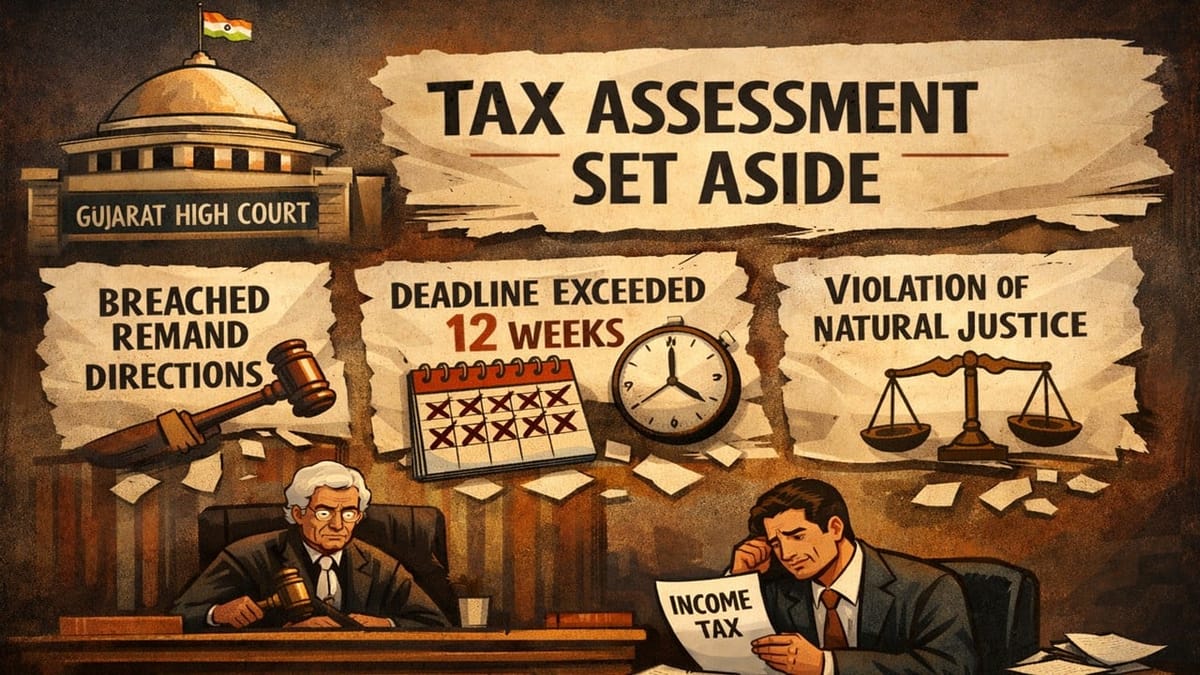

High Court set aside income tax assessment where authorities breached remand directions, exceeded the 12-week deadline, and violated natural justice.

Meetu Kumari | Jan 28, 2026 |

Faceless Assessment Quashed for Breach of HC Directions and Natural Justice

Gryphon Ceramics Private Limited, dealing in manufacturing large ceramic slabs, filed its return of income for AY 2018-19, declaring income of Rs. 19,110. On scrutiny, an assessment order under Section 143(3) read with Section 144B was passed on 20.09.2021, assessing income at Rs. 10.41 crore, without a personal hearing.

The assessee went to the High Court, which quashed the order for violation of natural justice and remanded the matter with a direction to complete a de novo assessment within 12 weeks. However, notices were first issued by the Jurisdictional Assessing Officer, followed by a transfer back to the Faceless Assessment Unit, which granted only one day to respond to a show-cause notice. The assessment order was passed, beyond the time limit fixed by the court.

Issue Before Court: Whether an assessment order passed beyond the time limit fixed by the High Court, after deviation from the remand directions and with inadequate opportunity of hearing, is sustainable in law.

HC Held: The High Court quashed the assessment order. The Court held that its earlier remand directions were clearly violated, as the assessment was neither completed within the stipulated 12-week period nor carried out strictly by the FAO as expressly directed.

The Court further held that granting only one day to respond to a detailed show-cause notice involving voluminous material amounted to a blatant breach of natural justice. The Court declined to grant another remand and set aside the assessment.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"