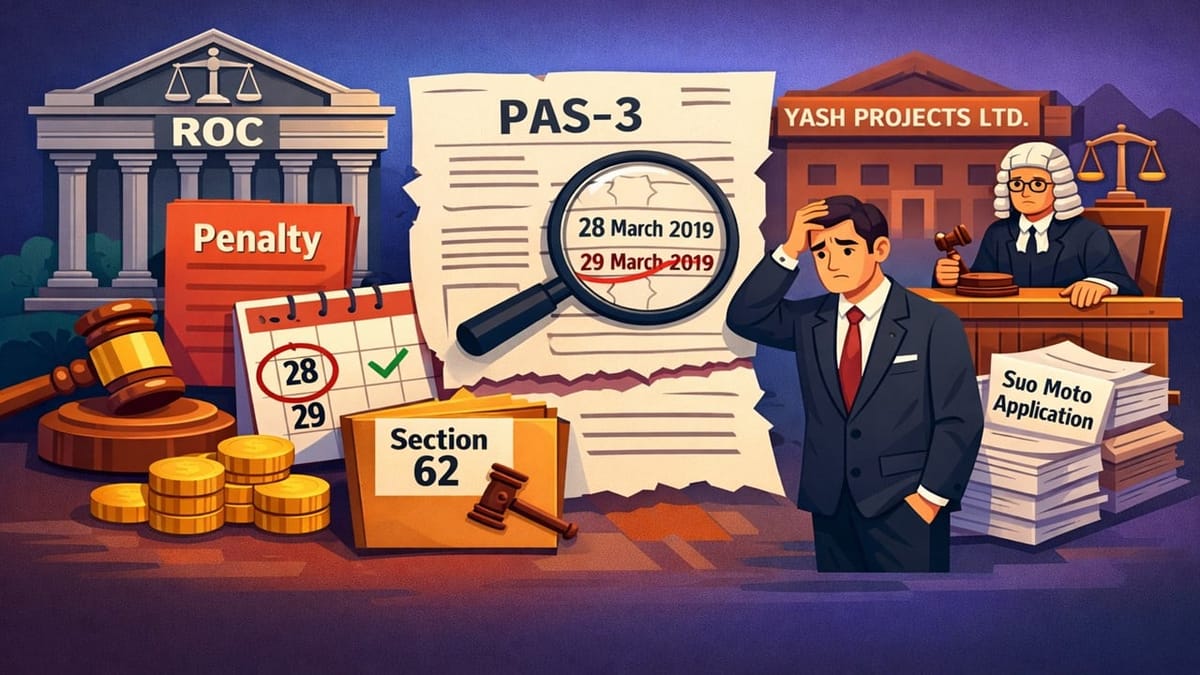

The company wrongly mentioned the date of allotment as 28th March, 2019, instead of the correct date, 29th March, 2019 while Form PAS-3 for the allotment of 13 Lakh shares.

Nidhi | Jan 7, 2026 |

ROC Imposes Penalty on Company and its Director For Making Typing Error in Form PAS-3

The Registrar of Companies (ROC), Ahmedabad, has recently imposed a penalty on a company and its managing directors under Section 454 of the Companies Act over a typographical error while filing form PAS-3.

The case started when the company, Yash Projects Limited, made some typing errors while filing Form PAS-3 for the allotment of 13 Lakh shares. The company wrongly mentioned the date of allotment as 28th March, 2019, instead of the correct date, 29th March, 2019. The company, on identifying this mistake, applied for a Suo moto adjudication application under Section 62 (1). Even though there was no malafide intention and the company had followed all the provisions under Section 62(1)(a), the incorrect filing was still treated as a violation.

As there was no penalty specified for this non-compliance, the case was treated as a violation under Section 450 of the Companies Act, which levies a penalty on the company and its directors for a violation for which no specific punishment is laid down anywhere. Under this Section, the ROC levies a penalty of up to Rs 10,000, with an extra Rs 1,000 per day if the default continues (limited at Rs 2 Lakhs for the company and Rs 50,000 for individuals).

Accordingly, the ROC imposed a penalty of Rs 2 Lakh on Om Yash Projects Ltd and Rs 50,000 on its Managing Director. The company has been directed to correct the default and pay the penalty amount within 90 days. The penalty is required to be paid through the e-Adjudication Facility on the Ministry of Corporate Affairs (MCA) Portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"