ITAT remands the double disallowance issue to AO, rejects CIT(A)’s view on the doctrine of merger, and allows the assessee’s appeal.

Vanshika verma | Feb 14, 2026 |

Doctrine of Merger Not Applicable: Orders u/s 143(1) and 154 Separately Appealable

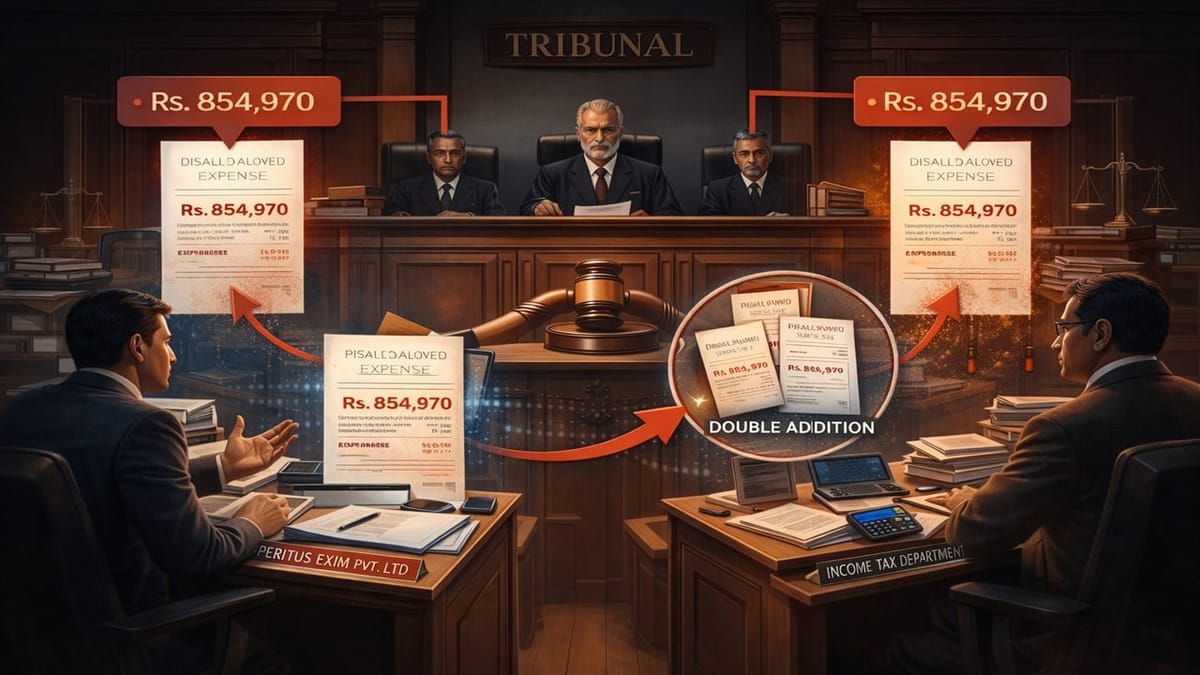

ITAT Delhi remanded the matter to the AO to verify and rectify the alleged double disallowance of Rs. 854,970, allowing the assessee’s appeal for statistical purposes.

The present appeal has been filed by Peritus Exim Pvt. Ltd against the DCIT in ITAT Delhi, against the order passed by CIT(A), dated June 24, 2025, for AY 2020-21.

The assessee filed its income tax return for AY 2020-21, declaring an income of about Rs. 39,387,570 on January 27, 2021. While filing the return, the company itself disallowed certain expenses amounting to Rs. 854,970 in its computation of income. The return of income was processed under section 143(1) of the Act.

Later, the assessee noticed that AO disallowed the same amount of Rs. 8,54,970, but in a different clause of the return of income. This resulted in a double disallowance of the same expense and created a tax demand. The assessee paid the demand of about Rs.2,90,398, and later another amount of Rs.2,98,854 was adjusted from its refund of the next year.

The assessee filed a rectification application under section 154 after realising that the same expense had been disallowed twice. However, the AO passed a rectification order again, raising the demand.

The assessee then approached CIT(A). However, the CIT(A) dismissed the appeal, stating that since the addition was originally made under section 143(1), the assessee should have challenged that order instead of filing rectification proceedings. He also said that both orders (under section 143(1) and section 154) are separate and independently appealable. However, he directed the AO to verify the tax payments already made by the assessee.

Being aggrieved with the CIT(A) decision, the assessee further approached the Tribunal. The AR argued that it had already disallowed the expenses in its return, and the department again disallowed the same amount, which clearly resulted in double addition. Therefore, the rectification application was valid and should have been allowed.

After hearing both sides, the Tribunal observed that the assessee had suo moto disallowed the amount, and the CPC again disallowed the same amount while processing the return. However, the Tribunal did not agree with the CIT(A)’s view that the doctrine of merger does not apply. It held that since the issue is directly related to a mistake apparent on record, the matter should be examined properly.

Therefore, in the interest of justice, the tribunal sent the matter back to the AO to reconsider the issue and verify the claim of double disallowance according to law. As a result, the Tribunal allowed the appeal for statistical purposes.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"