The Central Board of Direct Taxes(CBDT) has issued corrigendum to its Notification issued earlier to notify new ITR-7 applicable for the Assessment Year 2023-24.

Reetu | Mar 4, 2023 |

CBDT issues Corrigendum to ITR-7 notified for Assessment Year 2023-24

The Central Board of Direct Taxes(CBDT) has issued corrigendum to its Notification issued earlier to notify new ITR-7 applicable for the Assessment Year 2023-24. The corrigendum is issued to correct minor errors/omissions in the ITR forms.

The Notification Stated, “In the notification of the Government of India, Ministry of Finance, Department of Revenue (Central Board of Direct Taxes), published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i), vide number G.S.R. 95(E), dated the 14th February, 2023:––

(i) at page 51,––

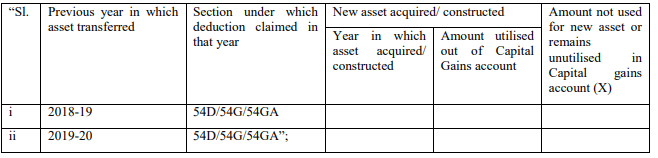

(a) in for the table under item (a) under row 7, the following table shall be substituted, namely:––

(b) in the row after item (b) under row 7, for the letters and figure “Xi + b”, the letters and figures “Xi + Xii + b” shall be substituted;

(ii) at page 53,––

(a) in for the table under item (a) under row 10, the following table shall be substituted, namely:––

(b) in the row after item (b) under row 10, for the letters and figure “Xi + b”, the letters and figures “Xi + Xii+ b” shall be substituted;

(iii) at page 54, in the table under row E, for the letters and figures “B8* + B9e* + B11a1*”, the letters and figures “B8* + B11a1*” shall be substituted in both places;

(iv) at page 55, in row 2, in item (c), for the words, brackets and letters “Any other income chargeable at special rate (total of ci to cxv)”, the words, brackets and letters “Any other income chargeable at special rate (total of ci to cxiv)” shall be substituted;”

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"