Reetu | Oct 7, 2024 |

CBIC Notification to align various Customs Changes made in Budget 2024

The Central Board of Indirect Taxes and Customs (CBIC) has issued a Notification dated 30th September 2024 to align various Customs Changes made in Budget 2024.

In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby directs that each of the notification issued by the Government of India in the Ministry of Finance (Department of Revenue) as specified.

Notification No. 24/2005-Customs dated 1st March 2005

The Notification No. 24/2005- Customs, dated the 1st March 2005 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide G.S.R. 123(E), dated the 1st March 2005.

Amendment:

In the said notification, in the TABLE, against serial number 4, in column (3), for the words “except Ink cartridges, with print head assembly; Ink cartridges, without print head assembly; Ink spray nozzle”, the words “except cartridges or toners with print head assembly; cartridges or toners, without print head assembly; Ink spray nozzle ” shall be substituted.

Notification No. 73/2005-Customs dated the 22nd July 2005

The Notification No. 73/2005-Customs, dated the 22nd July 2005 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 498(E), dated the 22nd July 2005.

Amendment:

In the said notification, in the TABLE,-

(i) Against serial number 46, for the entry in column (2), the entry “2906 11” shall be substituted;

(ii) against serial number 181, for the entry in column (2), the entry “8806 10 00 to 8807 30 20” shall be substituted;

Notification No. 101/2007-Customs dated 11th September 2007

The Notification No. 101/2007-Customs dated 11th September 2007 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 583(E), dated 11th September 2007.

Amendment:

In the said notification, in the TABLE,-

(i) Serial number 276 and the entries relating thereto shall be omitted;

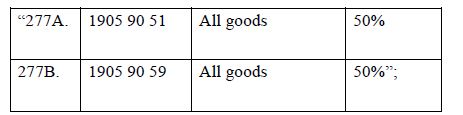

(ii) after serial number 277 and the entries relating thereto, the following serial numbers and the entries shall be inserted, namely: –

(iii) against serial number 938, for the entry in column (2), the entry “7610 90 21, 7610 90 29” shall be substituted;

(iv) against serial number 1016, for the entry in column (2), the entry “8807 30 10, 8807 30 20” shall be substituted.

Notification No. 10/2008-Customs dated 15th January 2008

The Notification No. 10/2008-Customs, dated the 15th January 2008 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 33(E), dated the 15th January 2008.

Amendment:

In the said notification, in the TABLE,-

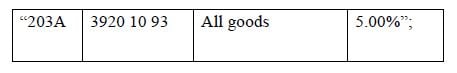

(i) After serial number 203 and the entries relating thereto, the following serial number and the entries shall be inserted, namely: –

(ii) against serial number 299, for the entry in column (2), the entry “63079091, 63079092, 63079099” shall be substituted.

Notification No. 57/2009-Customs dated 30th May 2009

The Notification No. 57/2009-Customs dated 30th May 2009 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 371(E), dated the 30th May 2009.

Amendment:

In the said notification, in the TABLE,-

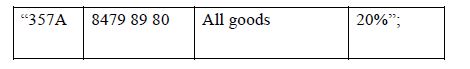

(i) After serial number 357 and the entries relating thereto, the following serial number and the entries shall be inserted, namely: –

(ii) against serial number 408, for the entry in column (2), the entries “8537 10 10, 8537 10 90” shall be substituted.

Notification No. 151/2009-Customs dated the 31st December 2009

The Notification No. 151/2009-Customs, dated the 31st December 2009 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 942(E), dated the 31st December 2009.

Amendment:

In the said notification, in the TABLE, against serial number 93A, for the entry in column (2), the entry “8807 30” shall be substituted;

Notification 152/2009-Customs dated the 31st December 2009

The Notification 152/2009-Customs, dated the 31st December 2009 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 943(E), dated the 31st December 2009.

Amendment:

In the said notification, in the TABLE, against serial number 906A, for the entry in column (2), the entry “8807 (except 8807 30)” shall be substituted.

Notification No. 69/2011-Customs dated the 29th July 2011

The Notification No. 69/2011-Customs, dated the 29th July 2011 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 593(E), dated the 29th July 2011.

Amendment:

In the said notification, in the TABLE, against serial number 180, for the entry in column (2), the entry “2710 12 90, 2710 19 32, 2710 19 33, 2710 19 39” shall be substituted.

Notification No. 50/2017-Customs dated the 30th June 2017

The Notification No. 50/2017-Customs, dated the 30th June 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 785(E), dated the 30th June 2017.

Amendment:

In the said notification,

I. In the Table, against S. No. 464, in column (2), for the entry “8537 10 00’’, the entry “8537 10” shall be substituted;

II. in the ANNEXURE, in List 33-

(i) against S. No. 9, in column (2), for the figures “8906 90 00”, the figures “8906 90” shall be substituted;

(ii) against S. No. 21, in column (2), for the figures “6914 90 00”, the figures “6914 90” shall be substituted.

Notification No. 53/2017-Customs dated the 30th June 2017

The Notification No. 53/2017-Customs, dated the 30th June 2017 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide G.S.R. 788(E), dated the 30th June 2017.

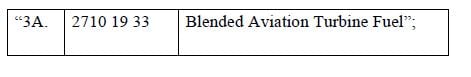

In the said notification, in the TABLE, after serial number 3 and the entries relating thereto, the following serial number and the entries shall be inserted, namely: –

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"