Reetu | Sep 9, 2021 |

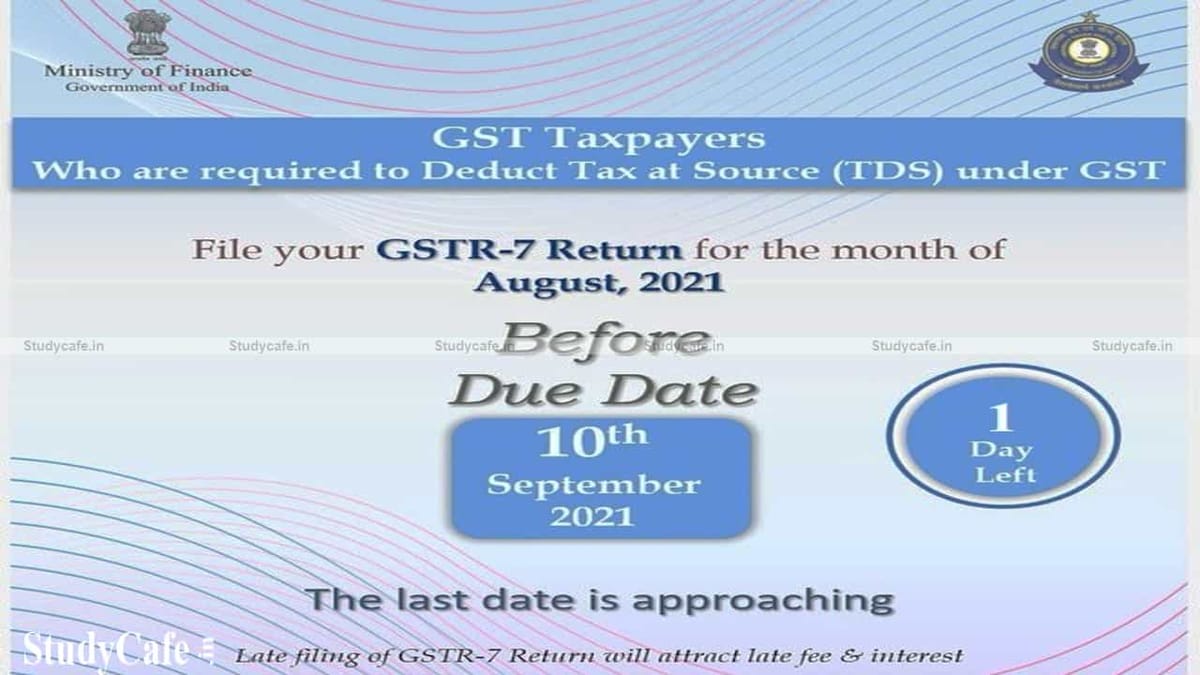

CBIC reminds GST Taxpayers who Deduct TDS to file GSTR-7 Return for August 2021

The Central Board of Indirect Taxes and Customs reminded the GST Taxpayers who Deduct TDS to file GSTR-7 for August, 2021 by September 10, 2021.

The filing of GSTR-7 for a month is due on the 10th of the following month. For instance, the due date of filing GSTR-7 for August is 10th September.

The GSTR-7 is a monthly return that must be filed by those who are required to deduct Tax Deducted at Source (TDS) under the Goods and Services Tax (GST).

GST registered persons whose TDS is to be deducted under GST are required to submit Form GSTR-7 by the 10th of the following month. It contains details of TDS deducted, TDS payable, TDS refund, etc.

If the GST return is not filed on time, a penalty of Rs 100 will be levied under the CGST and Rs 100 will be levied under the SGST, for a total of Rs 200 per day. The maximum late fee, however, should not exceed Rs 5,000. If you file your IGST late, you will not be charged a penalty. Interest of 18 percent per year must be paid in addition to late fees. It must be calculated based on the amount of TDS to be paid. The period for interest calculation are going to be from subsequent day of the maturity of filing to the payment date.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"