Reetu | Mar 10, 2023 |

Excise and GST Return Due Date; Taxpayers Should Not Miss

The Central Board of Indirect Taxes and Customs(CBIC) has issued reminder to file Central Excise Return and GST Returns. Today is the last date to file Excise and GST Return.

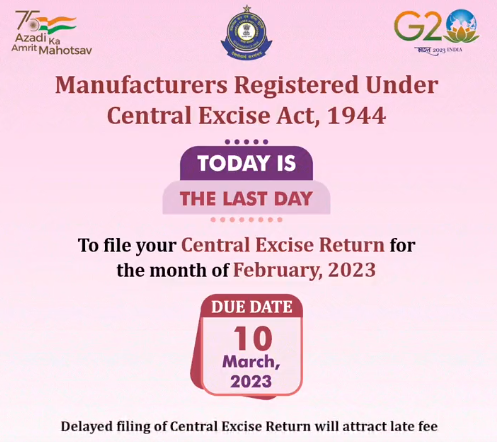

Via tweet, CBIC notified, “Attention, manufacturers registered under Central Excise Act, 1944. Today is the last day to file your Central Excise Return for the month of February 2023. Delayed filing of Central Excise Return will attract late fee.”

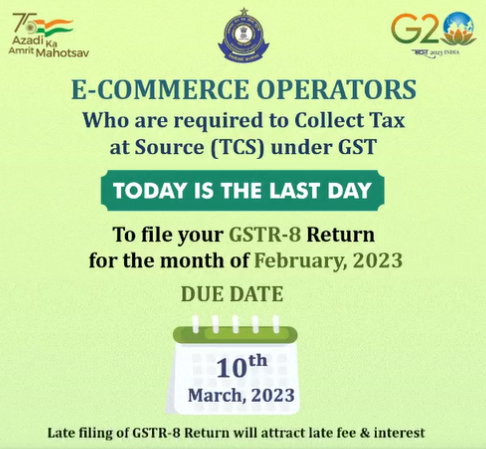

Similarly for e-Commerce Operators CBIC tweeted, “Attention, e-Commerce Operators, who are required to Collect Tax at Source (TCS) under GST. Today is the last day to file your GSTR-8 Return for the month of February 2023. Late filing of GSTR-8 Return will attract late fee and interest.”

For GST Taxpayer CBIC with his tweet notified, “Attention, GST taxpayers who are required to Deduct Tax at Source (TDS) under GST. Today is the last day to file your GSTR-7 Return for the month of February 2023. Late filing of GSTR-7 Return will attract late fee and interest.”

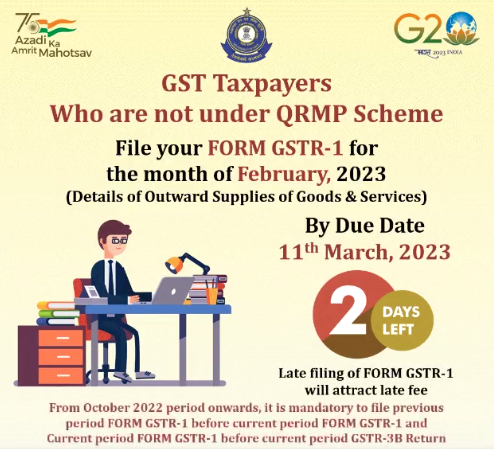

For Others GST Taxpayers, CBIC notified via tweet, “Attention, GST Taxpayers who are not under QRMP Scheme. The last day to file your Form GSTR-1 for the month of February 2023 is 11th March 2023. Late filing of Form GSTR-1 will attract late fee.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"