Since the relevant notice denied the personal hearing to the petitioner company, the court held that the order violated the mandatory procedure.

Nidhi | Feb 18, 2026 |

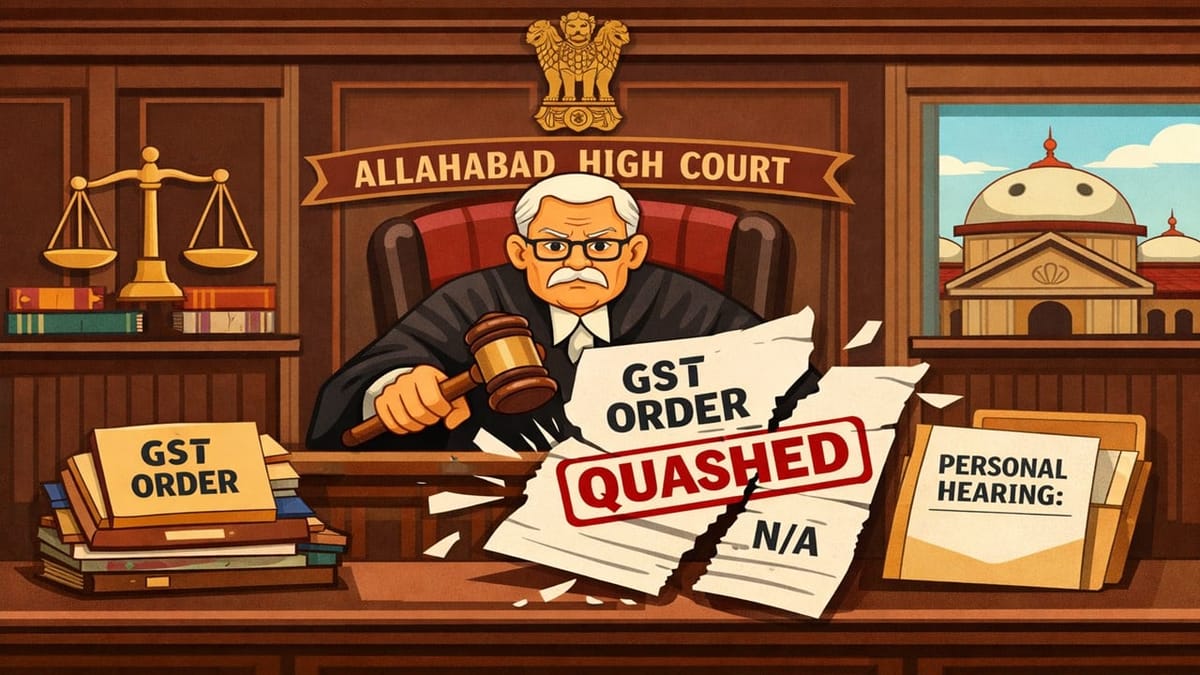

Allahabad HC Quashes GST Order After Personal Hearing Column in Notice Mentions “NA”

The Allahabad High Court has quashed a GST order due to a lack of personal hearing since the relevant notice did not allow the petitioner to appear for an oral hearing.

The petitioner, Satish Engineering Works, received a notice where the column for the “date of personal hearing” mentioned “NA,” i.e., “Not Applicable.” This clearly showed that the petitioner company was not given any opportunity for a personal hearing. Therefore, the petitioner filed a writ before the Allahabad High Court, arguing that it did not get a hearing opportunity.

The High Court agreed with the company, observing that Section 75(4) of the UPGST Act, 2017, clearly says that the petitioner must be given an opportunity for a personal hearing even if the petitioner fails to comply with the show cause notice.

The Court further explained that the rules of natural justice prescribed two requirements: a written reply and an oral hearing. If a petitioner does not reply to the show cause notice, it cannot lead to the denial of the oral hearing. The petitioner still has the right to appear for the personal hearing.

Since the relevant notice denied the personal hearing to the petitioner company, the court held that the order violated the mandatory procedure. Therefore, the GST order was set aside, and the matter was sent back to the assessing authority.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"