Saloni Kumari | Jun 28, 2025 |

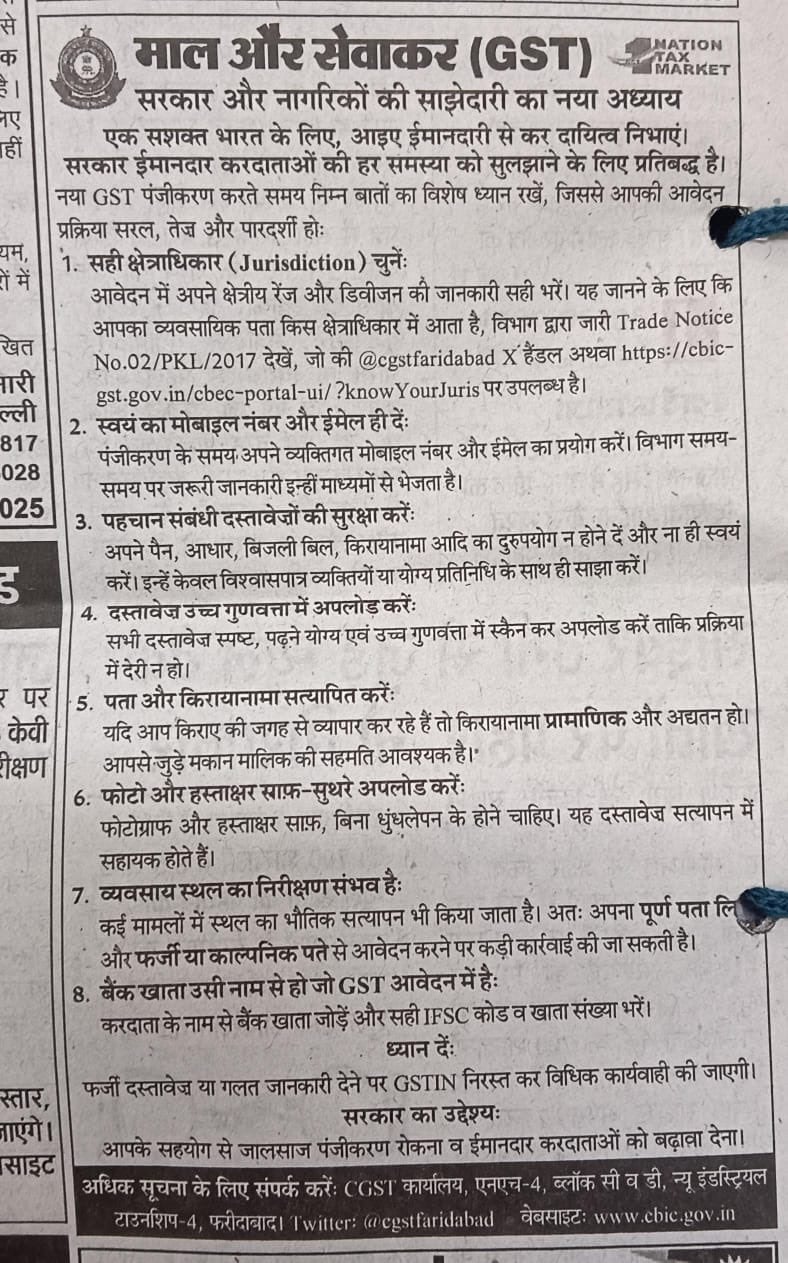

GST Fraud Prevention: Faridabad CGST Issues Urgent Guidelines for Applicants

The Faridabad Commissionerate has issued a public advisory highlighting significant precautions to take while doing GST registration. The aim of his advisory is to control bogus GST registrations and ensure transparency.

The advisory outlines the significance of proper documentation, correct information, and alertness in the GST registration process.

The CGST office in Faridabad asks both the government and all citizens of the country to work together to form a genuine tax system with complete transparency. The issued advisory mentions numerous steps to avoid issues and delays in legal processes:

1. Correct Jurisdiction: Always select your correct jurisdiction as per your location of business. As incorrect jurisdiction may result in delays or rejection.

2. Use Email and Personal Mobile Number: Applicant must always use only his/her personal contact details. This makes sure key details are received directly.

3. Secure Personal Documents: Individuals are advised to carefully manage documents such as Aadhaar, electricity bills, and rent agreements. These documents should never be shared with any unauthorised individual.

4. Upload Clear and Readable Documents: Always add documents of high quality, as low-quality documents may lead to rejection.

5. Verify Address Proof: A valid and authorised rent agreement, in addition to the consent of the property’s owner, is compulsory if a rented space is utilised.

6. Clear Photos and Signatures: Individuals should upload their clear photograph and signature, clearly visible without any marks on it.

7. Possible Inspection: Physical inspection of the business premises may be conducted. Providing fake addresses can lead to strict legal action.

8. Use the Same Name for Bank and GST: The bank account you use for GST registration must be in your name (the same name as on the GST application), and the IFSC code should be correct.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"