As per the new regulation, taxpayers submitting FTC claims through Form 44 must now receive a verification by a certified chartered accountant.

Nidhi | Feb 9, 2026 |

Draft IT Rules, 2026: CA Verification Required for Foreign Tax Credit

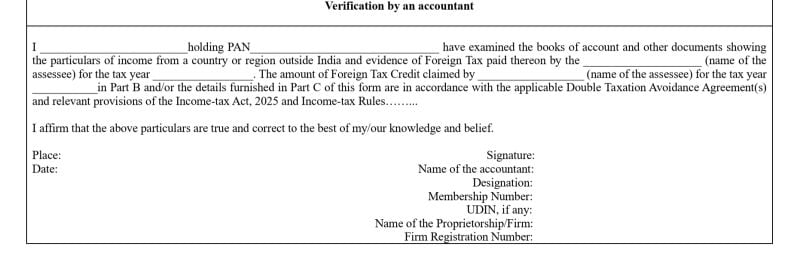

The Income Tax Department recently released the Draft Income Tax Rules, 2026, where Draft Rule 76 has introduced some important changes. These changes relate to the Foreign Tax Credit (FTC). As per the new regulation, taxpayers submitting FTC claims through Form 44 must now receive a verification by a certified chartered accountant.

What is a Foreign Tax Credit?

The residents who earn income from a foreign country are required to pay tax in that country. To prevent double taxation on the same income, the FTC allows taxpayers to offset or reduce their tax liability in India.

Who Requires FTC Verification?

The verification is mandatory if the assessee is a company or if the foreign tax paid outside India is equal to or more than the limit of Rs 1 lakh.

What Must Be Included in an Accountant’s Certification?

The accountant must certify the following things:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"