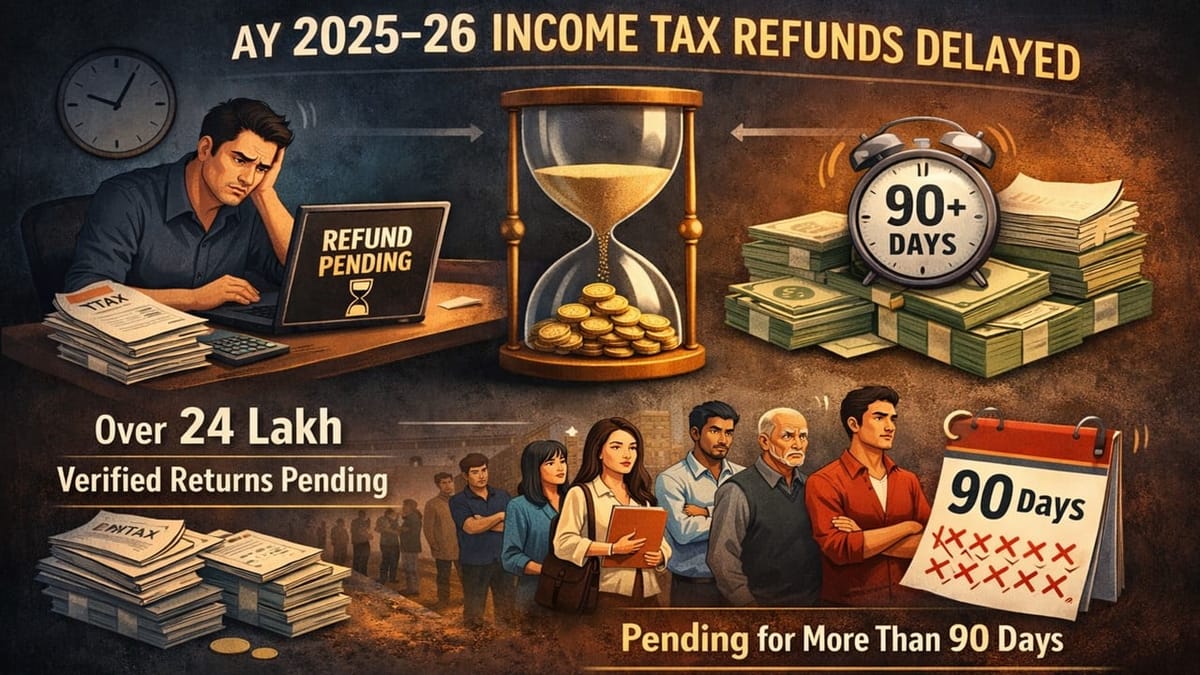

Many taxpayers are still waiting for their AY 2025-26 income tax refunds, as over 24 lakh verified returns have remained pending for more than 90 days.

Saloni Kumari | Feb 11, 2026 |

ITR Filed but Refund Not Received? Over 24 Lakh Returns Pending Beyond 90 Days

If you have not received your income tax refund yet, then you must know that you are not alone; there are numerous such individuals who timely furnished their income tax returns (ITR) before the statutory deadline, yet still have not received their tax refunds.

As per data available on the Income Tax Portal, for the Assessment Year (AY) 2025-26, approximately 8.80 returns have been filed, among which about 8.68 crore returns have been successfully verified, around 8.15 crore returns have been processed by the tax authorities, and there are over 24 lakh returns still pending to get processed for more than 90 days.

The Minister of State for Finance, Pankaj Chaudhary, has also confirmed this in his written reply in the Rajya Sabha. In his statement, he said that till February 04, 2026, a total of 8.79 crore returns were filed, of which about 24.64 lakh returns are still pending for more than 90 days. This indicates a large number of taxpayers are still awaiting their refunds, and in several cases, refunds are even kept on hold.

The issue was also highlighted before the Rajya Sabha MP Deepak Prakash, wherein he asked the tax department whether they had sent large-scale messages in December 2025, suggesting taxpayers furnish a revised return within just three to four days. He further raised the question, asking the tax authorities why refunds of genuine taxpayers have been held back without even explicitly checking the issues in their returns. Also, he asked the tax authorities to explain the reason why several returns are pending for more than 90 days till January 31, 2025.

Answering the question, Chaudhary said that the department had indeed sent large-scale messages to the taxpayers, pushing them towards suo moto compliance, rather than taking strict actions. These messages were part of the NUDGE campaign started by the Central Board of Direct Taxes (CBDT). Under the said campaign, taxpayers were asked to revise the initially filed returns and revise them if any discrepancies or issues were found in them.

As per the government, returns having defects or irregularities in them were detected using advanced risk analysis of the NUDGE campaign. These irregularities mainly included non-disclosure of foreign assets or income, incorrect or excess deduction claims, and wrong claims under sections such as 80G, 80GGC, and 80E.

If you are also among the taxpayers whose tax returns are still pending to get processed for the Assessment Year 2025-26, then you are first required to make sure that your return has been properly verified. Be consistent in checking your return processing status on the income tax portal. If you have received any notice or communication from the tax authorities, then make sure you are replying to them in a timely manner. Make sure your bank account details are correct and are correctly linked to receive the refund.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"