The CBIC has levied Anti-Dumping Duty on 'Self-Adhesive Vinyl (SAV)' imported from China PR for 3 Years via issuing a Notification.

Reetu | Mar 18, 2024 |

CBIC Levies Anti-Dumping Duty on ‘Self-Adhesive Vinyl (SAV)’ imported from China PR for 3 Years

The Central Board of Indirect Taxes and Customs (CBIC) has levied Anti-Dumping Duty on ‘Self-Adhesive Vinyl (SAV)’ imported from China PR for 3 Years via issuing a Notification.

The Notification Read as follows:

Whereas, in the matter of “Self-Adhesive Vinyl (SAV)” (hereinafter referred to as the subject goods), falling under tariff items 3919 90 90, 3919 10 00, 3919 90 10, 3919 90 20, 3920 99 19, 3920 69 29 or 3921 90 99 of the First Schedule of the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs Tariff Act), originating in, or exported from China PR (hereinafter referred to as the subject country) and imported into India, the designated authority in its final findings, vide notification F. No. 6/13/2022-DGTR, dated the 28th December, 2023, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 28th December, 2023, has come to the conclusion, inter alia that-

(i) the product under consideration that has been exported to India from the subject country at dumped prices;

(ii) the domestic industry has suffered material injury;

(iii) material injury has been caused by the dumped imports of the subject goods from the subject country,

and has recommended the imposition of anti-dumping duty on imports of the subject goods, originating in, or exported from the subject country and imported into India, in order to remove injury to the domestic industry.

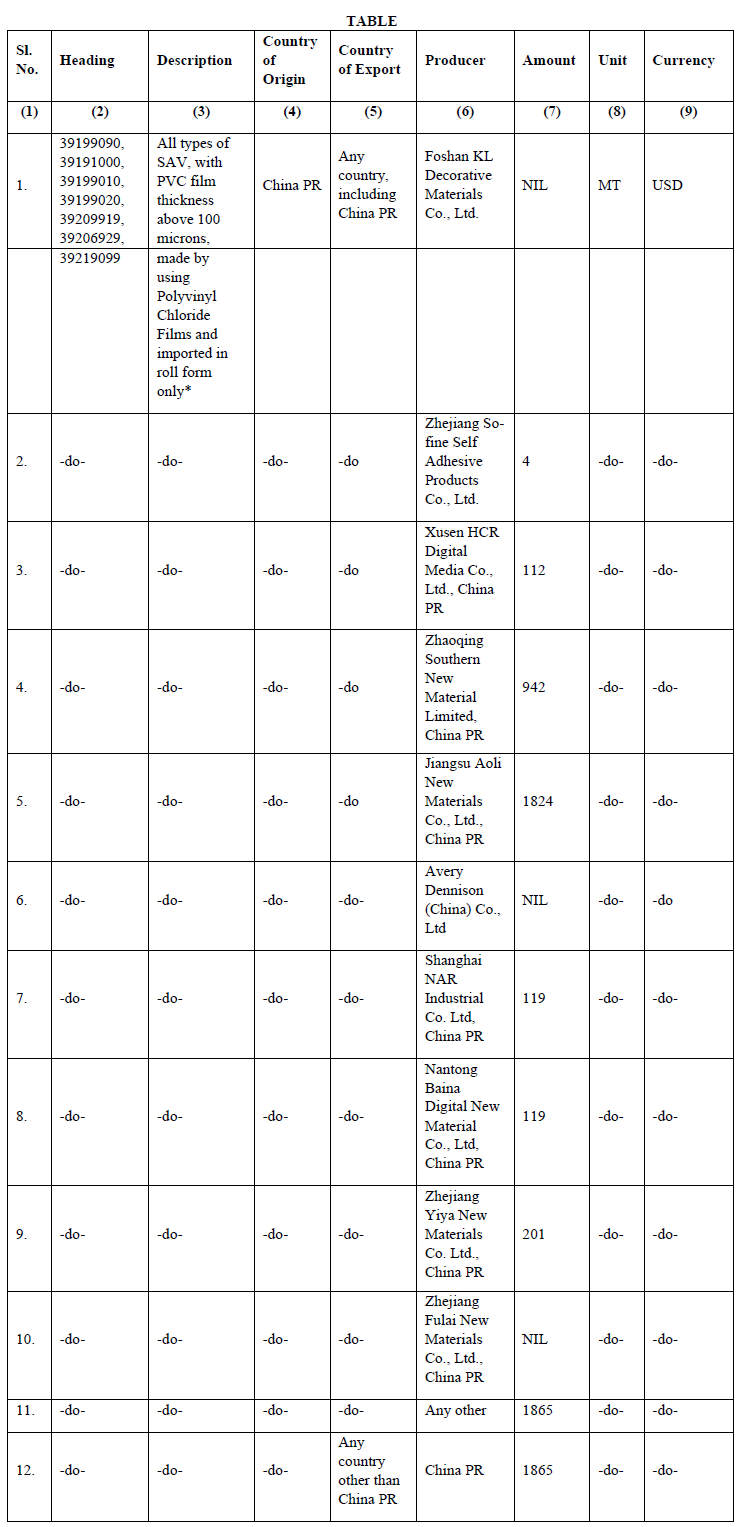

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section 9A of the Customs Tariff Act read with rules 18 and 20 of the Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final findings of the designated authority, hereby imposes on the subject goods, the description of which is specified in column (3) of the Table below, falling under the tariff item of the First Schedule to the Customs Tariff Act as specified in the corresponding entry in column (2), originating in the countries as specified in the corresponding entry in column (4), exported from the countries as specified in the corresponding entry in column (5), produced by the producers as specified in the corresponding entry in column (6), and imported into India, an anti-dumping duty at the rate equal to the amount as specified in the corresponding entry in column (7), in the currency as specified in the corresponding entry in column (9) and as per unit of measurement as specified in the corresponding entry in column (8) of the following Table, namely:-

*Self-adhesive films like sticker, tape, label, pouch, PP, PET, TPU, inkjet media (less than 50 micron), profile, cloth, reflective, metalized, glow vinyl, HDPE, floor marking tape, acrylic, BOPP, automotive are not covered within the scope of PUC. Further, reflective films, sun control films and glass safety films and self-adhesive products made using other than PVC films such as PET, PU, BOPP, etc. outside the scope of the product under consideration.

The anti-dumping duty imposed under this notification shall be levied for a period of three years (unless revoked, superseded or amended earlier) from the date of publication of this notification in the Official Gazette and shall be payable in Indian currency.

Explanation.- For the purposes of this notification, rate of exchange applicable for the purpose of calculation of such anti-dumping duty shall be the rate which is specified in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Customs Act.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"