Vanshika verma | Feb 5, 2026 |

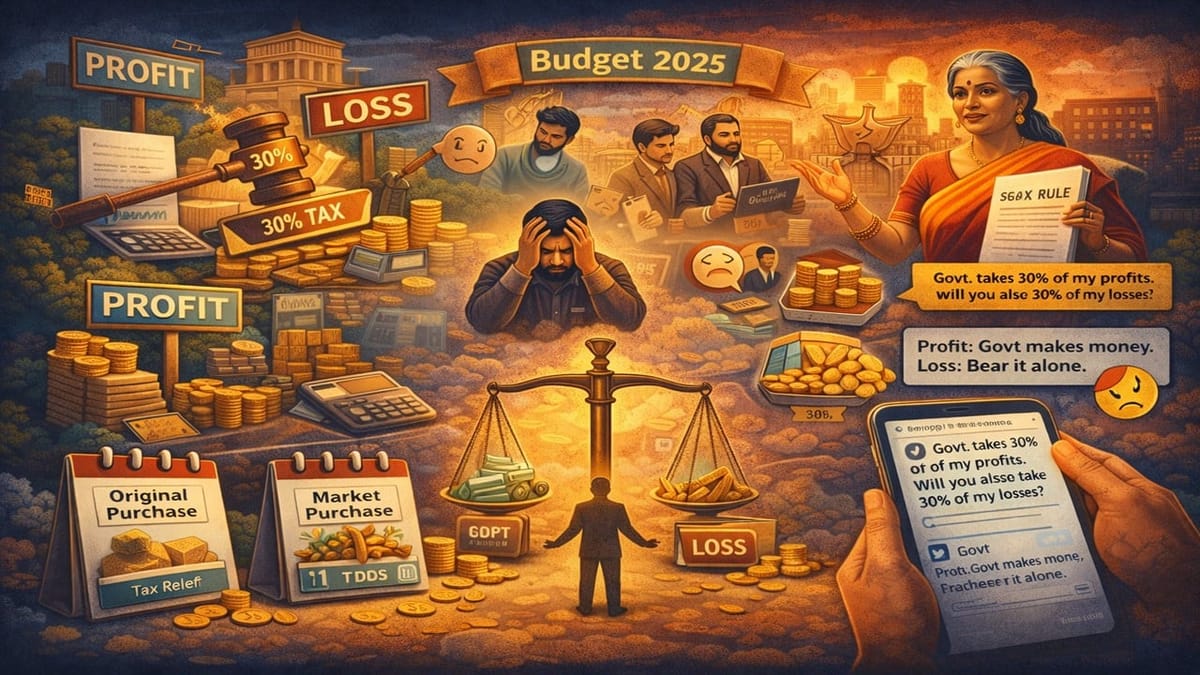

Budget 2026: New SGB Tax Rule Sparks Debate on Fairness

During the Budget 2026, the Finance Minister, Nirmala Sitharaman, proposed a new rule about Sovereign Gold Bonds (SGBs). According to this rule, tax exemption will only be given to people who bought SGBs directly from the RBI when they were first issued and kept them until maturity.

People who buy SGBs later from the market or from other investors will not get this tax benefit. This means only original buyers who hold the bond for the full period will be eligible for tax relief.

One user on the social media platform ‘X’ questioned the government’s decision. The user said that if the government takes 30% of people’s profits as tax, then what about their losses? Will the government also pay 30% of their losses?

The user also pointed out that investors take all the risk, but the government only benefits when there is profit. According to them, this makes it seem like risk is only for citizens, while rewards are guaranteed for the government.

The user further added that this is exactly how crypto taxation works in India. Profits are taxed at 30%, 1% TDS is deducted on every transaction, and losses cannot be set off or carried forward. So, when you make a profit, the government takes its share, but when you make a loss, you have to bear it alone.

In the real world, profits are uncertain, losses are real, and risk is borne almost entirely by individuals who invest their time, money, and effort without any guarantee of success. However, many policies treat gains as if they were guaranteed income while giving little recognition to losses.

The user added, “This isn’t fairness. This isn’t reform. This is punishing risk-takers, discouraging innovation, and pushing capital out of India.” The user further said, “You can’t treat crypto like it’s risk-free income.” That feels unfair and unrealistic.

People are not asking for favors. They just want rules that make sense. If the government takes a share when someone makes a profit, it should also acknowledge and allow relief when someone makes a loss. Fairness means sharing both the good and the bad, not only the gains.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"