Reetu | Aug 8, 2022 |

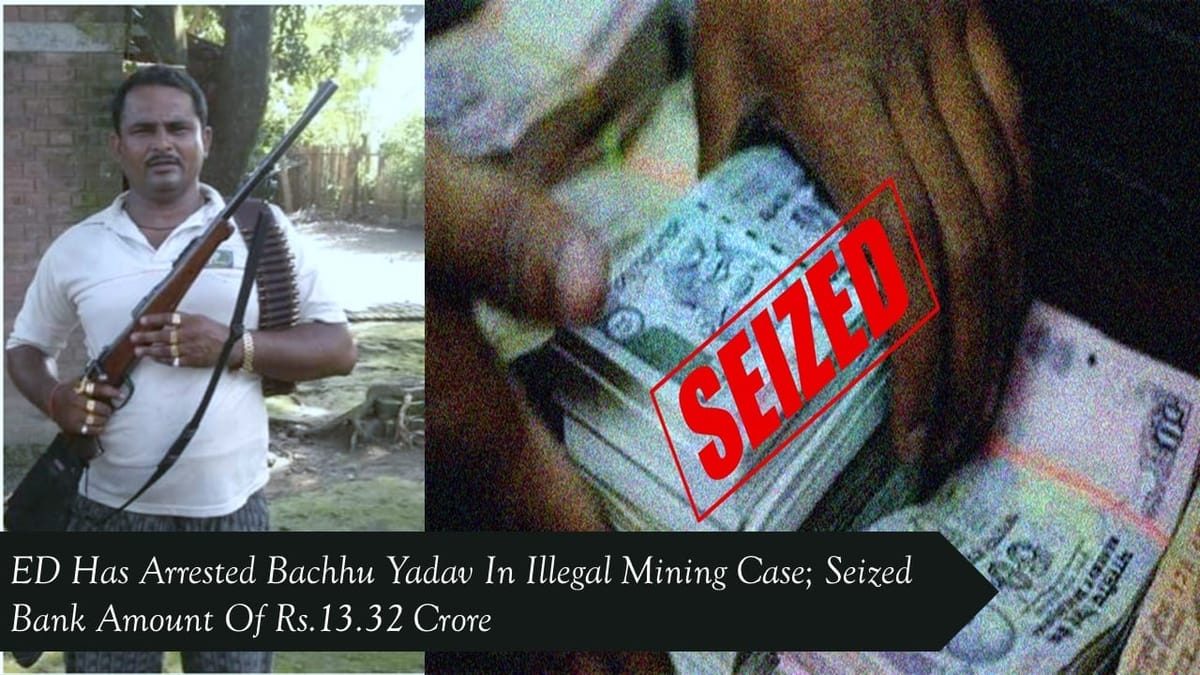

ED arrested Bachhu Yadav in illegal Mining Case; Seized Bank Amount of Rs.13.32 Crore

The Directorate of Enforcement (ED) has arrested Bachhu Yadav, associate of Pankaj Mishra under Prevention of Money Laundering Act (PMLA), 2002 in illegal Mining case.

The aforementioned individual was presented before the Special PMLA Court in Ranchi today, and the Honorable Court is pleased to place the accused under ED Custody for a period of six days.

Investigation reveals that Bachhu Yadav is one of Pankaj Mishra’s bodyguards and works closely with the businessman on large-scale activities involving illicit mining and the transportation of their products. In the course of the inquiry, it was also discovered that Bacchu Yadav is a habitual offender. In the Sahibganj Area, he is the subject of numerous instances involving attempted murder, extortion, threats, and the possession of illegal weapons.

On the basis of a FIR filed by Barharwa Police Station, Sahibganj District, Jharkhand, against Pankaj Mishra & ors under different sections of the IPC, 1860, ED began an inquiry into money laundering. Later, a number of FIRs involving illicit mining were included in the investigation. In this instance, ED has so far discovered POC totaling more than Rs. 100 Crore.

On 08.07.22, the ED had previously carried out searches in Sahibganj, Barhet, Rajmahal, Mirza Chauki, and Barharwa, and had confiscated Rs 5.34 Crore in cash. Later, in the Sahibganj Area, ED had confiscated three hyva trucks, six stone crushers, and one inland vessel, the M.V. Infrastructure III. Additionally, the ED has confiscated Rs 13.32 billion from 50 bank accounts. After Pankaj Mishra was found guilty of money laundering, ED had earlier detained him on July 19, 22. He is currently in judicial custody.

Further investigation into the case is in progress.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"