Deepak Gupta | Nov 24, 2022 |

![CBIC empowers CCI to deal with Anti Profiteering cases [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2022/11/STUDYCAFE-IMAGES-Autosaved-13.jpg)

CBIC empowers CCI to deal with Anti Profiteering cases [Read Notification]

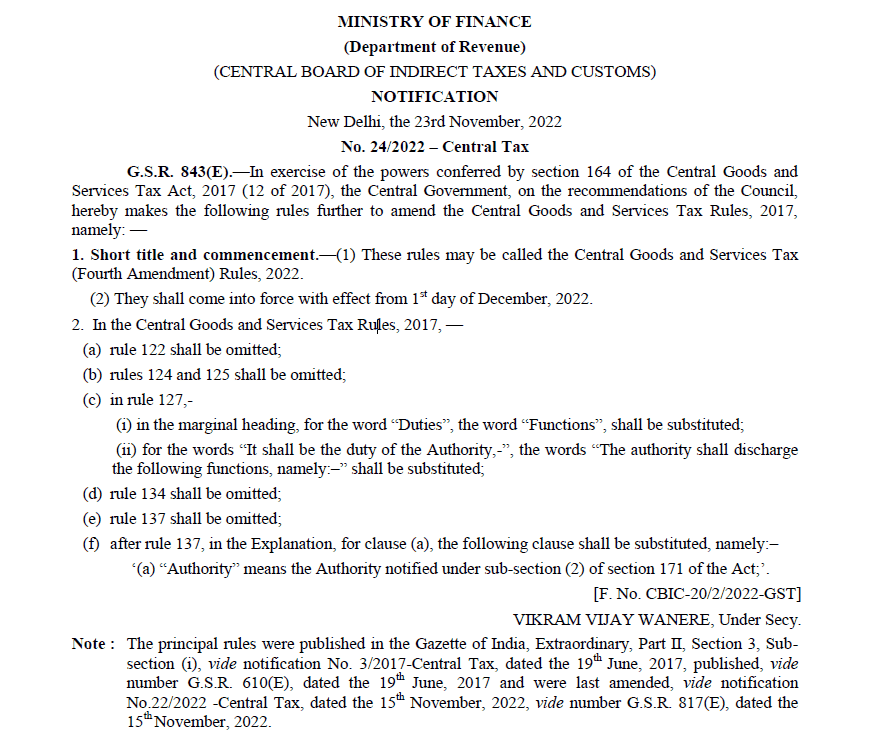

In the exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, the Central Board of Indirect Taxes and Customs (CBIC) has notified Central Goods and Services Tax (Fourth Amendment) Rules, 2022 Empowering Competition Commission of India (CCI) to deal with Anti Profiteering cases in GST.

The Notification in given below for reference:

In exercise of the powers conferred by sub-section (2) of section 171 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Goods and Services Tax Council, hereby empowers the Competition Commission of India established under sub-section (1) of section 7 of the Competition Act, 2002 (12 of 2003), to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

Another Notification is given below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"