Vanshika verma | Jan 31, 2026 |

Delhi Family Loses Rs. 42,000 Despite Quick Response to OTP Scam

OTP scams are increasing rapidly in India, and even acting immediately isn’t always enough to stop money from being stolen. Such scams have become very common in recent years. Through such scams, scammers trick people into sharing sensitive information without realising it.

A recent case has surfaced, a family in Delhi lost around Rs. 42,000 overnight after their credit card was misused through repeated OTP-based transactions. This incident highlights serious concerns about banks’ responsibility, customer support systems, and the effectiveness of real-time fraud monitoring in the country.

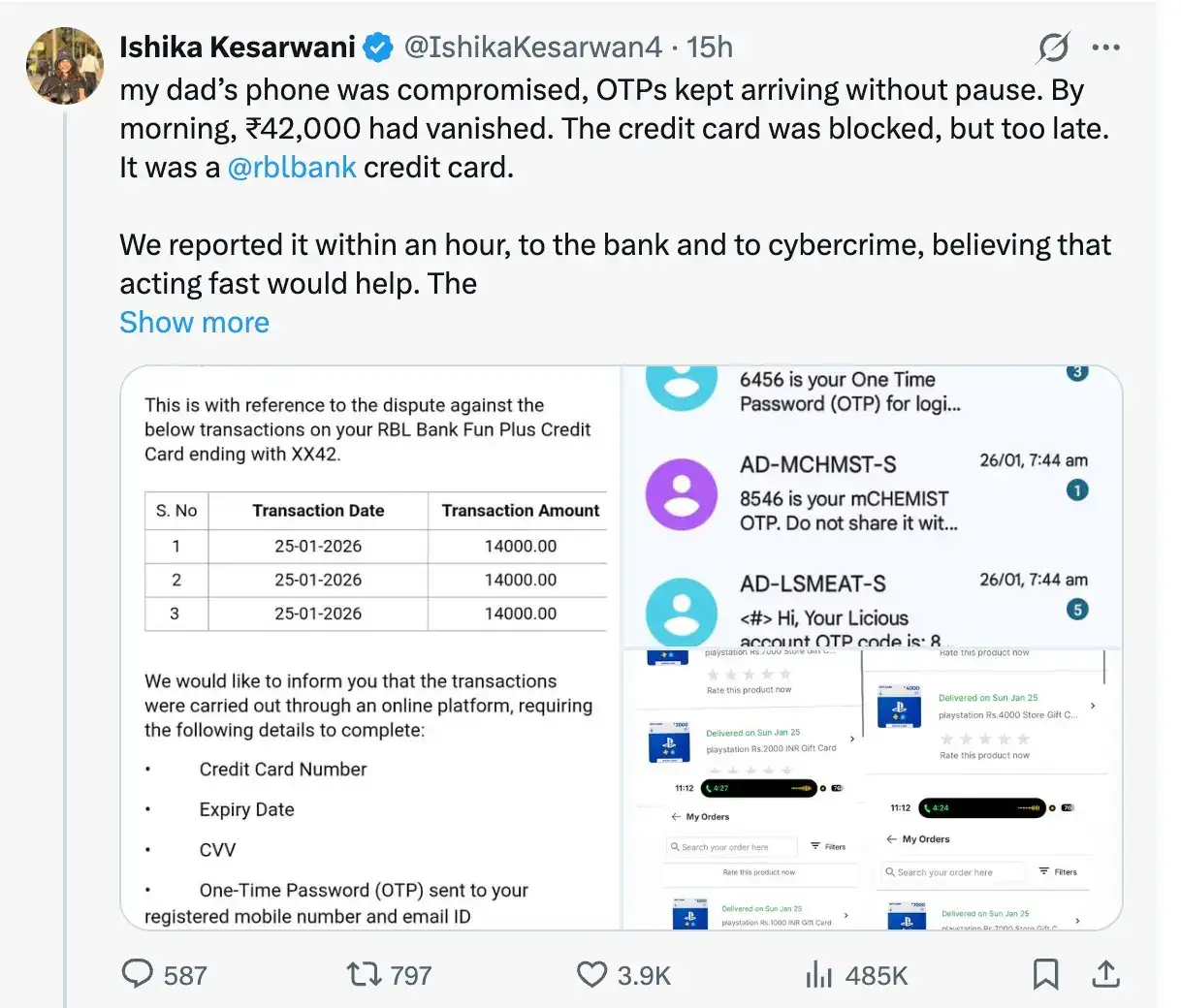

A user shared an incident on the social media platform X, saying that her father’s smartphone was hacked late at night. Soon after, he started receiving many OTP messages one after another. By the time morning came, Rs 42,000 had already been charged to his credit card.

As soon as the family noticed the suspicious activity, they blocked the card. However, the money had already been spent. The credit card involved was issued by RBL Bank.

The family reported the fraud within an hour. They filed complaints with the bank and also registered a case on the cybercrime portal, hoping that quick action would help stop the transactions or recover the money.

Despite acting quickly, they did not get the support they expected. The bank later sent an email stating that the case was not considered credit card fraud. Because of this, the bank said it could not provide any further assistance.

The response sparked widespread criticism online. The user questioned why fraud monitoring systems didn’t flag multiple OTP-based transactions occurring in rapid succession. She also asked what the purpose of these systems is if they fail to prevent such obvious fraudulent activity in real time.

A user replied to her post, “Indian banks terrify me. We don’t have this nonsense in the UK unless someone gets duped by fake calls and emails, and even then, if they were a victim of fraud, they will get their money back. It’s the law.”

Several users replied saying that they have experienced similar problems, particularly with digital gift cards, where banks frequently refuse to take responsibility. Experts have consistently cautioned that fraud involving OTPs and digital vouchers exists in a grey zone, often leaving victims caught between banks, service platforms, and law enforcement authorities. At present, the family is still awaiting a resolution, and the Rs 42,000 has yet to be recovered.

How to Protect Yourself from OTP-Based Scams

To avoid such scams, turn off mobile data immediately, use your bank’s app or call the helpline to block your card instantly, do not open links sent via SMS, WhatsApp, or email from unknown sources, report the incident immediately to prevent unauthorised transactions, regularly install security patches and software updates, Use screen locks and app locks to secure your device and lastly, check bank statements regularly to detect suspicious activity early.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"