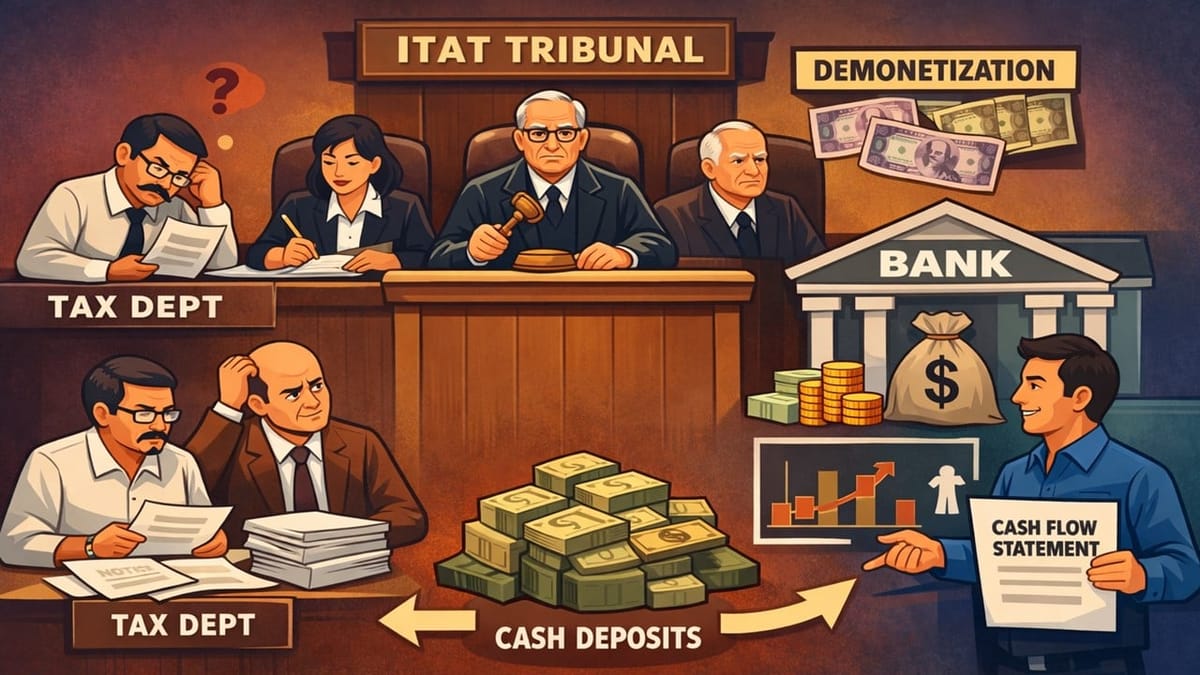

Income Tax Addition for Unexplained Cash Deposits During Demonetization Period deleted for Cash Balance Backed by Books of account and computation of income

Nidhi | Feb 12, 2026 |

Demonetization Cash Deposits Addition Deleted as Books Fully Explained Cash Balance

The Income Tax Appellate Tribunal (ITAT) restored a matter involving additions made towards the alleged unexplained cash deposits made during the demonetization period.

The income tax return (ITR) filed by the assessee, Sabrunnisa Israr Ahmad Shaikh, was selected for scrutiny, and during the proceedings, the AO questioned the cash deposits of Rs 12 lakh made by the assessee during the demonetization period. The assessee, to substantiate the source of the deposits, submitted a copy of the capital account, balance sheet, and computation of income. The AO, however, noted that the assessee did not have enough cash balance to make a deposit of Rs 12 lakh in the Specified Bank Notes during the demonetization period. Therefore, the AO passed an order holding that the assessee failed to prove the source of the cash deposits.

During the proceedings, the assessee paid Rs 2,27,332 tax under the head “income from other sources.” Therefore, the AO restricted the addition to Rs 9,72,668 under section 69A, treating it as income from undisclosed sources. The CIT(A) also upheld this addition. Therefore, the assessee approached the ITAT.

The assessee contended that the cash deposits were the accumulated past savings. She submitted that she earns income from two properties and from a sweet shop run by her husband. The assessee also produced a copy of the cash flow statement showing the opening cash balance as Rs 13,58,261 as of 01/04/2016, and the Rs 12 lakh deposit was made out of this balance.

The ITAT agreed with the contentions of the assessee, noting that the lower authorities did not consider the cash flow statement submitted by the assessee. Since the lower authorities did not properly examine the cash balance in the cash flow statement, the ITAT restored the issue to the Assessing Officer for fresh consideration. The AO was directed to verify the details submitted by the assessee in the cash flow statement. The assessee was also directed to comply with the notices and submit the details asked by the AO.

Accordingly, the tribunal set aside the order.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"