Reetu | Sep 6, 2023 |

GST: HSN Update for E-Invoice and E-Way Bill

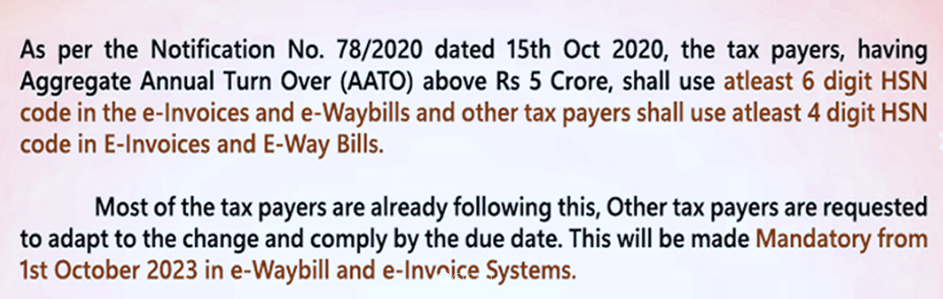

The Goods and Services Tax (GST) E-way bill system has issued an update, urging GST taxpayers to incorporate 6 Digit or 4 Digit HSN Codes, which will become essential in the near future.

It said that, “According to Notification No. 78/2020 dated 15th October 2020, taxpayers with an aggregate annual turnover (AATO) of more than Rs.5 crore must use a 6 digit HSN number in their e-invoices and e-Waybills, while other taxpayers must use a 4 digit HSN code. The majority of taxpayers are already doing so. Other taxpayers are being asked to adjust to the change and comply by the due date. This will become mandatory in e-Waybill and e-Invoice Systems on October 1, 2023.”

Furthermore, it is critical to note that this obligatory change will take effect on October 1, 2023, affecting both the e-Waybill and e-Invoice Systems. Taxpayers should make the required changes to their invoicing and way billing procedures within this timeframe to guarantee smooth compliance with the amended requirements.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"