Vanshika verma | Feb 5, 2026 |

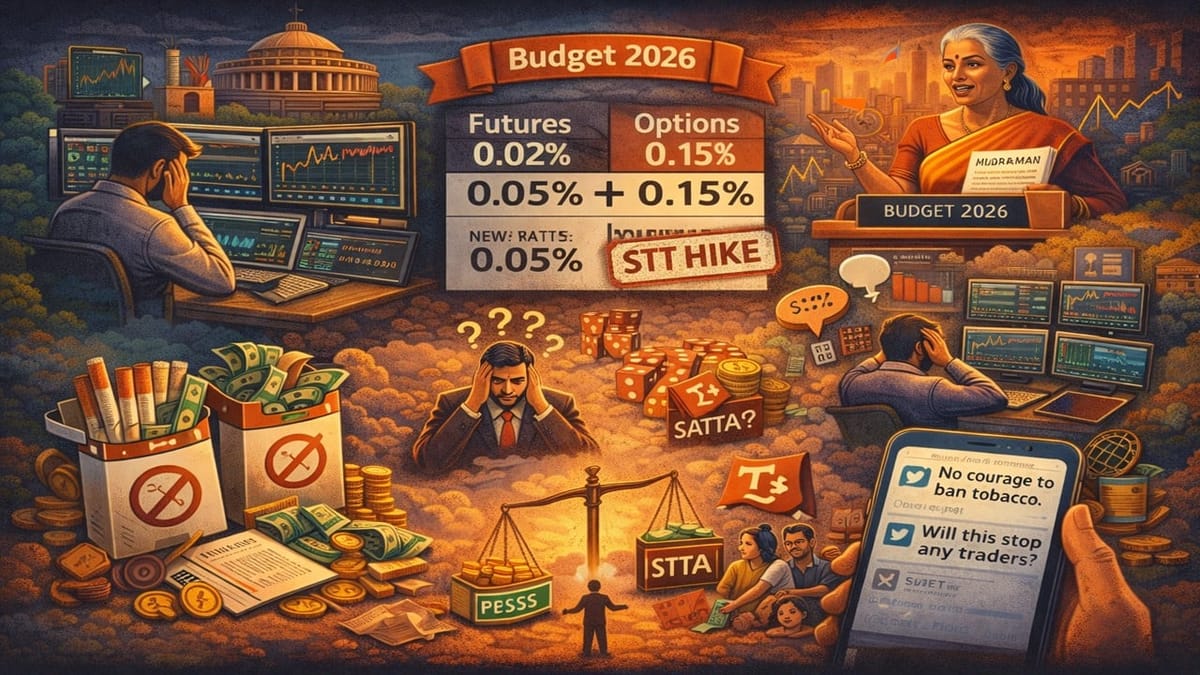

F&O Traders React as Government Raises STT: Will It Really Stop Satta

During the Budget 2026, Finance Minister Nirmala Sitharaman proposed an increase in the Securities Transaction Tax (STT) on futures contracts from 0.02% to 0.05%. STT of options are proposed to be raised to 0.15% from the present rate of 0.01% and 0.125%, respectively.

Nirmala Sitharaman said over 90% of people entering the F&O market had lost huge amounts of money, and the government has kept public interest in mind while deciding to hike STT. She further said, “Like, as they say in Hindi, satta was happening.”

One user on the social media platform ‘X’ (previously known as Twitter) said the STT hike was not driven by revenue considerations. Hike done to curb SATTA.

The user added that most people die from cancer, and many families become bankrupt due to high treatment costs. Yet, no government has the courage to ban tobacco. If revenue is truly not the reason, then tobacco should be banned in India as well.

Another user said, “By increasing STT, will the government be able to curb F&O trading?” He added that F&O is a business; it’s daily bread and butter for many.

He further said that F&O is the main source of income for many people. A lot of traders do it regularly, and they’re not going to stop. So in the end, the government will just earn more money from it anyway.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"