CA Pratibha Goyal | May 5, 2023 |

GST Portal Glitches: Is it fair to make Tax Professionals/ Taxpayers completely responsible?

In a recent advisory by the Goods and Service Tax Network Portal (GSTN Portal), the company advised taxpayers to do the filing on time and to avoid last minute rush. But is it fair to make Tax Professionals/ Taxpayers completely responsible?

Let’s see the views of Tax Professionals on Twitter:

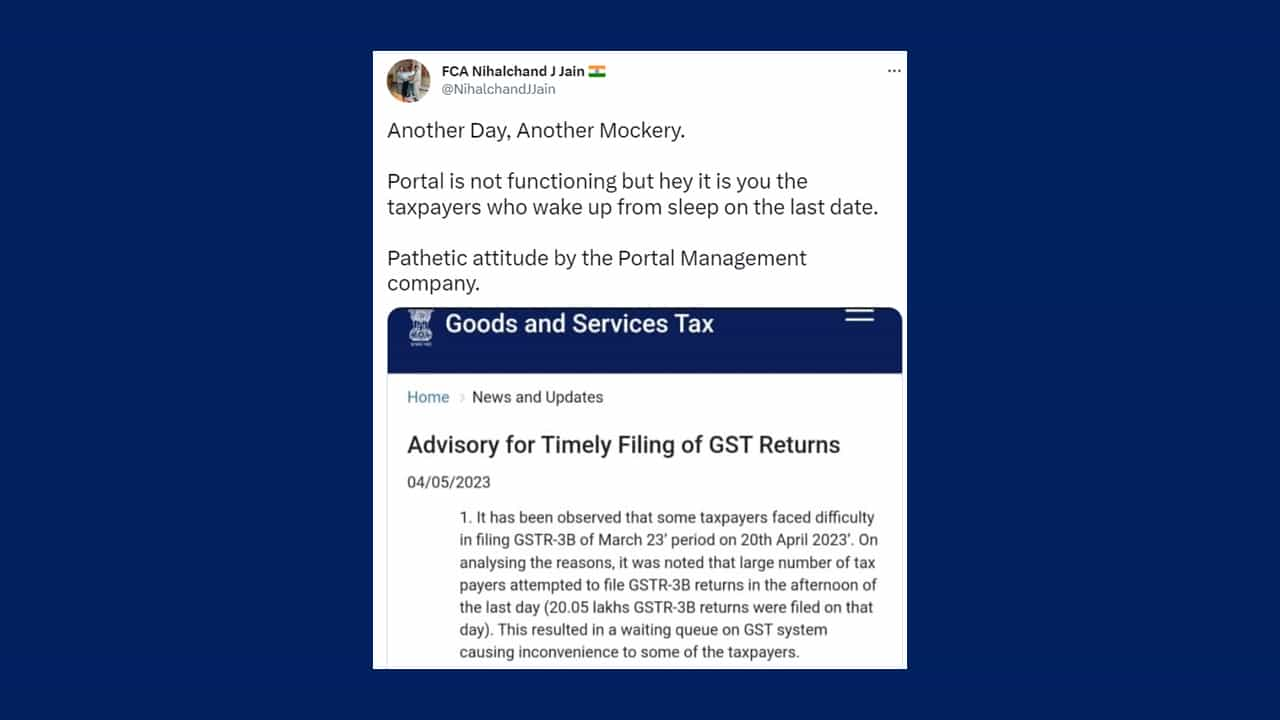

CA Nihalchand J Jain wrote,

“Another Day, Another Mockery.

Portal is not functioning but hey it is you the taxpayers who wake up from sleep on the last date.

Pathetic attitude by the Portal Management company.”

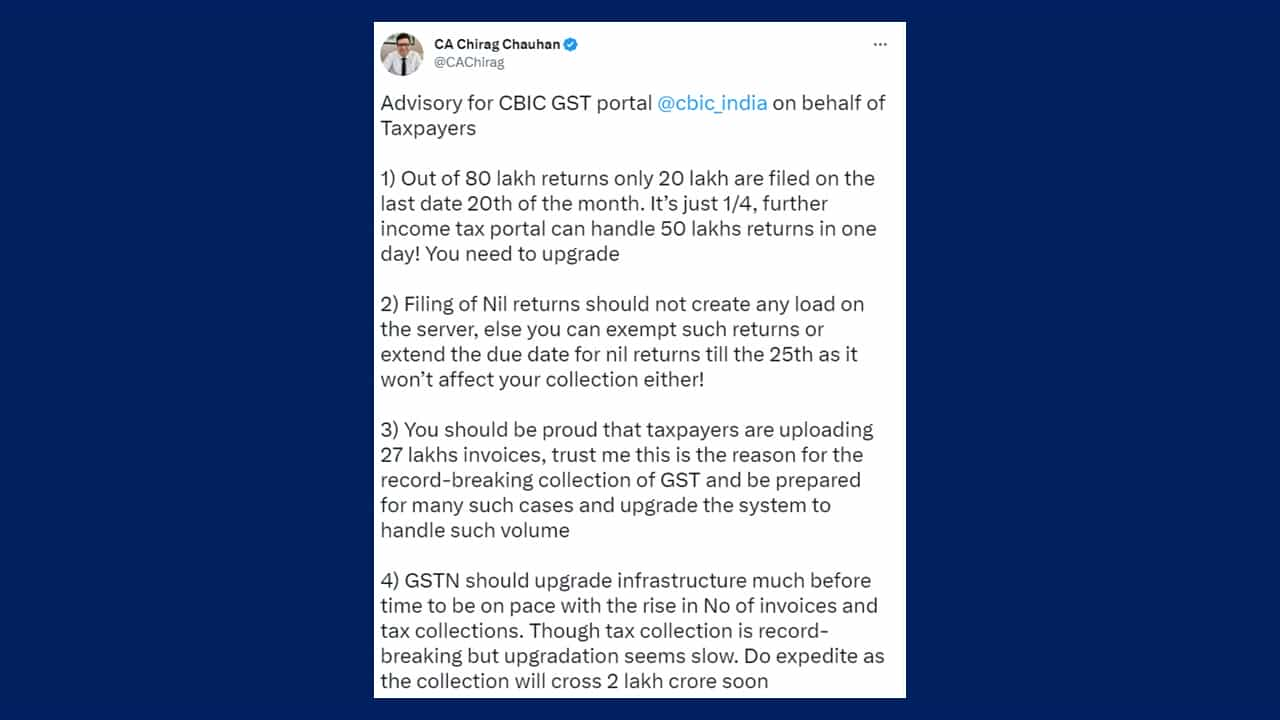

CA Chirag Chauhan tagged CBIC and wrote an Advisory for CBIC GST portal on behalf of Taxpayers,

1) Out of 80 lakh returns only 20 lakh are filed on the last date 20th of the month. It’s just 1/4, further income tax portal can handle 50 lakhs returns in one day! You need to upgrade

2) Filing of Nil returns should not create any load on the server, else you can exempt such returns or extend the due date for nil returns till the 25th as it won’t affect your collection either!

3) You should be proud that taxpayers are uploading 27 lakhs invoices, trust me this is the reason for the record-breaking collection of GST and be prepared for many such cases and upgrade the system to handle such volume

4) GSTN should upgrade infrastructure much before time to be on pace with the rise in No of invoices and tax collections. Though tax collection is record-breaking but upgradation seems slow. Do expedite as the collection will cross 2 lakh crore soon

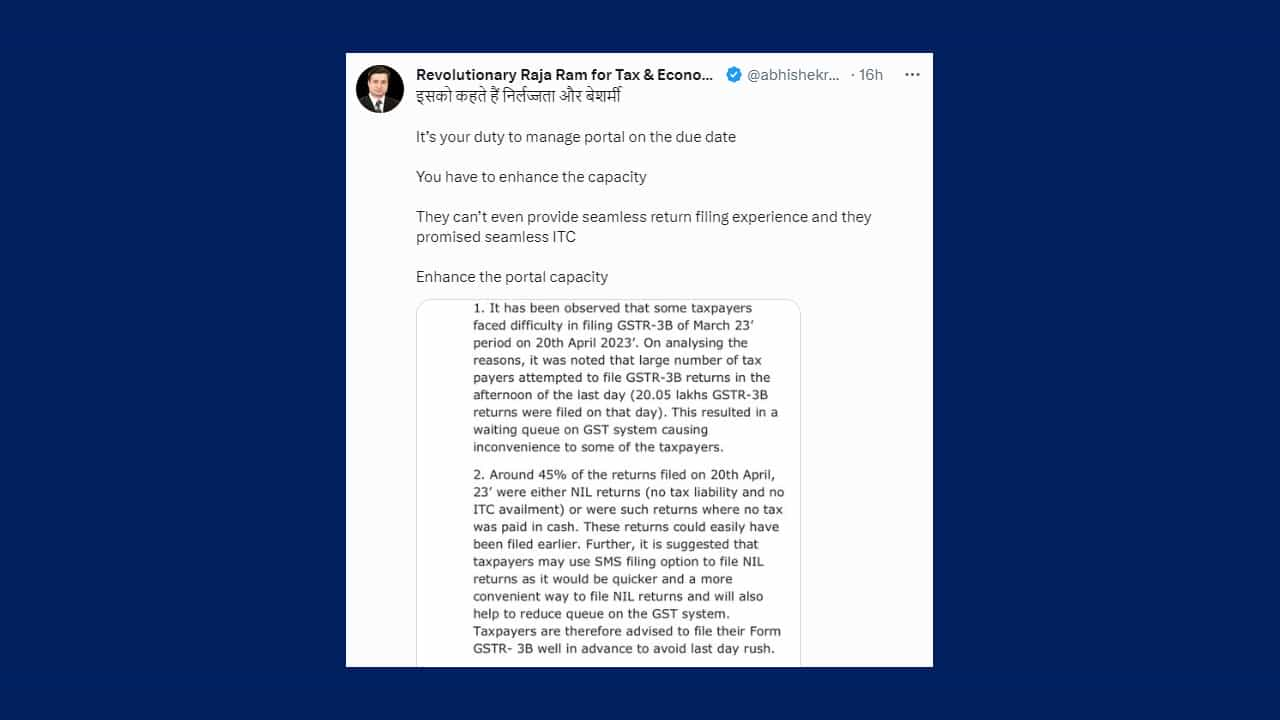

CA Abhishek Raja Ram wrote, that It’s duty of GSTN to manage portal on the due date. They have to enhance the capacity. They can’t even provide seamless return filing experience and they promised seamless ITC.

Do you think that Is it fair to make Tax Professionals/ Taxpayers completely responsible? GSTN has no responsibility for this?

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"