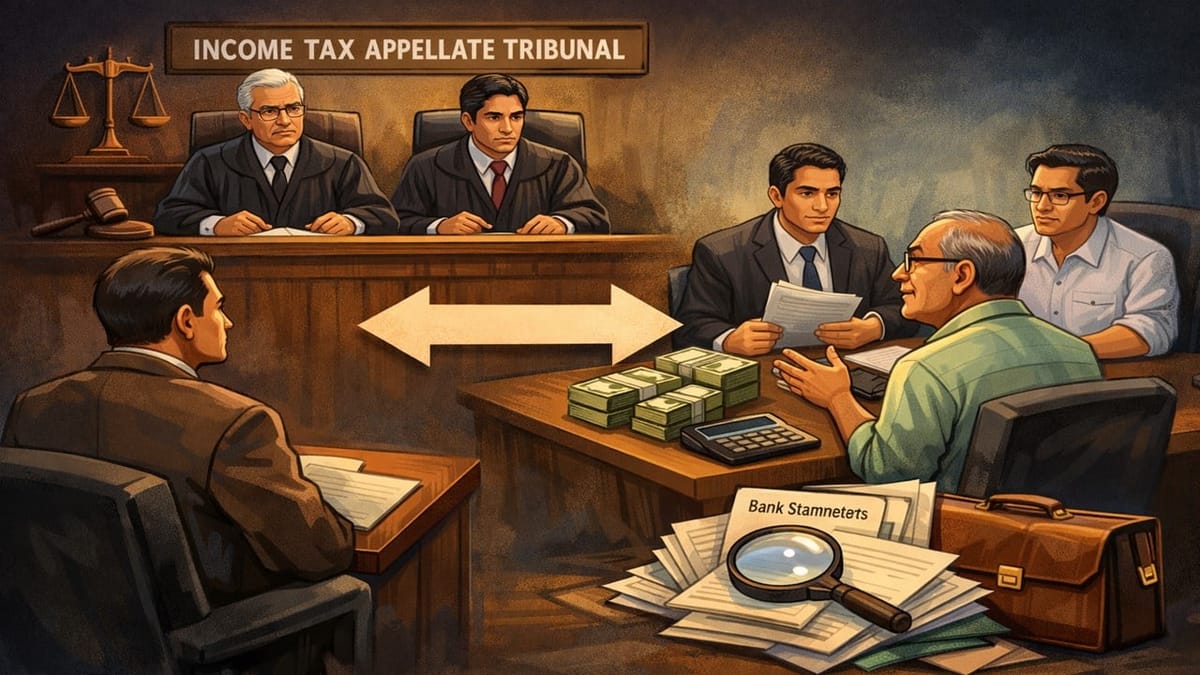

ITAT Ahmedabad remands Rs 63.75 lakh cash addition to CIT(A), granting the assessee a final opportunity to submit evidence.

Vanshika verma | Dec 17, 2025 |

Addition Based on Third-Party Statement Sent Back for Fresh Consideration by ITAT

ITAT Ahmedabad set aside the CIT(A)’s order confirming Rs 63.75 lakh cash addition made based on a third-party statement. The matter was remanded to CIT(A) for fresh adjudication, granting the assessee a final opportunity to explain the source of cash with proper evidence.

The present appeal has been filed by Mahendra Manilal Shah (Appellant) against the Income Tax Officer, Ward, Ahmedabad (Respondent) in the Income Tax Appellate Tribunal (ITAT) “A” Bench, Ahmedabad, before Dr B.R.R. Kumar (Vice-President) and Shri Siddhartha Nautiyal (Judicial Member). The case is related to the assessment year 2012-13 and was decided on December 12, 2025. The appeal is filed by the assessee against the order dated August 10, 2025, passed by the CIT(A).

The assessee filed an appeal before the CIT(A), arguing that the AO had made an addition of Rs 63,75,000 based on a third-party statement and without any proper evidence. However, the CIT(A) upheld the addition because the assessee did not submit the required details despite multiple opportunities.

Being aggrieved with the CIT(A) decision, the assessee further approached the ITAT. Tribunal noticed that the assessee was offered multiple opportunities for hearing to report details and clarifications to explain the source of the cash payment of Rs 63,75,000. However, the assessee failed to reply before the CIT(A). Before the Tribunal, the assessee requested one more chance to submit all necessary documents and explanations. Considering this request and in the interest of justice, the Tribunal set aside the CIT(A)’s order and sent the matter back to the CIT(A) for fresh consideration.

Tribunal also directed the assessee to submit all relevant bank statements and documents and to fully cooperate without seeking unnecessary adjournments.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"