Deepak Gupta | Nov 15, 2022 |

Due date for GST Annual Return & GST Reconcilliation for FY 2021-22

As per Rule 80 of the CGST Rules, 2017, every registered person liable to file an Annual Return (GSTR-9) for every financial year on or before the 31st of December of the next financial year.

As per Section 44 read with rule 80 taxpayers whose, Aggregate Annual Turnover during a financial year exceeds Rs. 5 Cr is Required to file a Self-Certified Reconciliation Statement (GSTR-9C) along with GST Annual Return (GSTR-9).

Accordingly, the last date for filing the GST Annual Return & GST Reconciliation for FY 2021-22 is 31st December 2022.

Annual return

44. Every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person shall furnish an annual return which may include a self-certified reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year, with the audited annual financial statement for every financial year electronically, within such time and in such form and in such manner as may be prescribed:

Provided that the Commissioner may, on the recommendations of the Council, by notification, exempt any class of registered persons from filing annual return under this section:

Provided further that nothing contained in this section shall apply to any department of the Central Government or a State Government or a local authority, whose books of account are subject to audit by the Comptroller and Auditor-General of India or an auditor appointed for auditing the accounts of local authorities under any law for the time being in force.

GSTR-9 & 9C enabled on GST Portal for FY 2021-22

Notification No. 10/2022- Central Tax, dated 05.07.2022

G.S.R. ……(E).— In exercise of the powers conferred by the first proviso to section 44 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Commissioner, on the recommendations of the Council, hereby exempts the registered person whose aggregate turnover in the financial year 2021-22 is up to two crore rupees, from filing annual return for the said financial year.

Notification No. 30/2021 – Central Tax, dt. 30-07-2021, Sixth amendment (2021) in the CGST Rules, 2017 [Amendment in Rule 80 dealing with GST Annual Return]

80. Annual return.- (1) Every registered person, other than those referred to in the second proviso to section 44, an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year as specified under section 44 electronically in FORM GSTR-9 on or before the thirty-first day of December following the end of such financial year through the common portal either directly or through a Facilitation Centre notified by the Commissioner:

Provided that a person paying tax under section 10 shall furnish the annual return in FORM GSTR-9A.

(2) Every electronic commerce operator required to collect tax at source under section 52 shall furnish annual statement referred to in sub-section (5) of the said section in FORM GSTR 9B.

(3) Every registered person, other than those referred to in the second proviso to section 44, an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, whose aggregate turnover during a financial year exceeds five crore rupees, shall also furnish a self-certified reconciliation statement as specified under section 44 in FORM GSTR-9C along with the annual return referred to in sub-rule (1), on or before the thirty-first day of December following the end of such financial year, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

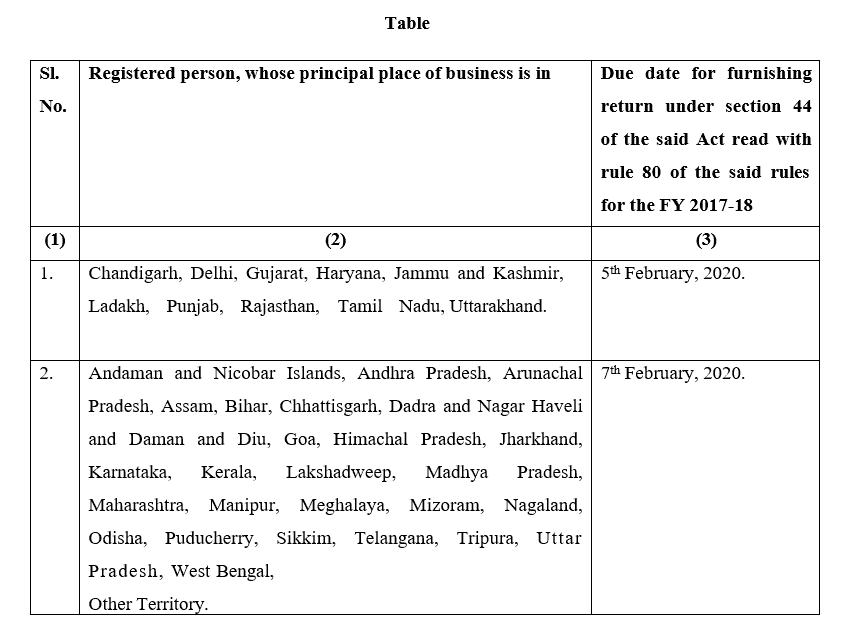

Due Dates for Filing GST Annual Return and GST Audit for FY 2017-18 was was extended upto 05th-07th February 2020.

The Relevant Notification is Notification No.06/2020 – Central Tax dated 3rd February, 2020 red with Corrigendum dated 04th February, 2020:

G.S.R…..(E).–In exercise of the powers conferred by sub-section (1) of section 44 of the Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said Act), read with rule 80 of the Central Goods and Services Tax Rules, 2017 (hereafter in this notification referred to as the said rules), the Commissioner, on the recommendations of the Council, hereby extends the time limit for furnishing of the annual return specified under section 44 of the said Act read with rule 80 of the said rules, electronically through the common portal, in respect of the period from the 1st July, 2017 to the 31st March, 2018, for the class of registered person specified in column (2) of the Table below, till the time period as specified in the corresponding entry in column (3) of the said Table, namely:-

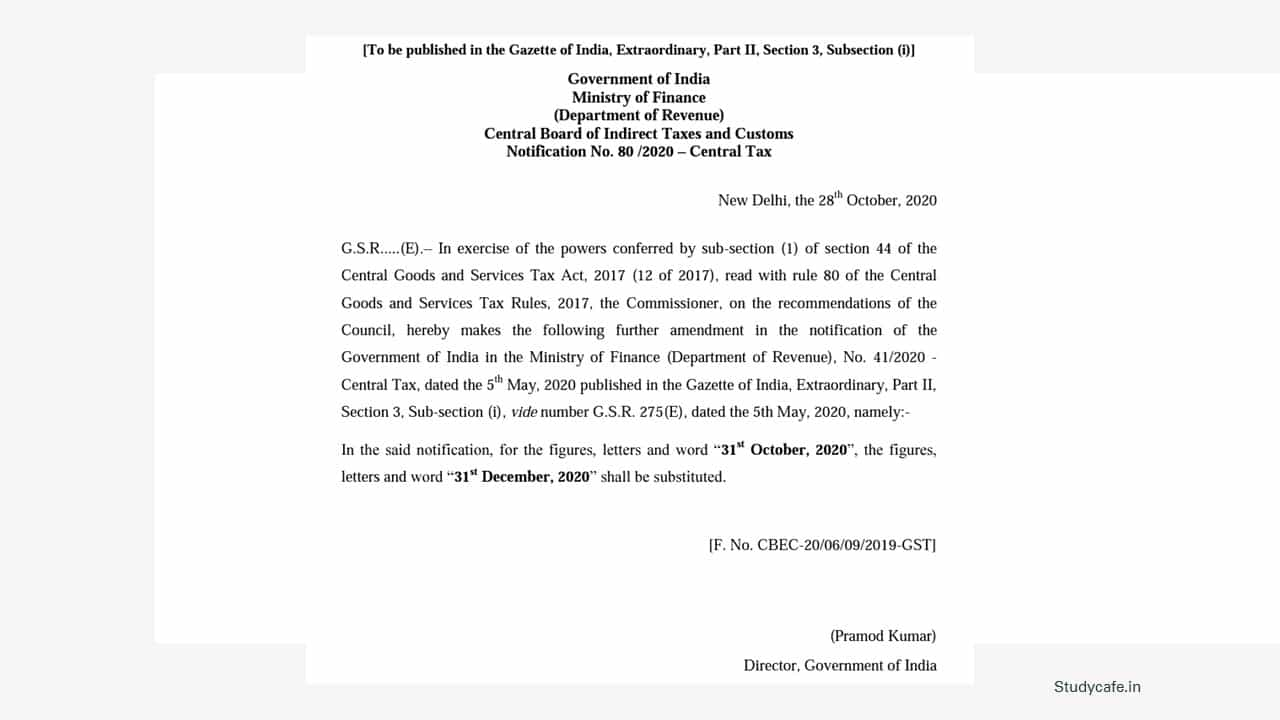

Due Dates for Filing GST Annual Return and GST Audit for FY 2018-19 was extended upto 31st December 2020.

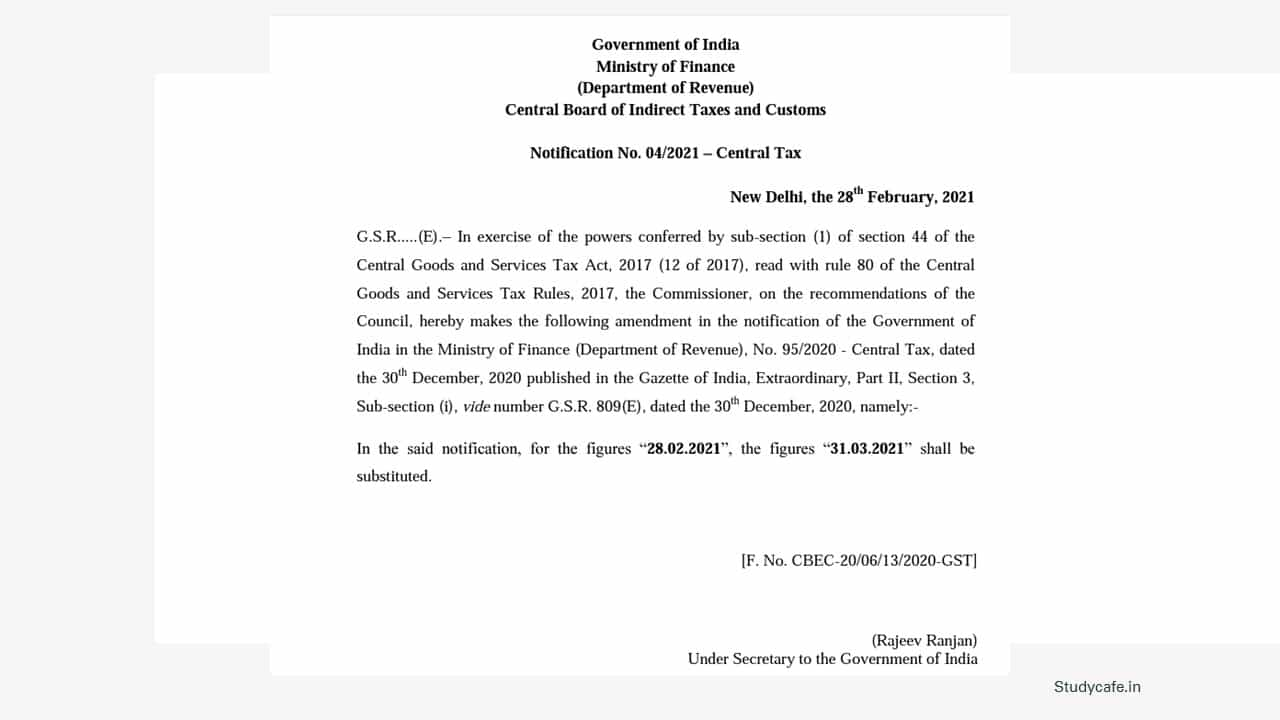

Due Dates for Filing GST Annual Return and GST Audit for FY 2019-20 was was extended upto 31st March 2021.

Due Dates for Filing GST Annual Return and GST Reconcilliation Statement for FY 2020-21 was extended upto 28th February 2022. [Notification No. 40/2021 –Central Tax dated 29th December 2021]

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"