Reetu | Jun 5, 2020 |

Annual Statement of TDS/TCS with new Annual Information Statement

In Budget 2020-21 a new Section 285BB in the Income Tax Act was inserted to implement revised Form 26AS . In that effect CBDT has notified new FORM 26AS [Annual Information Statement] via Notification No 30/2020 dated 28th May 2020, Rule 31AB has been omitted and Rule 114-I has been inserted after Rule 114-H to share annual financial information in respect of each taxpayer not only of taxes paid by of TDS/TCS or otherwise.

• This form will also have mobile no, email I’d and Aadhar no. of the taxpayer.

• Information on this form 26AS will not be a onetime affair at year end. This will be a live 26AS , as this will be updated regularly within 3 months from the end of the month in which such information is received.

• The revised 26AS Form is more comprehensive and informative and will be a complete profile of the taxpayer for a particular year

• The implication of this new form 26AS will be that banks , financial institutions or any other authority or customer , buyer etc. while carrying out due diligence of the person/corporate, concerned will now ask for form 26AS so as to be sure that there are not any major issues about such person/corporates.

• As a result of introduction of New 26AS now it will be difficult for any taxpayer to hide information from any bank / financial institution/ authority about any proceedings against under any law or tax demand , tax disputes etc .

Annual Statement of TDS/TCS with new Annual Information Statement

This new form 26AS will also provide information in respect of specified financial transactions which includes the following-

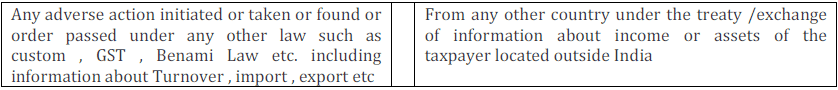

An enabling provision has been notified empowering the CBDT to authorise DG Systems or any other officer to upload in this form 26AS the following information received from any other officer, Tax Department or authority under any law so that not only the concerned taxpayer but also all the Income Tax authorities will know and have access to such information.

Tags: Income Tax

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"