Delhi High Court refused to entertain a writ in a bogus ITC case and directed the taxpayer to file a statutory appeal under Section 107.

Saloni Kumari | Dec 5, 2025 |

Delhi HC Refuses to Intervene in Fake ITC Dispute; Directs Company to Comply Statutory Appeal Route u/s 107

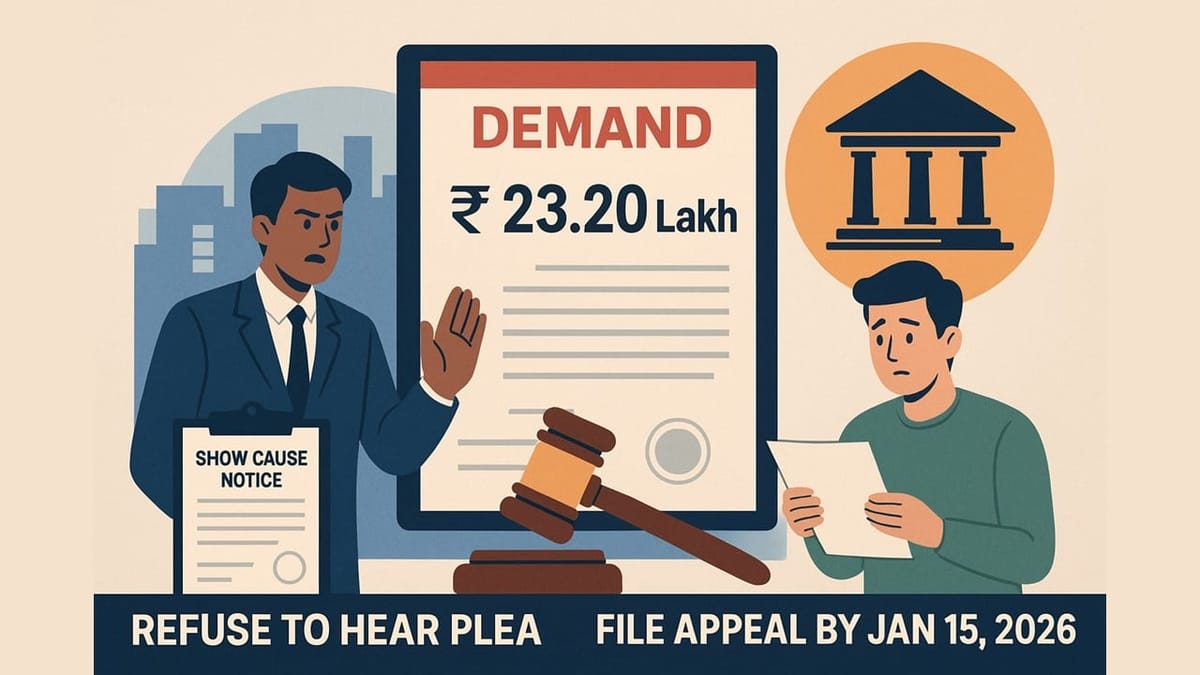

The Delhi High Court, in a fake ITC claim dispute, refused to hear the company’s plea, ruling that they must file an appeal under Section 107. The court noted a typing mistake in the notice but held it irrelevant and gave the company time to file an appeal until January 15, 2026.

The current appeal has been filed by a company named M/s A V Metals Marketing Pvt Ltd, in the High Court of Delhi, challenging a GST order passed by the Office of Additional Commissioner of Central GST, Delhi North (GST department) on January 21, 2025. The order raised a demand of Rs. 23.20 lakh alleging the company for fraudulently availing bogus Input Tax Credit (ITC).

During the hearing in the court, the company claimed that they were never given the opportunity of a personal hearing before issuing the final order, which is a clear violation of the principles of natural justice. Moreover, the issued show cause notice (SCN) included a typographical error regarding the reply date. The correct date of the hearing should have been August 28, 2024; however, the notice mentioned August 28, 2025. However, the court said that the typing mistake does not help the company because they did not file any reply at all.

The court said that in cases related to fake ITC, high courts generally do not interfere because the matters involve complex facts, large amounts of fake ITC affect the GST system, and the law already provides a proper appeal process.

The court cited several earlier Supreme Court and high court judgements, including the Supreme Court’s ruling in Civil Appeal No. 5121/2021 dated September 03, 2021, titled ‘The Assistant Commissioner of State Tax & Ors. V. M/s Commercial Steel Limited, High Court in W.P.(C) 5737/2025 titled Mukesh Kumar Garg v. Union of India & Ors. And M/s Sheetal and Sons & Ors. V. Union of India & Anr., 2025: DHC: 4057-DB, this court’s ruling in W.P.(C) 5815/2025 titled M/s MHJ Metal Techs v. Central Goods and Services Tax Delhi South and the Supreme Court’s ruling in SLP(C) 27411/2025 titled M/S Metal Techs v. Central Goods and Services Tax Delhi South. All these judgements were based on a similar issue of bogus ITC claims, and all ruled that if an appeal is available, taxpayers should use that appeal instead of directly coming to the High Court.

In conclusion to the above findings, the court refused to hear the case and directed the company to file an appeal under Section 107 of the CGST Act and gave the company time until January 15, 2026, to file the appeal with the required pre-deposit. The appeal will be heard on its merits and not rejected as time-barred.

Additionally, instructed the GST Department to be more careful in the future while drafting notices, especially with dates and financial years, and to circulate this instruction across all Commissionerates.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"