The bank account details submitted by the company showed that it had started the business without fulfilling the required payment from shareholders and proper filing of Form INC-20A.

Nidhi | Jan 8, 2026 |

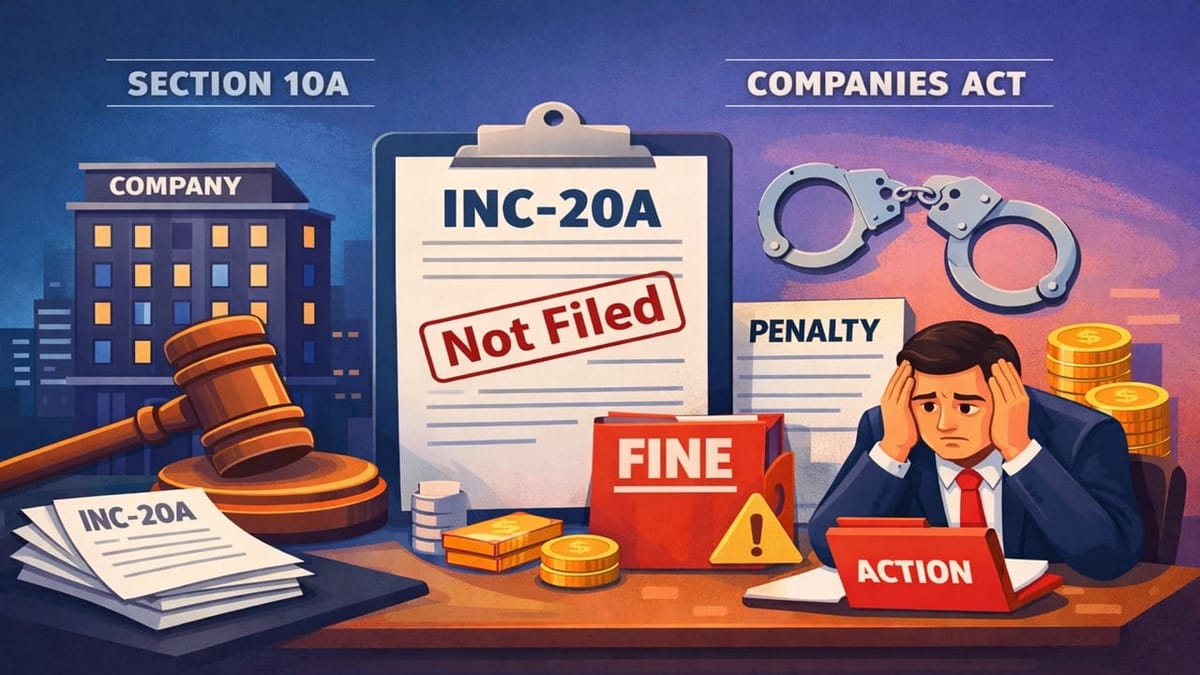

Company Penalised by ROC for starting business without filing Form INC-20A

The Registrar of Companies (ROC), Pune, levied a penalty on a company and its director for the non-compliance with Section 10A(2) of the Companies Act, which requires the company to file a mandatory declaration in Form INA-20A within 180 days of its incorporation.

The company Stalwart Global Freight Private Limited was incorporated on 4th April, 2025 under the jurisdiction of the ROC, Pune. The company did not file the required Form INC-20A within the specified 180 days. This form confirms that the subscribers have paid for their shares. The bank account details submitted by the company showed that it had started the business without fulfilling the required payment from shareholders and proper filing of Form INC-20A, violating Section 10A(2) of the Companies Act.

The company voluntarily informed its violation to the ROC by filing a suo moto application via GNL-1 under section 10A of the Companies Act, 2013.

Since the company had violated the provisions of the Companies Act, the ROC imposed a penalty of Rs 50,000 on the company. Additionally, its directors were fined Rs 1,00,000 each for the violation. The penalty is required to be paid from their personal funds.

The company has been directed to correct the mistake and pay the penalty amount within 90 days through the Ministry of Corporate Affairs (MCA) portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"