Nidhi | Sep 22, 2025 |

GST Reforms: Railways Reduce Water Bottle Prices for Passengers

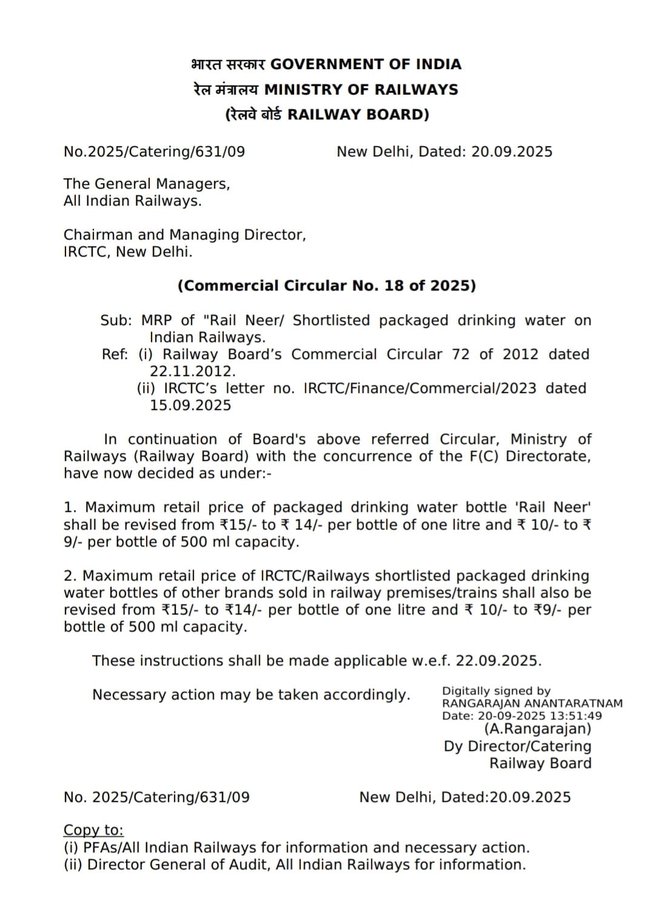

The Ministry of Railways has announced a relief to passengers by reducing the price of packaged drinking water. To ensure that the benefits of reduced GST are directly passed on to the consumers, both Rail Neer and other IRCTC-approved water bottles will be sold at a lower price in trains and at railway stations, starting from 22nd September 2025.

In a commercial circular dated September 20, 2025, the Ministry of Railways said that from 22nd September 2025, the Railways have reduced the maximum retail price (MRP) of the packaged drinking water ‘Rail Neer‘ from Rs 15 to Rs 14 per one litre. For a 500 ml bottle, the price has been reduced from Rs 10 to Rs 9. Apart from this, the MRP of IRCTC/Railways shortlisted packaged drinking water bottles of different brands sold in railway premises/trains will also be reduced from Rs 15 to Rs 14 for a one-litre bottle and from Rs 10 to Rs 9 for a 500 ml bottle.

This decision makes sure that passengers will get water at the same price everywhere, whether it is bought inside a train or at a station. There will be no price difference between Rail Neer and other approved brands. This step will also make sure that the benefits of the government’s reduced GST rates are directly passed on to the passengers.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"