Deepak Gupta | Aug 23, 2022 |

GST Number Obtained by misusing PAN of a Farmer: CBIC initiates probe for recovery of GST of Rs. 37.5 lakh

The 37.5 lakh Goods and Services Tax Notice was slapped against a poor farmer in Bihar’s Khagaria has been the subject of an investigation by the Central Board of Indirect Taxes and Customs (CBIC).

The CBIC said on Monday that they had contacted the victim and discovered that the firm in Rajasthan’s Pali was set up “without his knowledge” by allegedly misusing his PAN card, which he had reportedly provided for opening a bank account. This came a day after Media Reports highlighted how a poor farmer in Bihar’s Khagaria received a GST notice of 37.5 lakh rupees.

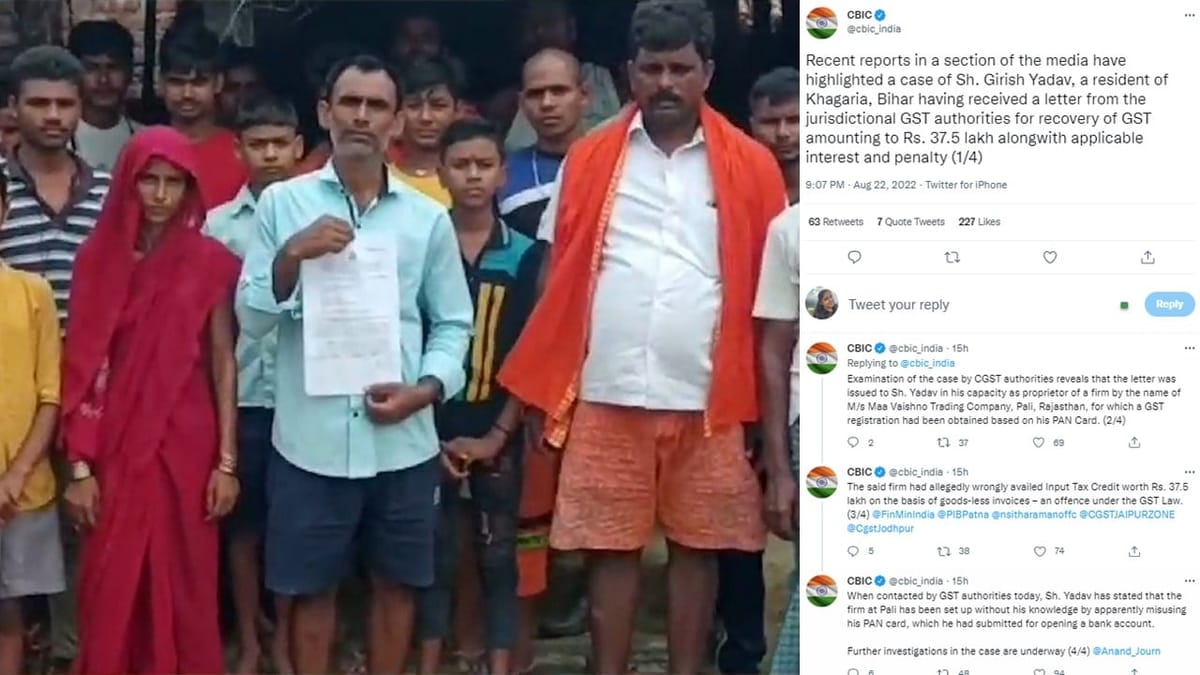

Recent reports in a section of the media have highlighted the case of Sh. Girish Yadav, a resident of Khagaria, Bihar has received a letter from the jurisdictional GST authorities for recovery of GST amounting to Rs. 37.5 lakh along with applicable interest and penalty.

Examination of the case by CGST authorities reveals that the letter was issued to Sh. Yadav in his capacity as proprietor of a firm by the name of M/s Maa Vaishno Trading Company, Pali, Rajasthan, for which a GST registration had been obtained based on his PAN Card.

The said firm had allegedly wrongly availed Input Tax Credit (ITC) worth Rs. 37.5 lakh on the basis of goods less invoices, which is an offence under the GST Law.

When contacted by GST authorities today, Sh. Yadav has stated that the firm at Pali has been set up without his knowledge by apparently misusing his PAN card, which he had submitted for opening a bank account.

Further investigations in the case are underway

Source: CBIC Twitter Handle

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"