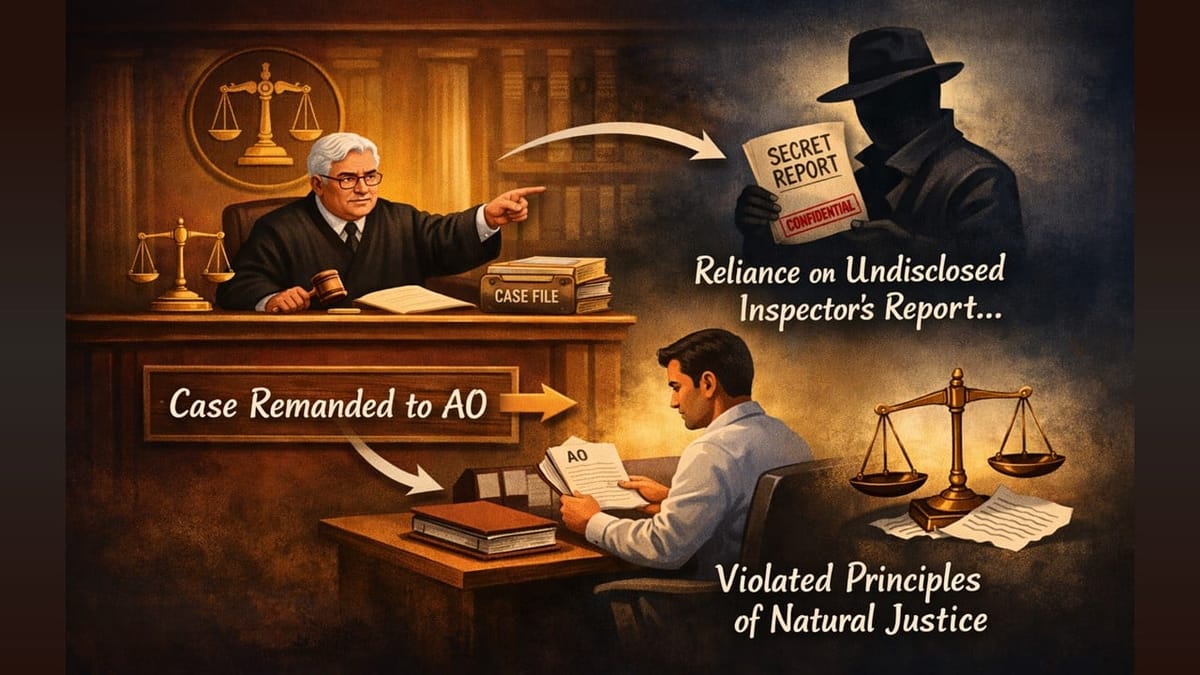

ITAT remanded the case to the AO after holding that reliance on an undisclosed Inspector’s report violated principles of natural justice.

Saloni Kumari | Jan 22, 2026 |

ITAT Sets Aside Rs. 73.50 Lakh Share Capital Addition Over Violation of Natural Justice

ITAT Delhi quashes the CIT(A)’s order holding that reliance on an undisclosed Inspector’s report violated natural justice. The matter was remanded to the AO for fresh adjudication after granting a proper hearing to the assessee accordingly.

Cygnus Infrabuild Private Limited has filed the present appeal in the ITAT Delhi, against the Income Tax Department, challenging an order dated January 21, 2026, passed by the CIT(A)/NFAC, Delhi. The case is related to the Assessment Year 2011-12. The impugned order had dismissed the assessee’s appeal and sustained the Rs. 9.80 lakh addition made by the tax authorities.

The assessee had filed its income tax return (ITR) online for the year under consideration, declaring a total income of Rs. 5.43 lakh. During scrutiny of the return, the Assessing Officer (AO) assessed the total income of the assessee at Rs. 88.73 lakh after making an addition of Rs. 9.80 lakh on account of the estimated income of 5% on its receipts and the unexplained share capital and share premium amounting to Rs. 73.50 lakh.

The aggrieved assessee filed an appeal before the ITAT Delhi. When the tribunal heard the arguments from both sides, it said that the CIT(A) was wrong because he relied on the Inspector’s report without giving a copy of it to the assessee. Since the assessee was not given a chance to analyse and challenge the report, it was unfair to treat the share applicants as non-genuine. This action of lower authorities is explicitly against the principles of natural justice.

Considering the aforesaid findings, the ITAT sent the case back to the AO for fresh consideration after giving the assessee a proper opportunity for hearing. The assessee has also been directed to cooperate with the AO during proceedings. In conclusion, the appeal of the assessee has been allowed for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"