ROC Vijayawada imposes a penalty on the company for non-disclosure of depreciation in the statutory audit report, a violation under Section 450 of the Companies Act.

Saloni Kumari | Dec 8, 2025 |

CA Penalised for Failing to Report Depreciation Non-compliance by Company in Audit Report

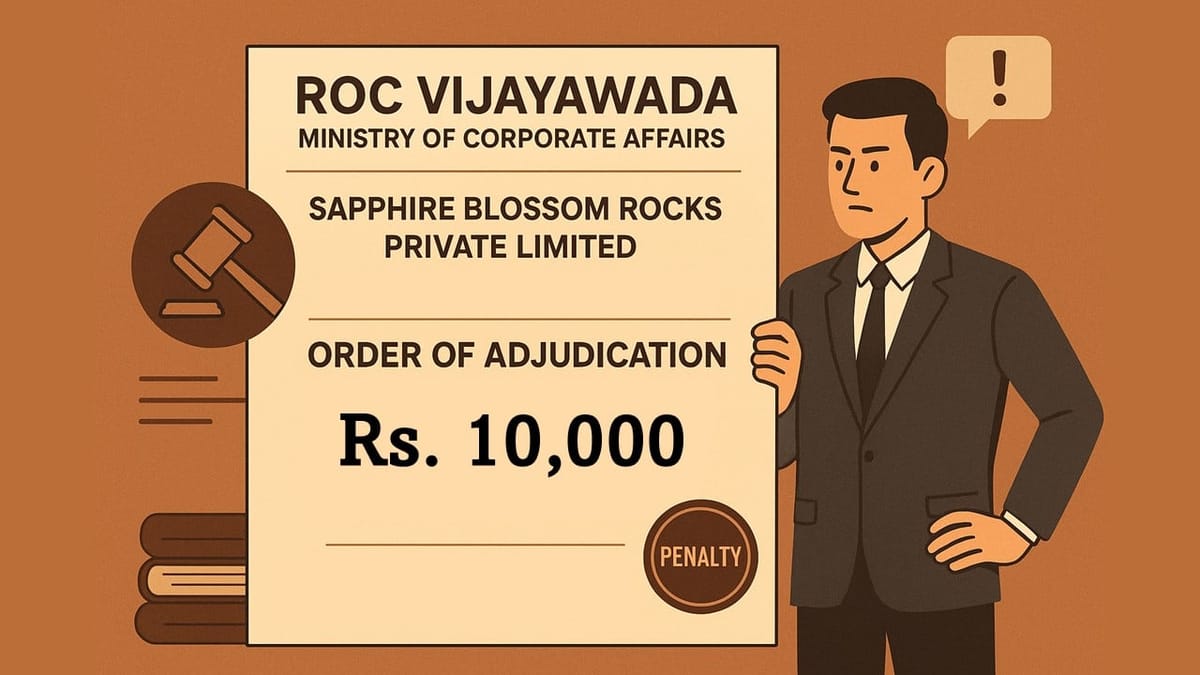

The ROC Vijayawada under the Ministry of Corporate Affairs (MCA) has recently issued an order of adjudication imposing a penalty of Rs. 10,000 (maximum upto Rs. 50,000) on a company named Sapphire Blossom Rocks Private Limited bearing CIN U14102AP2005PTC047503 under Section 454 of the Companies Act, 2013, for violation under Section 450 of the Companies Act, 2013.

The company is registered in Andhra Pradesh, and Mr Sudarsanam Naidu Pemmasani, having PAN AEMPP9706L, is an individual connected to the company. Section 450 of the Act says, if someone violates any company provision for which no specific penalty is given, they must pay a penalty of Rs. 10,000 and an additional Rs. 1,000 per day if the violation continues, up to a limit of Rs. 2 lakh for a company and Rs. 50,000 for an officer.

During the investigation, it was concluded that the statutory auditor of the company failed to report in the audit report that the company had not charged depreciation on its machinery and building for the financial year 2020-21. this information is important to be reported under Section 143(3) of the Companies Act, 2013. Since this key detail was missed by the M/s PMR Associates, they were considered to have violated the law. The company was issued a hearing notice on September 30, 2025. The authorised representative of the company attended the hearing on October 14, 2025.

Based on the above findings, the ROC noted that the auditor violated the provisions of Section 143(3) and is hence liable for the penalty under Section 450. In conclusion, ROC imposes a penalty of Rs. 10,000 on Mr Sudarsanam Naidu Pemmasani, with no additional daily penalty, and the maximum possible limit for such penalties for an individual is Rs. 50,000. The individual has been directed to correct the default done by him and pay the imposed penalty amount within 90 days of receiving the order. The penalty should be paid via the e-Adjudication portal on the MCA website using personal funds only.

If the company/individual is dissatisfied with the order of ROC, they can also further challenge it before the Regional Director, Hyderabad, within 60 days using Form ADJ and attaching a certified copy of this order. Non-payment within the prescribed time will attract further consequences under Section 454(8) of the Companies Act, 2013.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"