Under the new rules effective from December 1, 2025, the limits for paid-up capital and turnover have been increased to Rs 10 crore and Rs 100 crore, respectively.

Nidhi | Dec 2, 2025 |

MCA Breaking: Definition of “Small Company” Revised; New Limits Starting December 1

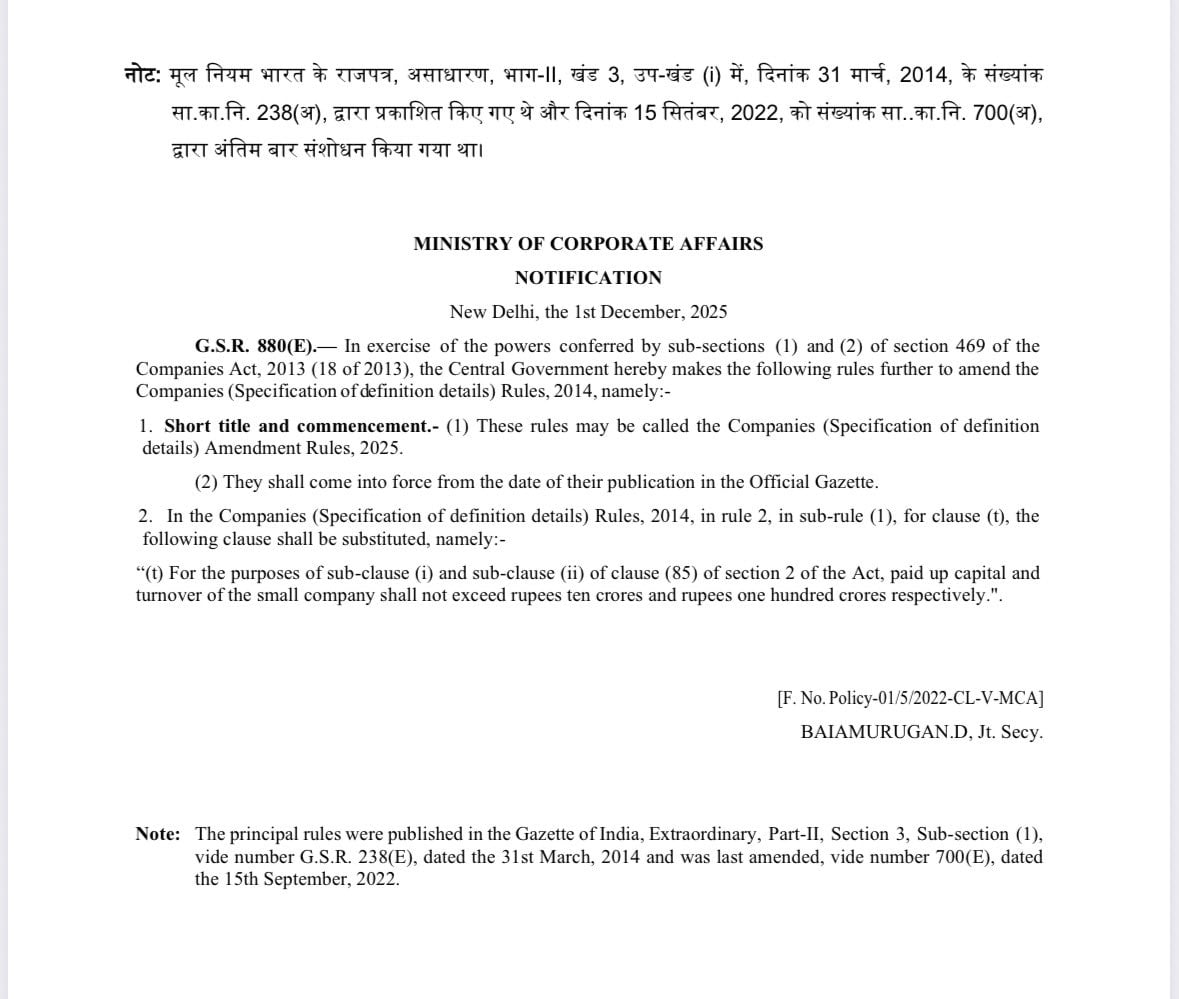

The Ministry of Corporate Affairs (MCA) has recently issued a notification dated December 1, 2025, revising the criteria for the definition of “Small Company” under the Companies Act. Starting from December 2025, the limits on paid-up capital and turnover for small companies have been increased. The change aims to reduce the compliance burden on small companies.

As per the notification, “(t) For the purposes of sub-clause (i) and sub-clause (ii) of clause (85) of section 2 of the Act, paid up capital and turnover of the small company shall not exceed rupees ten crores and rupees one hundred crores respectively.”

What Has Changed?

Previously, the paid-up capital for the small companies under the Companies Act was Rs 4 crore, and the turnover limit was Rs 40 Crore. Under the new rules effective from December 1, 2025, the limits for paid-up capital and turnover have been increased to Rs 10 crore and Rs 100 crore, respectively.

This means that to fall under the definition of “small company”, the companies must have a Paid-up capital of Rs 10 crore and a Turnover limit of Rs 100 crore. This will allow more companies to be classified as small companies. However, it must be noted that public companies, holding/subsidiary companies, Section 8 companies, and those covered under special acts are not included in this revision.

Small Companies Vs Other Companies

Small companies have several benefits compared to other types of companies. Here is the comparison:

With the new limits for paid-up capital and turnover, more companies can benefit from these relaxed rules, making compliance simpler.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"