Reetu | Jan 13, 2023 |

DGFT Discontinued Tariff Rate Quota for Import of Crude Soya Bean Oil

The Directorate General of Foreign Trade (DGFT) has discontinued Tariff Rate Quota for import of Crude Soya bean oil w.e.f. 01.04.2023 via issuing Public Notice.

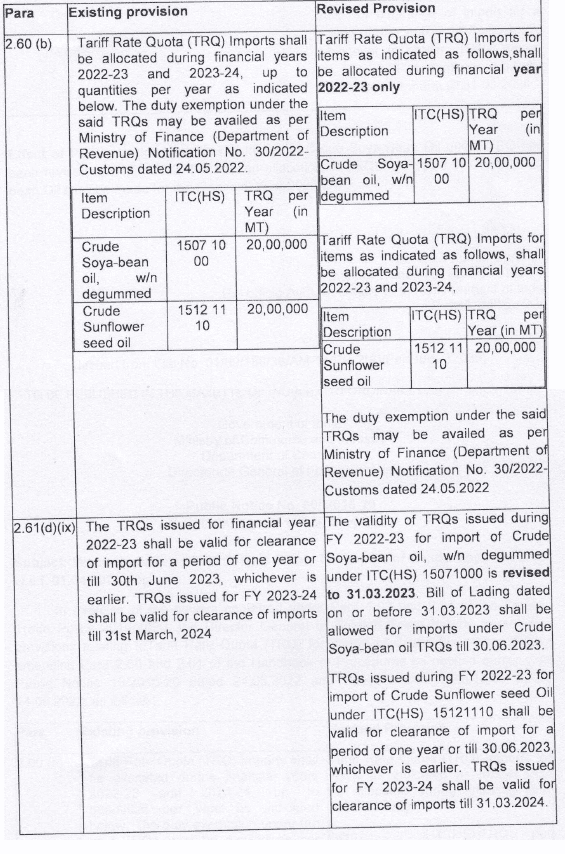

The Public Notice has provided, “In exercise of the powers conferred under Para 1.03 and 2.04 of the Foreign Trade Policy 2015-2020, the Director General of Foreign Trade hereby revises the provisions relating to Tariff Rate Quota (TRQ) for import of Crude Soya bean Oil by amending Para 2.60 and 2.61 of the Handbook of Procedures as notified earlier vide Public Notice 1012015-20 dated 24.05.2022 and Public Notice 1512015-20 dated 14.06.2022.”

Revised Provision related to Tariff Rate Quota as follows:

Effect of Public Notice: Last Date of Import of Crude Soya Bean Oil under TRQ has been revised to 31.03.2023. Further, no application of TRQs for import of Crude Soya bean Oil shall be made for the Financial Year 2023-24.

For Official Public Notice Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"