Deepak Gupta | May 23, 2019 |

Analysis of GST Audit Report Form GSTR-9C | Audit Report Form GSTR-9C summary:

The taxpayers registered under GST have to file various returns including an annual return. As per the provisions of GST registered taxpayer whose turnover during a financial year exceeds the Rs 2 crore is required to file GSTR 9C.

GSTR-9C is a statement ofreconciliationbetween the Annual returns in GSTR 9 filed for an FY, first being 2017-18 and the figures as per Audited Annual Financial statements of the taxpayer. It has to be certified by a Chartered Accountant or Cost Accountantand the due date for filing GSTR 9C for FY 17-18 is 30th June 2019.

An important point to note is that we cannot make payment of taxes while filing GSTR 9C. Declaring additional turnover/Taxes while filing GSTR 9 or Annual Return would simply mean informing proper officer on voluntary basis that you have not paid tax. In such cases one need to file FORM GST DRC-03 ( for making payment of taxes and interest ) and the proper officer shall issue an acknowledgement, accepting the payment made by the said person in FORM GST DRC04.

| Amendment made by Notification No. 74/2018 Central Tax dated 31st December, 2018 1.) All returns in FORM GSTR-1, FORM GSTR-3B and FORM GSTR-9 before filing FORM GSTR-9C 2.) ITC cannot be availed through FORM GSTR-9C 3.) Verification by taxpayer who is uploading reconciliation statement would be included in FORM GSTR-9C |

GSTR 9C has two major parts PART A Reconciliation Statement and PART B Certification. Through this article we have tried to give a brief of Form GSTR 9C.

The GSTR-9C consists of two main parts:

Part-A: Reconciliation Statement

Part-B: Certification

Part A of GSTR 9C can be divided into 5 basic parts and the same are summarized here under

| Parts | Description | Tables |

| Part 1 | Basic Details | Table 1-4 |

| Part 2 | Reconciliation of turnover declared in audited Annual Financial Statement with turnover declared in Annual Return (GSTR9) | Table 5-8 |

| Part 3 | Reconciliation of tax paid | Table 9-11 |

| Part 4 | Reconciliation of Input Tax Credit (ITC) | Table 12-16 |

| Part 5 | Auditor’s recommendation on additional Liability due to non-reconciliation | Table 17 |

Part I comprises of Basic Details likeFinancial Year for which GSTR 9C is being filed, GSTIN Number , Legal Name and Trade Name of the Entity.

Points to be noted :

The details for the period between July 2017 to March 2018 are to be provided in this statement for the financial year 2017-18. The reconciliation statement is to be filed for every GSTIN Separately.

The reference to current financial year in this statement is the financial year for which the reconciliation statement is being filedfor.

Distinction between a trade name and a legal name must be clearly understood and borne out in clause 3A and 3B of Part I. Attention must be paid to the fact that the trade name and legal name are not used interchangeably.

Part II consists of reconciliation of the annual turnover declared in the audited Annual Financial Statement with the turnover as declared in the Annual Return furnished in FORM GSTR-9 for this GSTIN

| Table No. | Instructions |

| 5A | The turnover as per the audited Annual Financial Statement shall be declared here. There may be cases where multiple GSTINs (State-wise) registrations exist on the same PAN. This is common for persons / entities with presence over multiple States. Such persons / entities, will have to internally derive their GSTIN wise turnover and declare the same here. This shall include export turnover (if any). It may be noted that reference to audited Annual Financial Statement includes reference to books of accounts in case of persons/ entities having presence over multiple States. |

| 5B | Unbilled revenue which was recorded in the books of accounts on the basis of accrual system of accounting in the last financial year and was carried forward to the current financial year shall be declared here. In other words, when GST is payable during the financial year on such revenue (which was recognized earlier), the value of such revenue shall be declared here. (For example, if rupees Ten Crores of unbilled revenue existed for the financial year 2016-17, and during the current financial year, GST was paid on rupees Four Crores of such revenue, then value of rupees Four Crores rupees shall be declared here) |

| 5C | Value of all advances for which GST has been paid but the same has not been recognized as revenue in the audited Annual Financial Statement shall be declared here. |

| 5D | Aggregate value of deemed supplies under Schedule I of the CGST Act, 2017 shall be declared here. Any deemed supply which is already part of the turnover in the audited Annual Financial Statement is not required to be included here. |

| 5E | Aggregate value of credit notes which were issued after 31st of March for any supply accounted in the current financial year but such credit notes were reflected in the annual return (GSTR-9)shall be declared here. |

| 5F | Trade discounts which are accounted for in the audited Annual Financial Statement but on which GST was leviable (being not permissible) shall be declared here. |

| 5G | Turnover included in the audited Annual Financial Statement for April 2017 to June 2017 shall be declared here. |

| 5H | Unbilled revenue which was recorded in the books of accounts on the basis of accrual system of accounting during the current financial year but GST was not payable on such revenue in the same financial year shall be declared here. |

| 5I | Value of all advances for which GST has not been paid but the same has been recognized as revenue in the audited Annual Financial Statement shall be declared here. |

| 5J | Aggregate value of credit notes which have been accounted for in the audited Annual Financial Statement but were not admissible under Section 34 of the CGST Act shall be declared here. |

| 5K | Aggregate value of all goods supplied by SEZs to DTA units for which the DTA units have filed bill of entry shall be declared here. |

| 5L | There may be cases where registered persons might have opted out of the composition scheme during the current financial year. Their turnover as per the audited Annual Financial Statement would include turnover both as composition taxpayer as well as normal taxpayer. Therefore, the turnover for which GST was paid under the composition scheme shall be declared here. |

| 5M | There may be cases where the taxable value and the invoice value differ due to valuation principles under section 15 of the CGST Act, 2017 and rules thereunder. Therefore, any difference between the turnover reported in the Annual Return (GSTR 9) and turnover reported in the audited Annual Financial Statement due to difference in valuation of supplies shall be declared here. |

| 5N | Any difference between the turnover reported in the Annual Return (GSTR9) and turnover reported in the audited Annual Financial Statement due to foreign exchange fluctuations shall be declared here. |

| 5O | Any difference between the turnover reported in the Annual Return (GSTR9) and turnover reported in the audited Annual Financial Statement due to reasons not listed above shall be declared here. |

| 5Q | Annual turnover as declared in the Annual Return (GSTR 9) shall be declared here. This turnover may be derived from Sr. No. 5N, 10 and 11 of Annual Return (GSTR 9). |

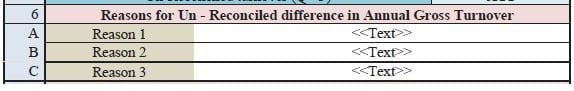

Reasons for non-reconciliation between the annual turnover declared in the audited Annual Financial Statement and turnover as declared in the Annual Return (GSTR 9) shall be specified here.

The table provides for reconciliation of taxable turnover from the audited annual turnover after adjustments with the taxable turnover declared in annual return (GSTR-9).

| 7A | Annual turnover as derived in Table 5P above would be auto-populated here. |

| 7B | Value of exempted, nil rated, non-GST and no-supply turnover shall be declared here. This shall be reported net of credit notes, debit notes and amendments if any. |

| 7C | Value of zero rated supplies (including supplies to SEZs) on which tax is not paid shall be declared here. This shall be reported net of credit notes, debit notes and amendments if any. |

| 7D | Value of reverse charge supplies on which tax is to be paid by the recipient shall be declared here. This shall be reported net of credit notes, debit notesand amendments if any. |

| 7E | The taxable turnover is derived as the difference between the annual turnover after adjustments declared in Table 7A above and the sum of all supplies (exempted, non-GST, reverse charge etc.) declared in Table 7B, 7C and 7D above. |

| 7F | Taxable turnover as declared in Table 4N of the Annual Return (GSTR9) shall be declared here. |

Reasons for non-reconciliation between adjusted annual taxable turnover as derived from Table 7E above and the taxable turnover declared in Table 7F shall be specified here.

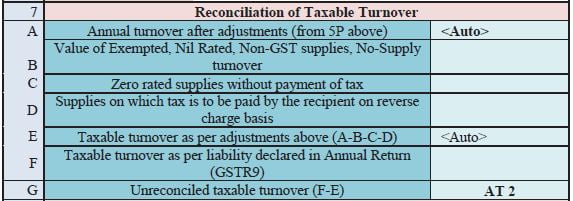

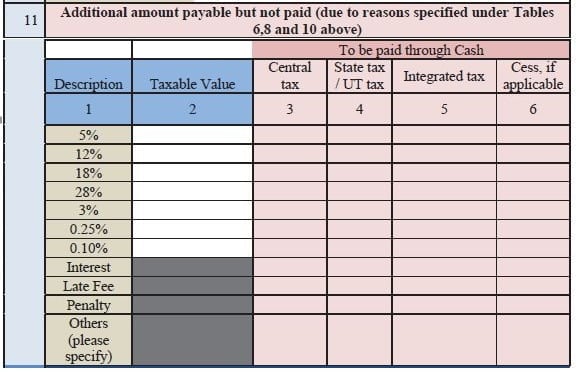

| Table No. | Instructions |

| 9 | The table provides for reconciliation of tax paid as per reconciliation statement and amount of tax paid as declared in Annual Return (GSTR 9). Under the head labelled RC, supplies where tax was paid on reverse charge basis by the recipient (i.e. the person for whom reconciliation statement has been prepared ) shall be declared. |

| 9P | The total amount to be paid as per liability declared in Table 9A to 9O is auto populated here. |

| 9Q | The amount payable as declared in Table 9 of the Annual Return (GSTR9) shall be declared here. It should also contain any differential tax paid on Table 10 or 11 of the Annual Return (GSTR9). |

Reasons for non-reconciliation between payable / liability declared in Table 9P above and the amount payable in Table 9Q shall be specified here.

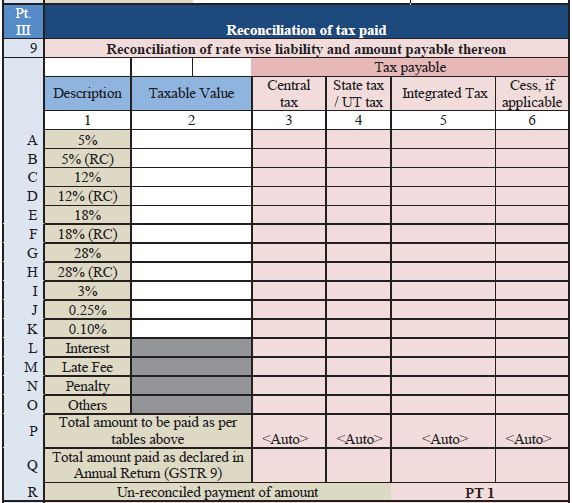

Any amount which is payable due to reasons specified under Table 6, 8 and 10 above shall be declared here.

Any amount which is payable due to reasons specified under Table 6, 8 and 10 above shall be declared here.

An important point to note is that we cannot make payment of taxes while filing GSTR 9C. Declaring additional turnover/Taxes while filing GSTR 9 or Annual Return would simply mean informing proper officer on voluntary basis that you have not paid tax. In such cases one need to file FORM GST DRC-03 ( for making payment of taxes and interest ) and the proper officer shall issue an acknowledgement, accepting the payment made by the said person in FORM GST DRC04.

Part IV consists of reconciliation of Input Tax Credit (ITC)

| Table No. | Instructions |

| 12A | ITC availed (after reversals) as per the audited Annual Financial Statement shall be declared here. There may be cases where multiple GSTINs (State- wise) registrations exist on the same PAN. This is common for persons / entities with presence over multiple States. Such persons / entities, will have to internally derive their ITC for each individual GSTIN and declare the same here. It may be noted that reference to audited Annual Financial Statement includes reference to books of accounts in case of persons / entities having presence over multiple States. |

| 12B | Any ITC which was booked in the audited Annual Financial Statement of earlier financial year(s)but availed in the ITC ledger in the financial year forwhich the reconciliation statement is being filed for shall be declared here. This shall include transitional credit which was booked in earlier years but availed during Financial Year 2017-18. |

| 12C | Any ITC which has been booked in the audited Annual Financial Statement of the current financial year but the same has not been credited to the ITC ledger for the said financial year shall be declared here. |

| 12D | ITC availed as per audited Annual Financial Statement or books of accounts as derived from values declared in Table 12A, 12B and 12C above will be auto-populated here. |

| 12E | Net ITC available for utilization as declared in Table 7J of Annual Return (GSTR9) shall be declared here. |

Reasons for non-reconciliation of ITC as per audited Annual Financial Statement or books of account (Table 12D) and the net ITC (Table12E) availed in the Annual Return (GSTR9) shall be specified here.

This table is for reconciliation of ITC declared in the Annual Return (GSTR9) against the expenses booked in the audited Annual Financial Statement or books of account. The various sub-heads specified under this table are general expenses in the audited Annual Financial Statement or books of account on which ITC may or may not be available. Further, this is only an indicative list of heads under which expenses are generally booked. Taxpayers may add or delete any of these heads but all heads of expenses on which GST has been paid / was payable are to be declared here.

| 14R | Total ITC declared in Table 14A to 14Q above shall be auto populated here. |

| 14S | Net ITC availed as declared in the Annual Return (GSTR9) shall be declared here. Table 7J of the Annual Return (GSTR9) may be used for filing this Table. |

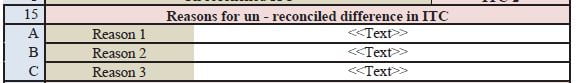

Reasons for non-reconciliation between ITC availed on the various expenses declared in Table 14R and ITC declared in Table 14S shall be specified here.

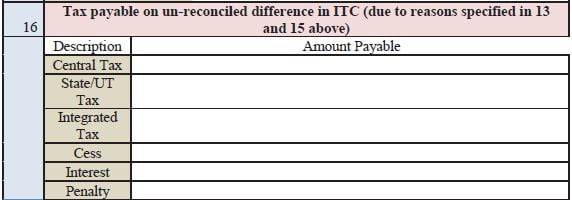

Any amount which is payable due to reasons specified in Table 13 and 15 above shall be declared here.

Part V consists of the auditors recommendation on the additional liability to be discharged by the taxpayer due to non-reconciliation of turnover or non-reconciliation of input tax The auditor shall also recommend if there is any other amount to be paid for supplies not included in the Annual Return. Any refund which has been erroneously taken and shall be paid back to the Government shall also be declared in this table. Lastly, any other outstanding demands which is recommended to be settled by the auditor shall be declared in this Table.

Towards, the end of the reconciliation statement taxpayers shall be given an option to pay their taxes as recommended by the auditor.

Certification of GSTR 9C can be done by a CA or CMA

Please note that ICAI videannouncement dated 28th September 2018 has clarified that Internal Auditor cannot undertake Goods and Service Tax (GST) Audit simultaneously

Reconciliation statement (FORM GSTR-9C) can be drawn up and certification can be done by the person who had conducted the audit of Accounts or it can be done by someone who has notconducted the audit of Accounts. Format of Certification are different in both the cases.

Part-A: Reconciliation Statement

Part-B:Certification

(The Author of this Article can be reached at pratibha_goyal@hotmail.com)

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information.In no event shall I shall be liable for any direct, indirect, special or incidental damage resulting from, arising out of or in connection with the use of the information. Please refer your consultant before relying on the provisions of this article.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"