Year 2018-19 and sent the matter back to the Assessing Officer after finding that the assessment and first appeal were decided without a proper hearing, indicating an explicit violation of the principles of natural justice.

Tirupathi Enterprises has filed the present appeal in the ITAT Bangalore, challenging an order dated May 29, 2024, passed by the CIT(A)/NFAC Delhi. The case pertains to the Assessment Year 2018-19.

The assessee company had filed its income tax return (ITR) for the year in consideration, declaring total income at Rs. 9.12 lakh. The income tax authorities choose the return for scrutiny for the reason of the offering of the income as income from house property. In conclusion, notices were issued addressing the assessee. However, the assessee did not respond to any of the notices; as a result, the AO passed an ex parte order under Sections 144 and 144B of the Income Tax Act, 1961, and treated the receipts as income from house property. After allowing standard deduction, the total income was assessed at Rs. 79.80 lakh instead of the income declared under presumptive taxation.

The aggrieved assessee filed an appeal before the CIT(A) challenging the aforesaid decision, but the same was deleted because of the non-appearance. On this, the assessee claimed that it was not aware of the proceedings because notices were sent to its auditor’s email ID.

When the tribunal analysed the facts of the case, it noted that the final order was issued without hearing the assessee, which is a clear violation of the principles of natural justice. As a result, the tribunal restored the case to the Assessing Officer (AO) for fresh examination. Further directed the tax authorities to give the assessee a proper opportunity of hearing. However, the Tribunal clarified that Section 44AD (presumptive taxation) does not apply in this case. The assessee’s appeal was allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"