The CBIC has notified Mandatory additional qualifiers in import/export declarations in respect of certain products via issuing Notification.

Reetu | Sep 30, 2023 |

CBIC notifies Mandatory additional qualifiers in import/export declarations in respect of certain products

The Central Board of Indirect Taxes and Customs (CBIC) has notified Mandatory additional qualifiers in import/export declarations in respect of certain products via issuing Circular.

The Circular stated, “Reference is drawn to the Circular No. 15/2023-Customs dated 07.06.2023 on the above-mentioned subject. The due date for implementation of Circular No. 15/2023-Customs dated 07.06.2023 was extended from 01.07.2023 to 01.10.2023 vide Circular no. 18/2023-Customs dated 30.06.2023.”

Various representations received in this regard has been examined in consultation with Department of Chemicals and Petrochemicals. Several stakeholder consultations were also held in this regard. Based on such consultation, the changes are made in the Circular No. 15/2023-Cus dated 07th June, 2023, para (4.1)and (4.2)as follows:

“4.1For the commodities imported under chapters 28, 29, 32, heading 3808 and chapter 39, it has been decided to seek additional details mandatorily at the time of filing import declarations as follows:

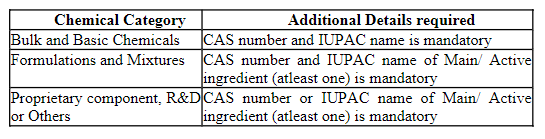

(a) Chemical Category:

(I) Bulk and Basic Chemicals;

(II) Formulations and Mixtures or

(III) Proprietary component, R&D or Others

b. In case of above chemical categories:

In case of non-availability of information for even one ingredient with the importer for the reason that information is not shared by the supplier due to confidentiality, a self-undertaking is to be provided in the Bill of Entry as follows:

Declaration on non-availability of CAS & IUPAC details

I certify that the information related to IUPAC & CAS number is not in my possession as the same is not provided by my supplier due to confidentiality.

The details of constituents declared in the Bill of Entry will be printed as Masked fields in the Bill of Entry.

These additional qualifiers shall be mandatory for imports under the said chapters for all bills of entry filed on or after 15.10.2023, in the manner mentioned in the Annexure-1 to this Circular. These fields shall be in addition to the existing declaration being made by importers.

It is to be clarified that mandatory additional qualifiers for exports under the specific CTHs of the said chapters for all Shipping bills filed on or after 01.10.2023 will remain the same.

Suitable Public Notice etc. may kindly be issued for guidance. Any difficulties faced or doubts arising in the implementation of this Circular may please be brought to the notice of Board.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"