Deepak Gupta | Nov 3, 2021 |

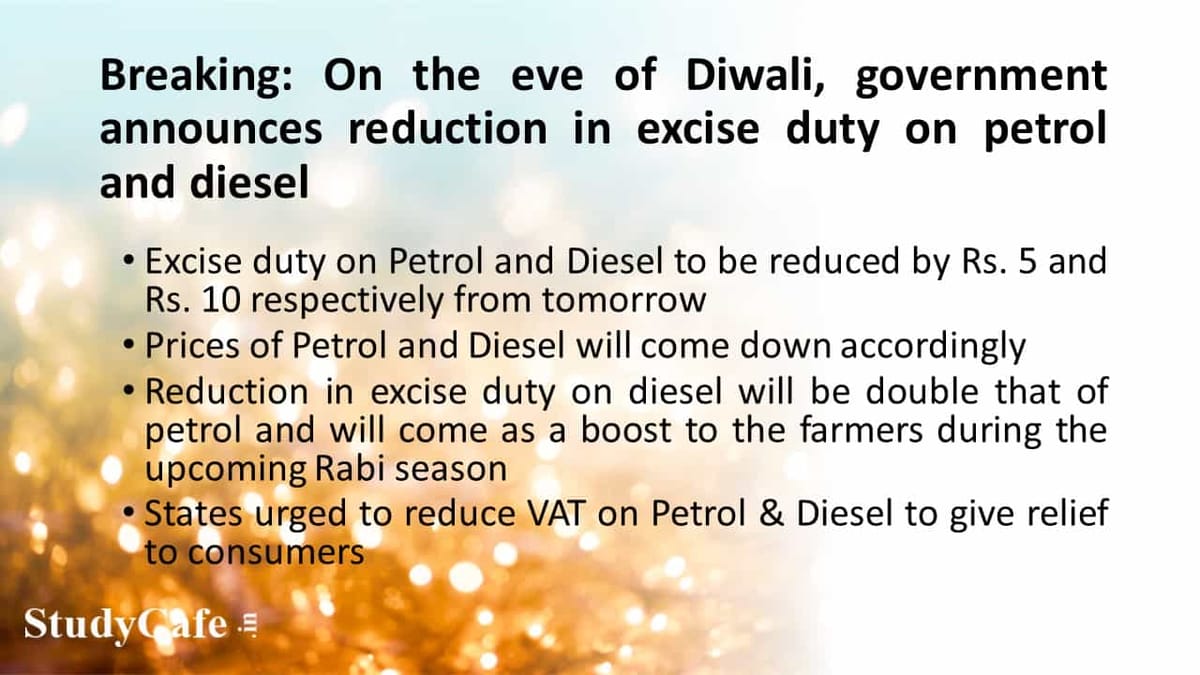

Breaking: On the eve of Diwali, government announces reduction in excise duty on petrol and diesel

The Government of India has made an important decision to reduce the Central Excise Duty on Petrol and Diesel by Rs. 5 and Rs. 10 respectively, effective tomorrow. Petrol and diesel prices will fall as a result.

Diesel will have its excise duty reduced by twice as much as gasoline. The hard work of Indian farmers has kept the economic growth momentum going even during the lockdown, and the massive reduction in diesel excise will help farmers during the upcoming Rabi season.

Crude oil prices have risen globally in recent months. As a result, domestic gasoline and diesel prices have risen in recent weeks, putting upward pressure on inflation. There have also been shortages and price increases in all forms of energy around the world. The Indian government has made efforts to ensure that there is no energy shortage in the country and that commodities such as petrol and diesel are available in sufficient quantities to meet our needs.

The Indian economy has seen a remarkable turnaround following the COVID-19-induced slowdown, owing to the enterprising ability of India’s aspirational population. Manufacturing, services, and agriculture are all experiencing significant increases in economic activity.

To give the economy a boost, the Government of India has decided to significantly reduce the excise duty on diesel and gasoline.

The reduction in excise duty on gasoline and diesel will also increase consumption and keep inflation low, benefiting the poor and middle classes. The decision made today is expected to boost the overall economic cycle.

States are also urged to reduce VAT on gasoline and diesel in proportion to provide relief to consumers.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"